Get the free COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT - osp uah

Show details

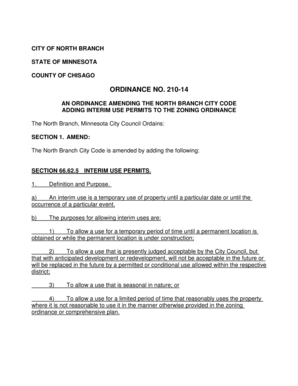

This document serves as a disclosure statement for educational institutions documenting their cost accounting practices as required by Public Law 100-679. It outlines the institution's policies regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost accounting standards board

Edit your cost accounting standards board form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost accounting standards board form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cost accounting standards board online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cost accounting standards board. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost accounting standards board

How to fill out COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT

01

Obtain the COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT form from the official website or relevant authority.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Begin by providing the necessary identification information such as your company name, address, and tax identification number.

04

Complete the section that outlines your cost accounting system and its compliance with applicable cost accounting standards.

05

Detail any changes made to your accounting practices since the last submission, if applicable.

06

Include financial data and documents that support your disclosed cost accounting practices.

07

Review your entries for accuracy and completeness.

08

Sign and date the form to certify the information provided is true and correct.

09

Submit the completed form to the designated office or authority before the deadline.

Who needs COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

01

The COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT is needed by contractors and subcontractors who are required to comply with federal cost accounting standards.

02

It is also necessary for entities that wish to establish cost accounting systems for federal contracts.

03

Additionally, the statement is required by organizations that seek to ensure transparency and accountability in their cost reporting practices.

Fill

form

: Try Risk Free

People Also Ask about

What is the cost accounting standard 416?

CAS 416 – Accounting for Insurance Costs This standard requires contractors to account for the insurance costs (such as premiums, losses, etc.) consistently and to allocate those costs to the cost objectives (such as contracts, projects, etc.) protected by the insurance coverage.

What is the cost accounting standards board disclosure statement?

The Cost Accounting Standards Board Disclosure Statement (CASB DS-1) is the form required by Public Law 100-679 for contractors and subcontractors. Its purpose is to provide consistency in reporting of costs. All new contractors are required to submit a CASB DS-1 before a contract of $50 million or more is awarded.

What is the cost accounting standard?

This standard deals with the principles and methods of classification, measurement and assignment of pollution control costs, for determination of Cost of product or service, and the presentation and disclosure in cost statements.

What is the cost accounting standard 406?

CAS 406 requires contractors to use defined cost accounting periods consistently when estimating, accumulating, and reporting costs. This standard ensures that costs are properly allocated to the correct time periods, promoting accuracy and fairness in contract pricing.

What are the CAS cost accounting standards?

Cost Accounting Standards (CAS) are a set of standards that are designed “to achieve uniformity and consistency in cost accounting practices.”

What is the threshold for a CAS disclosure statement?

A CASB Disclosure Statement is required if Full-CAS coverage applies to a contractor. [Click here] to learn more about types of CAS coverage and CAS applicability. Any CAS-covered contract of $50 million or more requires a Disclosure Statement prior to the contract award.

What is the cost accounting standard CAS 416?

CAS 416 provides criteria for the measurement of insurance costs, the assignment of such costs to cost accounting periods, and the allocation to final cost.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

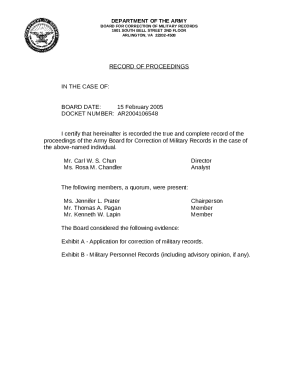

The Cost Accounting Standards Board (CASB) Disclosure Statement is a document required by the Cost Accounting Standards Board that outlines a contractor's cost accounting practices and policies. Its purpose is to provide transparency and ensure compliance with federal cost accounting standards.

Who is required to file COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

Generally, contractors who are negotiating contracts over a specified monetary threshold with the federal government are required to file the CASB Disclosure Statement. This requirement typically applies to companies that are subject to the Cost Accounting Standards.

How to fill out COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

Completing the CASB Disclosure Statement involves providing detailed information about your company's accounting practices, including methods for allocating costs, cost estimating, and financial reporting. Specific instructions and forms can typically be found on the website of the Cost Accounting Standards Board.

What is the purpose of COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

The primary purpose of the CASB Disclosure Statement is to ensure transparency in the cost accounting practices of federal contractors and to promote consistency in the application of cost principles across government contracts.

What information must be reported on COST ACCOUNTING STANDARDS BOARD DISCLOSURE STATEMENT?

The CASB Disclosure Statement requires reporting of various types of information, including accounting practices, cost allocation methods, indirect cost rates, overhead rates, and descriptions of the company’s financial management systems.

Fill out your cost accounting standards board online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Accounting Standards Board is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.