CA Compliance Affidavit Section 604 free printable template

Show details

City and County of San Francisco Department of Building Inspection Edwin M Lee, Mayor Tom C. Hui, S.E., C.B.O. Director COMPLIANCE AFFIDAVIT SECTION 604 OF THE SAN FRANCISCO HOUSING CODE (Requirements

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit 604 san francisco form

Edit your california section 604 san francisco housing code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit san francisco housing online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit 604 san francisco online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca section 604 san francisco online form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

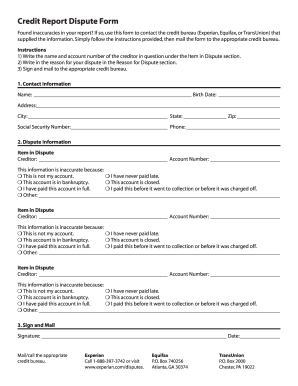

How to fill out 604 san francisco form

How to fill out CA Compliance Affidavit Section 604 - San

01

Start by obtaining the CA Compliance Affidavit Section 604 form.

02

Read the instructions carefully to understand the requirements.

03

Fill out your name and contact information in the designated fields.

04

Provide details about the property or entity associated with the affidavit.

05

Answer all questions truthfully, ensuring that information is accurate.

06

If applicable, include any supporting documentation as required.

07

Review the completed form for any errors or omissions.

08

Sign and date the affidavit where indicated.

Who needs CA Compliance Affidavit Section 604 - San?

01

Individuals or entities involved in real estate transactions in California.

02

Property owners or applicants for permits that require compliance with state laws.

03

Legal representatives handling affairs related to California real estate.

Fill

get compliance 604 edit

: Try Risk Free

People Also Ask about

How to avoid transfer tax in ca?

Transfer tax exemptions Gifts: If a homeowner gifts a property free of debts (like mortgages or liens), it is exempt from transfer taxes. Trust Transfers: Homeowners who transfer property into a revocable trust can do so free of tax. However, this exemption does not apply if the property is sold to a trust.

Who pays transfer tax in San Francisco?

San Francisco charges a transfer tax on each commercial and residential property sold within city boundaries, equal to a percentage of the property's sale price. The tax rate ranges from 0.5 percent to 2.5 percent and is typically paid by the seller.

How is transfer tax calculated in San Francisco?

Please use our transfer tax calculator to estimate your transfer tax.Transfer Tax. If entire value or consideration is Tax rate for entire value or consideration is $10,000,000 or more but less than $25,000,000$27.50 for each $500 or portion thereof$25,000,000 or more$30.00 for each $500 or portion thereof4 more rows

What is the affidavit of transfer tax in San Francisco?

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. Transfer tax is based on the purchase price if it is a purchase. Otherwise, it is based on the fair market value of the property being transferred.

How do you calculate transfer tax in California?

It depends on the location of the property. The County Transfer Tax is a standard of $1.10 per $1,000 of the sales price throughout the State. However, there are certain cities that also collect their own City Transfer Tax and those differ.

What is the transfer tax in California 2023?

The new transfer taxes approved by the voters are scheduled to take effect on April 1, 2023, adding an additional transfer tax of 4.4 percent of the value of any nonexempt property sold for more than $5 million but less than $10 million, and 5.5 percent of the value of any nonexempt property sold for $10 million or

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute code section 604 form online?

pdfFiller makes it easy to finish and sign code section 604 form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit code section 604 form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing code section 604 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit code section 604 form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing code section 604 form, you need to install and log in to the app.

What is CA Compliance Affidavit Section 604 - San?

CA Compliance Affidavit Section 604 - San is a legal document that certifies compliance with specific state regulations in California, particularly related to environmental laws, safety, and public welfare.

Who is required to file CA Compliance Affidavit Section 604 - San?

Individuals or entities engaging in certain regulated activities in California, such as businesses involved in construction, real estate transactions, or environmental assessments, are generally required to file this affidavit.

How to fill out CA Compliance Affidavit Section 604 - San?

To fill out the CA Compliance Affidavit Section 604 - San, one must provide accurate information about the business/entity, detail compliance with applicable regulations, and attach necessary documentation that supports the affidavit.

What is the purpose of CA Compliance Affidavit Section 604 - San?

The purpose of CA Compliance Affidavit Section 604 - San is to ensure that businesses comply with California's regulatory requirements, thereby promoting environmental safety and public health.

What information must be reported on CA Compliance Affidavit Section 604 - San?

The CA Compliance Affidavit Section 604 - San must report information such as the names and addresses of the parties involved, details of the activities subject to compliance, evidence of adherence to applicable laws, and any relevant permits or certifications.

Fill out your code section 604 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Code Section 604 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.