Get the free Choosing a super fund - OnePath

Show details

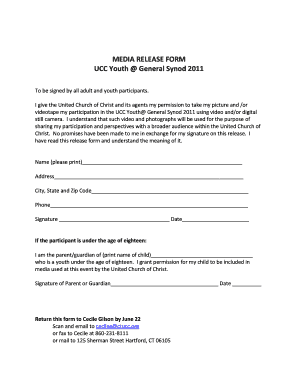

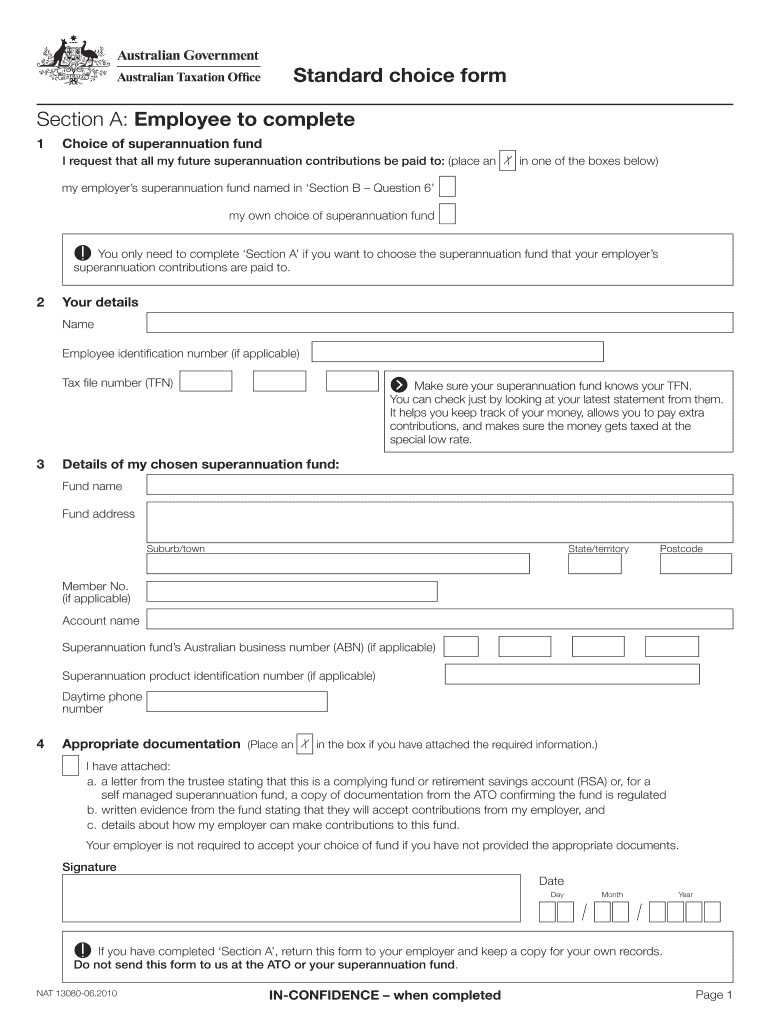

N visit our website at www.ato.gov.au or n phone us on 13 10 20 ... nominated fund (also known as their default fund). You do not need to ... If you quote your tax file number (TEN) to your employer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign choosing a super fund

Edit your choosing a super fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your choosing a super fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing choosing a super fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit choosing a super fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out choosing a super fund

How to fill out choosing a super fund:

01

Research different super funds: Start by researching different super funds that are available to you. Look for funds that align with your investment goals and risk tolerance. Consider factors such as fees, investment options, and member services.

02

Compare features and benefits: Once you have a list of potential super funds, compare their features and benefits. Look at their past performance, investment strategies, insurance options, and any additional services they offer. Consider how these features align with your financial goals and needs.

03

Assess fees and charges: Review the fees and charges associated with each super fund. This includes administration fees, investment fees, and any other costs involved. Make sure you understand these fees and consider their impact on your long-term returns.

04

Consider investment options: Look at the investment options offered by each super fund. Consider whether they align with your risk tolerance and investment objectives. This may include options such as diversified portfolios, ethical investments, or self-managed investment options.

05

Review insurance options: Evaluate the insurance options provided by each super fund. This may include life insurance, total and permanent disability cover, and income protection insurance. Consider your personal circumstances and determine whether the insurance offerings meet your needs.

06

Check member services and support: Look into the member services and support provided by each super fund. This may include educational resources, financial advice, and online account management tools. Consider the level of support you require and choose a fund that offers appropriate services.

