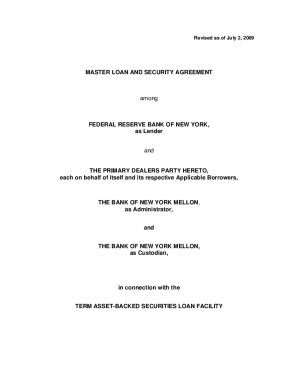

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Granter is a corporation and the Grantee is a corporation. Granter conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Granter, if any, which are reserved by Granter. This deed complies with all state statutory laws.

Get the free Quitclaim Deed

Show details

This document serves as a quitclaim deed between two corporations, detailing the conveyance of property from a Grantor Corporation to a Grantee Corporation along with legal considerations and conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quitclaim deed

Edit your quitclaim deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quitclaim deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quitclaim deed

How to fill out Quitclaim Deed

01

Start with the title of the document: Write 'Quitclaim Deed' at the top of the page.

02

Add the date: Include the date on which the deed is being executed.

03

Identify the grantor: Write the full name and address of the person transferring the property rights.

04

Identify the grantee: Write the full name and address of the person receiving the property rights.

05

Describe the property: Provide a legal description of the property, including the address and any relevant parcel number.

06

Include wording for the conveyance: Use language that indicates the grantor is transferring their interest in the property to the grantee.

07

Add any reservations or exceptions: If there are any rights that the grantor is retaining, include them here.

08

Sign the deed: The grantor must sign the document in front of a notary public.

09

Notarize the document: The notary should sign and stamp the deed to make it legally binding.

10

Record the deed: File the notarized deed with the county recorder's office where the property is located to complete the process.

Who needs Quitclaim Deed?

01

Individuals transferring property ownership without selling it, such as family members, friends, or divorced couples.

02

People needing to clear up title issues or disputes over property ownership.

03

Heirs or beneficiaries who are receiving property as part of an inheritance.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a quit claim deed?

The bottom line: Understanding quitclaim deeds However, because quitclaim deeds don't guarantee the title is free and clear, they aren't suitable for typical real estate transactions. In short, quitclaim deeds are for transferring property – not buying a home.

What is the meaning of quitclaim?

Generally, a quitclaim is a formal renunciation of a legal claim against some other person, or of a right to land. A person who quitclaims renounces or relinquishes a claim to some legal right, or transfers a legal interest in land.

What is a quitclaim deed in simple terms?

What does a quitclaim deed do? A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.

Why would someone use a quitclaim deed?

A quitclaim deed is a simple tool for transferring interest in a property without guaranteeing that the grantor has valid ownership. It's most commonly used in non-sale situations, such as transfers between family members, or to update or clarify ownership titles.

What does quitclaim mean in English?

quitclaim in American English 1. the release or relinquishment of a claim, action, right, or title. 2. a deed or other legal paper in which a person relinquishes to another a claim or title to some property or right without guaranteeing or warranting such title.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quitclaim Deed?

A Quitclaim Deed is a legal instrument that is used to transfer an individual's interest in a property to another person without any warranties against future claims.

Who is required to file Quitclaim Deed?

Generally, the person transferring their interest in the property, also known as the grantor, is required to file the Quitclaim Deed.

How to fill out Quitclaim Deed?

To fill out a Quitclaim Deed, you should include the names of the grantor and grantee, a legal description of the property, the date of transfer, and the signatures of the parties involved, along with any required notary acknowledgement.

What is the purpose of Quitclaim Deed?

The purpose of a Quitclaim Deed is to allow for the easy transfer of property interests, often used among family members or in situations where the granter does not wish to make any guarantees about the property.

What information must be reported on Quitclaim Deed?

The information that must be reported on a Quitclaim Deed includes the names of the parties, the legal description of the property, the date of the transaction, and the signature of the grantor, often accompanied by a notary's signature.

Fill out your quitclaim deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quitclaim Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.