Get the free REQUEST FOR DELINQUENT TAX NOTIFICATION - allegancounty

Show details

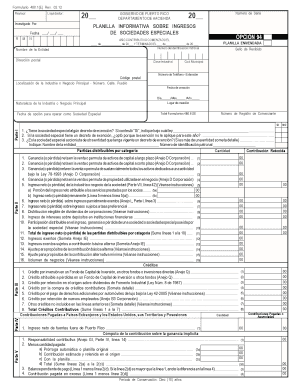

This form is used to request notification of delinquent property taxes for a property in Allegan County, especially for individuals who have an interest in the property but are not the owners.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for delinquent tax

Edit your request for delinquent tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for delinquent tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for delinquent tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for delinquent tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for delinquent tax

How to fill out REQUEST FOR DELINQUENT TAX NOTIFICATION

01

Obtain the REQUEST FOR DELINQUENT TAX NOTIFICATION form from the appropriate tax authority or website.

02

Fill in your personal information, including your name, address, and contact information in the designated fields.

03

Specify the tax year or years for which you are requesting the notification.

04

Indicate the reason for the request if required, providing any additional context or details as necessary.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the form at the bottom to authenticate your request.

07

Submit the completed form to the tax authority, either by mail or online, as instructed.

Who needs REQUEST FOR DELINQUENT TAX NOTIFICATION?

01

Individuals or businesses that have unpaid taxes and need formal notification of delinquency.

02

Tax professionals or accountants who are assisting clients with tax compliance and notification.

03

Property owners facing tax liens or other actions due to delinquent taxes.

Fill

form

: Try Risk Free

People Also Ask about

Why did I get a CP14 notice?

The CP14 is a balance due notice telling you that you owe money for unpaid taxes. The notice requests that a payment be made within 21 days. If the balance due is not fully paid within 60 days, the IRS can proceed with collection activity.

How to request tax back in the UK?

If your P800 calculation states that you can claim your tax refund online, then usually you can go into your Personal Tax Account (PTA) or the HMRC app and ask HMRC to pay it directly into your bank account via BACS. Or you can contact HMRC by telephone and ask them to send you a cheque.

Will I automatically get a tax refund in the UK?

As of 31 May 2024, HMRC has changed the way it deals with refunds. In the past, it would issue certain repayments automatically. Now, if your P800 calculation shows that you are due a tax refund, you may have to claim directly via your government gateway account in order to receive it.

How do I request tax back leaving the UK?

You can claim online or use form P85 to tell HMRC that you've left or are leaving the UK and want to claim back tax from your UK employment. You can claim if you: lived and worked in the UK. left the UK and may not be coming back.

Can tourists claim tax back in the UK?

However, as of January 1, 2021, the UK government discontinued the VAT refund scheme for tourists. For many visitors, this decision ended an era of cost-effective shopping in Britain. No longer can tourists claim refunds on the 20% VAT added to most items, which has left a noticeable gap for budget-conscious travelers.

What is a tax notice?

The Internal Revenue Service (IRS) will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment.

How to ask for a tax refund in the UK?

P800 tax calculation – you can claim online through your Personal Tax Account (PTA) – ask HMRC to pay the refund into your bank account via BACS. through the HMRC app – ask HMRC to pay the refund directly into your bank account via BACS. contact HMRC by telephone and ask them to send you a cheque.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST FOR DELINQUENT TAX NOTIFICATION?

REQUEST FOR DELINQUENT TAX NOTIFICATION is a formal request submitted to authorities to notify them about individuals or entities that have unpaid taxes.

Who is required to file REQUEST FOR DELINQUENT TAX NOTIFICATION?

Typically, tax authorities, such as local tax collectors or tax assessors, are required to file this notification for taxpayers who are delinquent in their tax payments.

How to fill out REQUEST FOR DELINQUENT TAX NOTIFICATION?

To fill out the REQUEST FOR DELINQUENT TAX NOTIFICATION, you need to provide information such as the taxpayer's name, address, tax identification number, details of the tax owed, and any prior notices sent.

What is the purpose of REQUEST FOR DELINQUENT TAX NOTIFICATION?

The purpose of REQUEST FOR DELINQUENT TAX NOTIFICATION is to officially notify tax authorities of delinquent taxes, which helps in the collection process and maintains accurate tax records.

What information must be reported on REQUEST FOR DELINQUENT TAX NOTIFICATION?

The information that must be reported includes the taxpayer's personal details, the amount of tax owed, the tax year or period for which the tax is delinquent, and any previous attempts made to collect the owed taxes.

Fill out your request for delinquent tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Delinquent Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.