Who needs choosing a super fund:

01

Individuals starting a new job: When starting a new job, you may be prompted to choose a super fund. It is essential to understand the options available and select a fund that suits your long-term financial goals.

02

Those who are self-employed: Self-employed individuals are responsible for setting up their own super fund. Choosing the right super fund is crucial in ensuring you have adequate retirement savings.

03

Individuals looking to consolidate super accounts: Many people have multiple super accounts from previous jobs. Consolidating these accounts into one fund can make it easier to manage your super and potentially reduce fees.

04

Individuals unhappy with their current super fund: If you are dissatisfied with your current super fund's performance, fees, or services, it may be worth considering other options. Choosing a new super fund can help improve your retirement savings strategy.

05

Those nearing retirement: As retirement approaches, it is essential to review your super fund to ensure it aligns with your retirement goals. This may include adjusting your investment options or considering income stream products.

Remember, it is advisable to seek professional financial advice when choosing a super fund to ensure it suits your individual circumstances and retirement objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my choosing a super fund directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your choosing a super fund and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit choosing a super fund in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your choosing a super fund, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out choosing a super fund on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your choosing a super fund. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

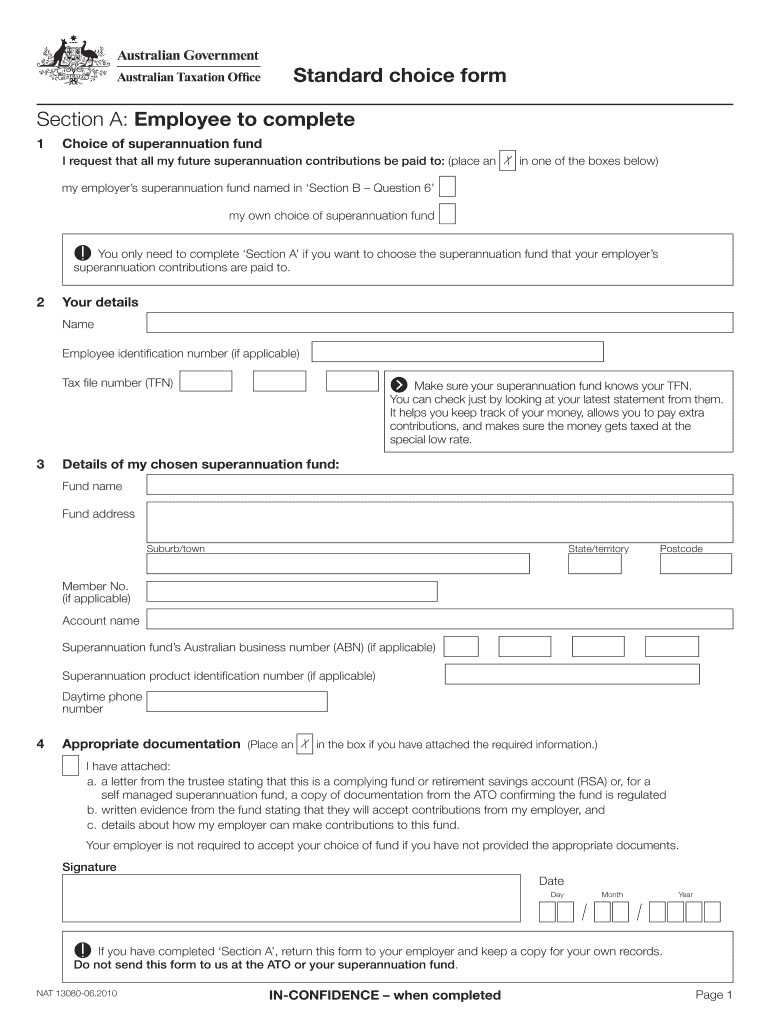

What is choosing a super fund?

Choosing a super fund refers to selecting a retirement fund where your employer will deposit your superannuation contributions.

Who is required to file choosing a super fund?

All employees in Australia are required to choose a super fund for their employer to deposit their superannuation contributions.

How to fill out choosing a super fund?

Employees can fill out choosing a super fund form provided by their employer or select a super fund through the MyGov website.

What is the purpose of choosing a super fund?

The purpose of choosing a super fund is to ensure that your employer deposits your superannuation contributions into a fund of your choice for your retirement savings.

What information must be reported on choosing a super fund?

Employees need to report their chosen super fund's name, address, and unique superannuation identifier (USI) when filling out the choosing a super fund form.

Fill out your choosing a super fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Choosing A Super Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.