Get the free Traditional or ROTH IRA TransferRollover Request Form

Show details

Traditional or ROTH IRA Transfer/Rollover Request Form P. O. BOX 701 Milwaukee WI 53201 (800) 4214184 www.eagleasset.com INSTRUCTIONS: Use this form to request a transfer or elect a rollover of assets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional or roth ira

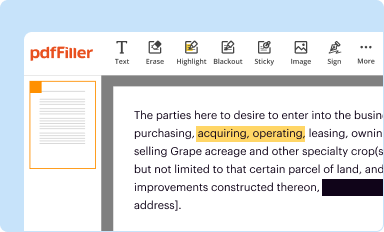

Edit your traditional or roth ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

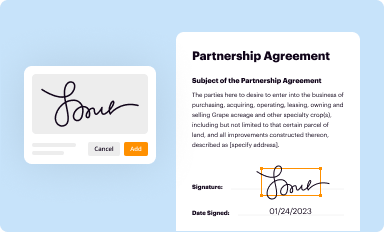

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

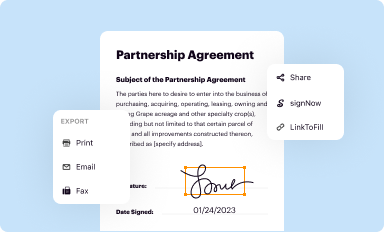

Share your form instantly

Email, fax, or share your traditional or roth ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

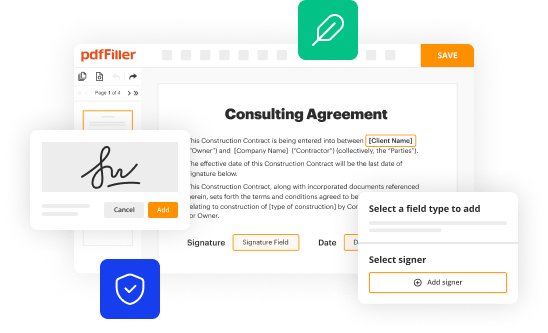

Editing traditional or roth ira online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit traditional or roth ira. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional or roth ira

How to Fill Out Traditional or Roth IRA:

01

Determine your eligibility: Before filling out a Traditional or Roth IRA, you should ensure that you meet the eligibility criteria. Traditional IRAs have no income limits, whereas Roth IRAs have income limits and other eligibility rules.

02

Choose the type of IRA: Traditional and Roth IRAs have different tax advantages and withdrawal rules. Understand the differences between the two and choose the one that aligns with your financial goals and current tax situation.

03

Select a financial institution: Look for a reputable financial institution that offers IRA accounts. Consider factors such as fees, investment options, customer service, and online access. You can choose a bank, credit union, brokerage firm, or other financial institutions to open your IRA.

04

Complete the application: Once you have chosen the financial institution, you will need to complete the application form. Provide the necessary personal information, such as your name, address, social security number, and employment details. Read the terms and conditions carefully before submitting the application.

05

Determine your contribution amount: Decide how much you want to contribute to your IRA. The contribution limit may change each year, so ensure you are aware of the current limits. Your financial institution can provide guidance on the maximum amount you can contribute.

06

Choose your investments: After opening your IRA, you will need to decide how to invest your contributions. Different financial institutions offer various investment options, such as stocks, bonds, mutual funds, or target-date funds. Seek professional financial advice if you are unsure about which investments are suitable for your goals and risk tolerance.

07

Monitor and manage your IRA: It is essential to regularly monitor the performance of your IRA investments and make adjustments as needed. Stay informed about any changes in tax laws or rules that may affect your IRA. Review your IRA annually and consider rebalancing your portfolio if necessary.

Who Needs Traditional or Roth IRA:

01

Individuals planning for retirement: Both traditional and Roth IRAs are retirement savings vehicles, making them suitable for individuals who want to build a nest egg for their retirement years. The choice between the two depends on factors such as tax considerations and when you anticipate needing the funds.

02

Those looking for tax advantages: Traditional IRAs offer potential tax deductions for contributions, which can help lower your taxable income in the year you contribute. On the other hand, Roth IRAs offer tax-free withdrawals in retirement, as contributions are made with after-tax money.

03

Individuals seeking diversification and control: IRAs provide a wide range of investment options, allowing individuals to diversify their holdings and have control over their retirement savings. This flexibility can be appealing to individuals who want to tailor their investments to their risk tolerance and investment goals.

04

Those wanting to continue savings after employer-sponsored retirement plans: If your employer-sponsored retirement plan, such as a 401(k), is maxed out or not available, IRAs provide an additional way to save for retirement. They allow you to contribute up to the annual limits set by the IRS, depending on the type of IRA and your age.

Remember, it is always recommended to consult with a financial advisor or tax professional to evaluate your specific financial situation and determine the best retirement savings strategy for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send traditional or roth ira to be eSigned by others?

When you're ready to share your traditional or roth ira, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete traditional or roth ira online?

pdfFiller has made filling out and eSigning traditional or roth ira easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit traditional or roth ira on an iOS device?

Create, edit, and share traditional or roth ira from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is traditional or roth ira?

Traditional and Roth IRAs are retirement savings accounts that offer different tax advantages. With a Traditional IRA, contributions may be tax-deductible, while contributions to a Roth IRA are made with after-tax dollars.

Who is required to file traditional or roth ira?

Individuals who have earned income are eligible to contribute to a Traditional or Roth IRA, but there may be income limits for Roth IRAs.

How to fill out traditional or roth ira?

To open and contribute to a Traditional or Roth IRA, individuals can contact a financial institution or investment firm that offers these accounts. They will need to provide personal information and determine how much to contribute.

What is the purpose of traditional or roth ira?

The purpose of Traditional and Roth IRAs is to provide individuals with a tax-advantaged way to save for retirement. They offer the potential for investment growth and may help individuals build a nest egg for their retirement years.

What information must be reported on traditional or roth ira?

Contributions, withdrawals, and investment gains or losses must be reported on Traditional and Roth IRA accounts to ensure compliance with tax laws.

What is the penalty for late filing of traditional or roth ira?

The penalty for late filing of Traditional or Roth IRAs is typically a percentage of the amount owed, based on how late the filing is and whether there was reasonable cause for the delay.

Fill out your traditional or roth ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Or Roth Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.