Get the free Report of Personal Expenses

Show details

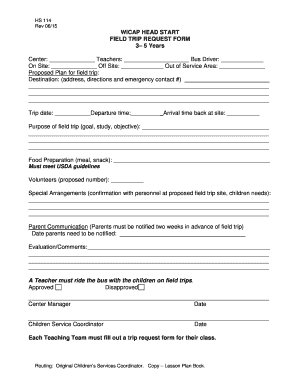

This document serves to report personal expenses incurred for county business and requests reimbursement for those expenses, detailing travel purpose, dates, and associated costs.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of personal expenses

Edit your report of personal expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of personal expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report of personal expenses online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit report of personal expenses. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of personal expenses

How to fill out Report of Personal Expenses

01

Begin by collecting all relevant receipts and documentation for your personal expenses.

02

Download the Report of Personal Expenses template from the official website or obtain a physical copy.

03

Fill in your personal information at the top of the form, including your name, address, and contact information.

04

List each expense individually, including the date, description, amount, and category (e.g., meals, transportation, lodging).

05

Ensure accuracy by double-checking the amounts and categories assigned to each expense.

06

If applicable, attach copies of receipts and documentation to support your claims.

07

Review the completed report for any errors or omissions.

08

Sign and date the report as required.

09

Submit the completed Report of Personal Expenses to the appropriate department or manager.

Who needs Report of Personal Expenses?

01

Employees seeking reimbursement for work-related expenses incurred while traveling or attending events.

02

Individuals managing personal finances who want to track and categorize their expenses for budgeting purposes.

03

Freelancers and contractors needing to report personal expenses to clients for reimbursements or tax deductions.

04

Individuals preparing for tax season who need to document personal expenses for deductions.

Fill

form

: Try Risk Free

People Also Ask about

What is meant by personal expenses?

Personal expenses are the costs we incur in our daily lives to maintain our lifestyle and meet our basic needs. These range from essential living costs to discretionary spending on leisure and entertainment.

What is an example of an expense report?

Some examples include meal expenses, travel expenses, car rentals, lodging, office supplies, or even mileage when an employee uses their vehicle for business travel.

How do I write an expense report?

How to Fill Out an Expense Report Enter your name, department, and employee ID number. Date the employee expense report. Provide a brief description of the business purpose of the expenses submitted for reimbursement. Enter the date, type, and amount of each expense in the related column.

How to explain personal expenses?

Personal expenses are the costs we incur in our daily lives to maintain our lifestyle and meet our basic needs. These range from essential living costs to discretionary spending on leisure and entertainment.

What is a personal expense and give an example?

Personal expenses are costs that are beyond your tuition and fees, room and board, books and supplies, and transportation. Personal expenses include necessities like laundry, cell phone service, clothing, personal care products, prescriptions, car insurance and registration, recreation, and more.

What is a personal expense report?

An expense report is a comprehensive record detailing the expenditures incurred by an individual or a business entity during a specific period. It serves as a crucial tool for managing finances and tracking spending.

What is an example of an expense report?

Some examples include meal expenses, travel expenses, car rentals, lodging, office supplies, or even mileage when an employee uses their vehicle for business travel.

What is the purpose of an expense report?

An expense report is a form that tracks your business's spending. In small businesses, expense reports are used when employees pay out-of-pocket for business expenses. Taxes are a large reason why small businesses need to use expense reports. Expense reports are crucial for helping track work-related expenditures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report of Personal Expenses?

A Report of Personal Expenses is a document that outlines and details an individual's personal expenditures over a specific period, typically for budgeting, tracking, or reimbursement purposes.

Who is required to file Report of Personal Expenses?

Individuals who are seeking reimbursement for expenses incurred on behalf of an organization or those managing their personal finances may be required to file a Report of Personal Expenses.

How to fill out Report of Personal Expenses?

To fill out a Report of Personal Expenses, one should list all personal expenses incurred, categorize them (e.g., travel, meals, entertainment), include dates and amounts, and provide any necessary receipts or documentation.

What is the purpose of Report of Personal Expenses?

The purpose of a Report of Personal Expenses is to accurately track spending, facilitate reimbursements, and assist in financial planning and budgeting.

What information must be reported on Report of Personal Expenses?

The Report of Personal Expenses must include the date of each expense, the type of expense, the amount spent, and supporting documentation such as receipts where applicable.

Fill out your report of personal expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Personal Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.