Get the free SOLO 401(k) PLAN LOAN REQUEST

Show details

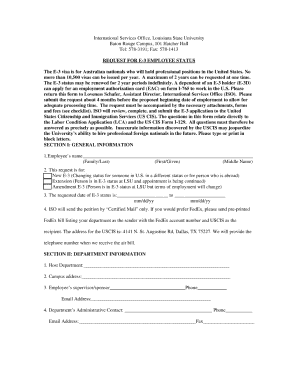

TCI SOLOKPLANLOANREQ 192 4 0316. Page 1 of 4 ... Purpose of this form: Please complete this form to request a participant loan from your ... be found online at www.trustamerica.com/advisor-forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign solo 401k plan loan

Edit your solo 401k plan loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your solo 401k plan loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit solo 401k plan loan online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit solo 401k plan loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out solo 401k plan loan

How to fill out solo 401k plan loan:

01

Determine eligibility: Before filling out a solo 401k plan loan, it is important to determine if you are eligible for such a loan. Typically, solo 401k plan participants are eligible to take out a loan if their plan allows for it and they meet certain requirements, such as being a plan participant and having a balance in their account.

02

Obtain the necessary loan paperwork: Contact the administrator of your solo 401k plan to obtain the loan paperwork. This may include forms such as a loan application, loan agreement, and any other supporting documents required by your plan.

03

Review loan terms and conditions: Carefully review the terms and conditions of the loan. This includes understanding the interest rate, repayment period, and any fees or penalties that may apply. It is crucial to understand the consequences of defaulting on the loan, as it can result in taxes and penalties.

04

Determine loan amount and purpose: Decide how much you would like to borrow from your solo 401k plan and the purpose of the loan. The loan amount is typically limited to 50% of your vested account balance or $50,000, whichever is less, but your plan may have different limits. Common purposes for solo 401k plan loans include paying off debt, funding education expenses, or making a down payment on a home.

05

Complete the loan application: Fill out the loan application form provided by your plan administrator. This may include providing personal and account information, as well as specifying the loan amount, repayment terms, and purpose.

06

Submit the loan paperwork: Once you have completed the loan application and any other required forms, submit them to your plan administrator. Be sure to keep copies for your records.

Who needs a solo 401k plan loan:

01

Self-employed individuals: Solo 401k plans are designed for self-employed individuals, including sole proprietors, independent contractors, and small business owners without any employees other than a spouse. These individuals often need access to funds for various purposes and may choose to take out a loan from their solo 401k plan instead of seeking external financing options.

02

Individuals with sufficient plan assets: To take out a solo 401k plan loan, individuals must have sufficient assets in their plan to borrow against. This means having a vested account balance, which is the portion of the account that the participant owns outright. The loan amount is typically limited to a percentage of the vested balance, making it important for individuals to have enough funds in their plan to meet their borrowing needs.

03

Individuals with a legitimate need for funds: Solo 401k plan loans are intended to provide participants with access to funds for specific purposes. Individuals who have a legitimate need for funds, such as paying off debt or funding a major expense, may consider taking out a loan from their solo 401k plan instead of using other financing options that could carry higher interest rates or fees.

Overall, solo 401k plan loans can be a useful tool for self-employed individuals who meet the eligibility requirements and have a legitimate need for funds. However, it is important to carefully consider the terms and potential consequences of taking out a loan before proceeding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify solo 401k plan loan without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your solo 401k plan loan into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the solo 401k plan loan electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your solo 401k plan loan in seconds.

Can I create an eSignature for the solo 401k plan loan in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your solo 401k plan loan directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is solo 401k plan loan?

A solo 401k plan loan is a loan that allows a participant in a solo 401k plan to borrow money from their account.

Who is required to file solo 401k plan loan?

Participants in a solo 401k plan who wish to take out a loan from their account are required to file for a solo 401k plan loan.

How to fill out solo 401k plan loan?

To fill out a solo 401k plan loan, participants need to complete a loan application and submit it to the plan administrator for approval.

What is the purpose of solo 401k plan loan?

The purpose of a solo 401k plan loan is to provide participants with access to funds in their retirement account for financial needs.

What information must be reported on solo 401k plan loan?

Information that must be reported on a solo 401k plan loan includes the amount borrowed, repayment terms, and any applicable interest rates.

Fill out your solo 401k plan loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Solo 401k Plan Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.