Get the free APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS - ...

Show details

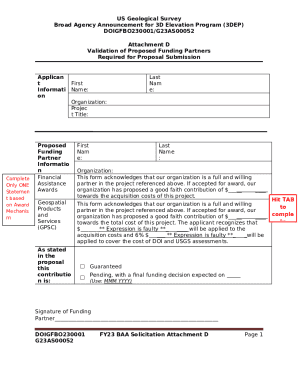

This document provides instructions for licensed attorneys in Texas to apply as sponsors for registered property tax consultants, detailing required personal information and submission guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application instructions for a

Edit your application instructions for a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application instructions for a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application instructions for a online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application instructions for a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application instructions for a

How to fill out APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS

01

Obtain the APPLICATION INSTRUCTIONS document from the relevant Texas authority or website.

02

Read through the instructions thoroughly to understand the eligibility criteria and requirements.

03

Prepare the necessary documentation, including any required identification and proof of qualifications.

04

Fill out the application form accurately, following the guidelines provided in the instructions.

05

Double-check all information for accuracy and completeness before submission.

06

Submit the completed application along with any required fees to the designated office.

Who needs APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

01

Texas attorneys who wish to sponsor property tax consultants in order to assist clients with property tax matters.

02

Individuals who are property tax consultants seeking formal sponsorship to practice in Texas.

Fill

form

: Try Risk Free

People Also Ask about

What is the highest salary for a tax consultant?

Highest paying cities near India for Tax Consultants Delhi, Delhi. ₹54,525 per month. 2 salaries reported. Bengaluru, Karnataka. ₹50,942 per month. 11 salaries reported. Gurgaon, Haryana. ₹49,326 per month. 8 salaries reported. Pune, Maharashtra. ₹46,002 per month. Hyderabad, Telangana. ₹41,584 per month. Show more nearby cities.

What does a property tax consultant do?

Property tax consultants ensure that businesses remain in compliance by staying abreast of changes in tax laws, filing required documentation accurately and timely, and representing clients in any disputes or audits with taxing authorities.

What does a tax consultant do on a resume?

Common Responsibilities Listed on Tax Consultant Resumes: Analyze complex tax data using advanced analytics and AI-driven tools. Collaborate with cross-functional teams to develop comprehensive tax strategies. Advise clients on tax implications of business decisions and transactions.

How to become a property tax consultant in Texas?

Twenty-four (24) Continuing Education hours are required within the two-year period. Forty (40) hours of pre-licensing education is required for first time registrants and the successful passing of an examination administered through PSI, the testing agency for TDLR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

The APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS outlines the steps and requirements necessary for an attorney in Texas to sponsor property tax consultants who represent clients in property tax matters.

Who is required to file APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

Attorneys who wish to sponsor property tax consultants must file the application. This is typically required for legal professionals wanting to oversee or support the activities of property tax professionals.

How to fill out APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

To fill out the application, attorneys must provide their legal information, including their Texas Bar number, personal details, and details about the property tax consultants they intend to sponsor. It may also require submitting supporting documentation as specified in the instructions.

What is the purpose of APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

The purpose of the application is to ensure that property tax consultants operate under the guidance of a licensed attorney, thereby maintaining legal standards and protecting the interests of clients in property tax matters.

What information must be reported on APPLICATION INSTRUCTIONS FOR A TEXAS ATTORNEY TO SPONSOR PROPERTY TAX CONSULTANTS?

The application must report the sponsoring attorney's Texas Bar number, contact information, details about the property tax consultants being sponsored, and any relevant legal disclosures required by the state.

Fill out your application instructions for a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Instructions For A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.