CT CERT-101 1998 free printable template

Show details

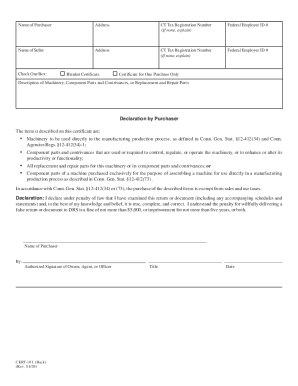

CERT101 (Rev. 12/98) STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES MACHINERY, COMPONENT PARTS AND REPLACEMENT AND REPAIR PARTS OF MACHINERY USED DIRECTLY IN A MANUFACTURING PROCESS CONN. GEN.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT CERT-101

Edit your CT CERT-101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT CERT-101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT CERT-101 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT CERT-101. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT CERT-101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT CERT-101

How to fill out cert-101 cert-101 - 8?

01

Begin by gathering all the necessary information and documents required to complete cert-101 cert-101 - 8. This may include personal details, contact information, and any relevant certifications or qualifications.

02

Access the cert-101 cert-101 - 8 form either online or in physical paper format, depending on the requirements of the organization or institution issuing the form.

03

Carefully read through the instructions provided with the form to ensure you understand the requirements and any specific guidelines for completing it.

04

Start by filling out the personal information section, including your full name, date of birth, and contact details. Double-check this information for accuracy.

05

Move on to the specific questions or sections of the form that pertain to your situation or purpose for filling it out. This could involve providing details about your education, work experience, or any relevant certifications or qualifications.

06

Take your time to accurately fill out each section, ensuring that you provide all the necessary information requested. If a question does not apply to you, write "N/A" or mark it as not applicable.

07

Pay close attention to any additional documents or attachments that may be required to accompany the cert-101 cert-101 - 8 form. Make sure you gather and attach these as instructed.

08

Double-check all the information you have provided on the form and review it for any errors or omissions. It is crucial to ensure the accuracy and completeness of the form.

09

Once you are confident that you have filled out the cert-101 cert-101 - 8 form correctly, sign and date it as required. Follow any submission instructions provided, whether it is online submission or mailing it to a specific address.

10

Keep a copy of the completed cert-101 cert-101 - 8 form for your records, in case it is needed in the future.

Who needs cert-101 cert-101 - 8?

01

Individuals seeking to pursue a specific certification or qualification may need to fill out cert-101 cert-101 - 8. This form is typically required by organizations or institutions offering certification programs or courses.

02

Employers or educational institutions may also require individuals to complete cert-101 cert-101 - 8 as part of an application process or to verify their qualifications.

03

Government agencies or licensing bodies may request cert-101 cert-101 - 8 to assess an individual's eligibility for certain licenses or permits.

Overall, anyone who needs to provide detailed information about their background, education, or qualifications for a specific purpose may be required to fill out cert-101 cert-101 - 8. It is essential to check the specific requirements of the organization or institution requesting the form to determine if it is necessary.

Fill

form

: Try Risk Free

People Also Ask about

What is the exempt form for NYS sales tax?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Who qualifies for sales tax exemption in North Carolina?

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

What are non taxable sales in Idaho?

In Idaho, purchases of tangible personal property for purposes of resale are not subject to tax. However, all sales are presumed taxable, and the seller has the burden of proving that a sale is not taxable (unless the seller has a resale certificate on file from you, the purchaser).

Do you need a resale certificate in Idaho?

Idaho does not require registration with the state for a resale certificate.

What is St 101?

Form ST-101, Sales Tax Resale or Exemption Certificate and Instructions.

Do Connecticut tax exempt certificates expire?

How long is my Connecticut sales tax exemption certificate good for? Most blanket exemption certificates is considered to be valid for precisely three years from the from the date that they were issued, so long as the tax exempt situation is still in effect.

What is exempt from sales tax in CT?

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

Do Connecticut sales tax exemption certificates expire?

How long is my Connecticut sales tax exemption certificate good for? Most blanket exemption certificates is considered to be valid for precisely three years from the from the date that they were issued, so long as the tax exempt situation is still in effect.

What items are taxable in CT?

Tangible products are taxable in Connecticut, with a few exceptions. These exceptions include certain groceries, some clothing, safety gear like firearm locks, child car seats and bike helmets, compact fluorescent bulbs, college textbooks, medical equipment and certain motor vehicles.

Does a exemption certificate expire?

Certificates are valid for up to three years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT CERT-101 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your CT CERT-101 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the CT CERT-101 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your CT CERT-101.

How do I edit CT CERT-101 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign CT CERT-101 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is cert-101 cert-101 - 8?

Cert-101 cert-101 - 8 is a form used for reporting certain information to the relevant authorities.

Who is required to file cert-101 cert-101 - 8?

Any individual or organization that meets the criteria set by the authorities must file cert-101 cert-101 - 8.

How to fill out cert-101 cert-101 - 8?

Cert-101 cert-101 - 8 can be filled out online or by mail following the instructions provided by the authorities.

What is the purpose of cert-101 cert-101 - 8?

The purpose of cert-101 cert-101 - 8 is to gather specific information required by the authorities for regulatory purposes.

What information must be reported on cert-101 cert-101 - 8?

Cert-101 cert-101 - 8 requires reporting of specific details such as financial information, operational data, and other relevant information.

Fill out your CT CERT-101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT CERT-101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.