Get the free Personal Tax Plan

Show details

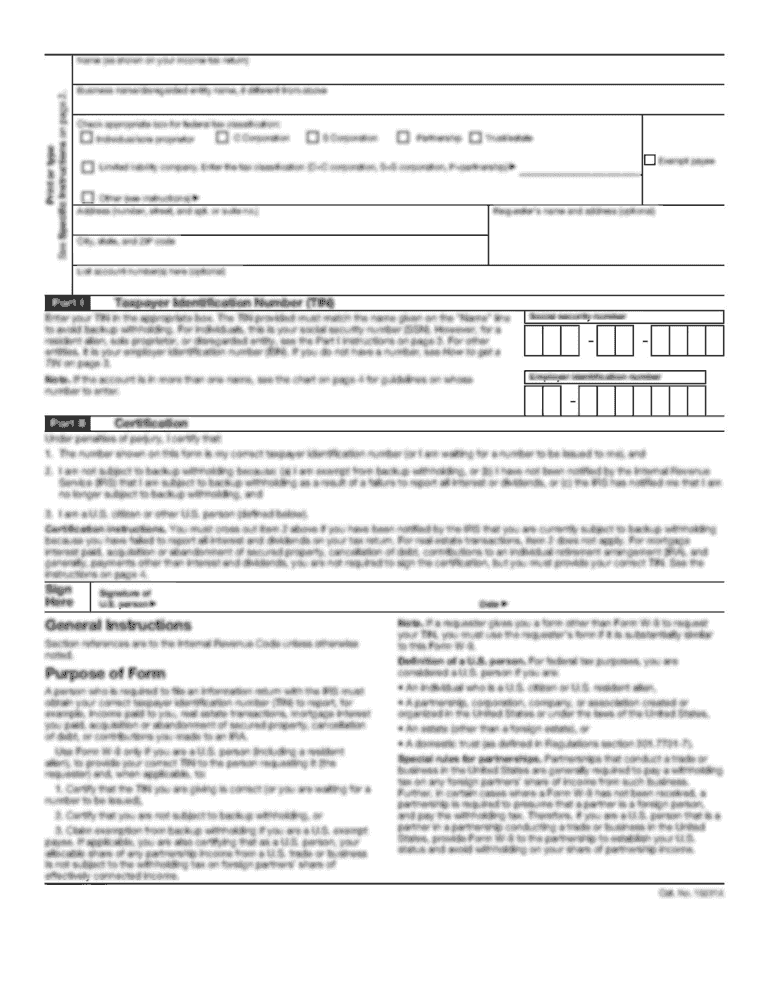

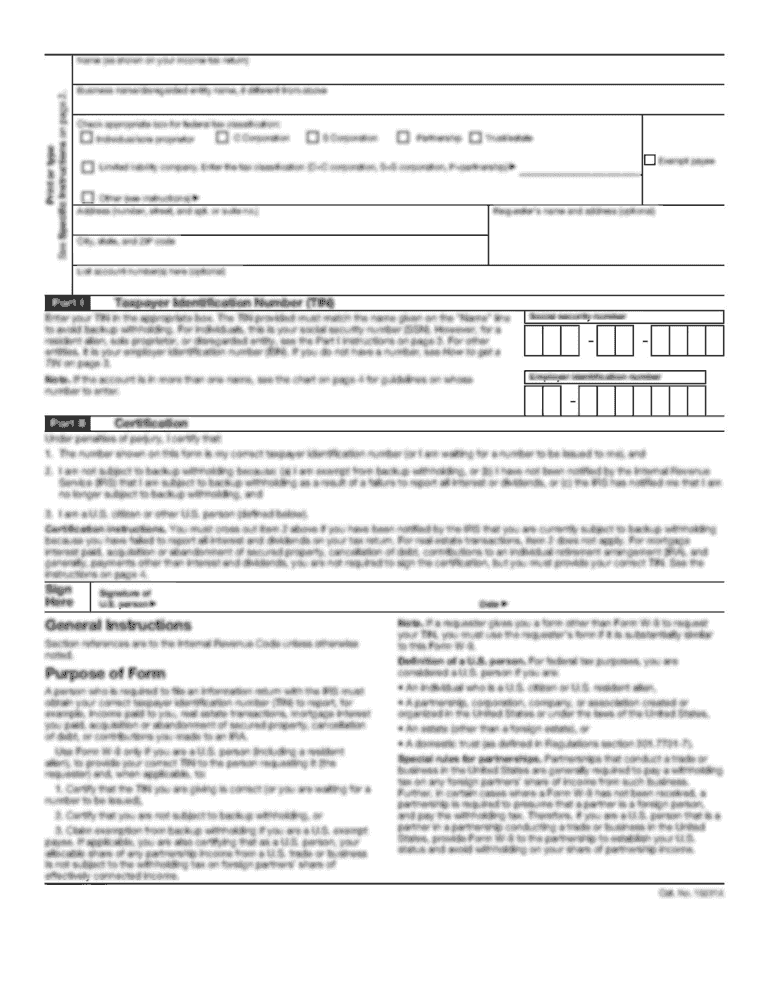

Prepared by Michael Brewster EA Brewster Scott Associates 729 Grapevine Hwy. Suite 172 Hurst TX 76054 682-203-8060 mbrewster stressfreetaxhelp*com www. StressFreeTaxHelp*com Personal Tax Plan Prepared for Mr. Mrs. Howard Cunningham 565 N* Clinton Dr. Fort Worth 76111 We collect nonpublic personal information about you that we obtain from you or with your authorization* We don t disclose any nonpublic personal information obtained in the course of our practice except as required or permitted...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal tax plan

Edit your personal tax plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal tax plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal tax plan online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal tax plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal tax plan

How to fill out Personal Tax Plan

01

Start by gathering your financial documents including income statements, previous tax returns, and expense records.

02

Assess your current tax situation including filing status and deductions you qualify for.

03

Identify your income sources and estimate the total expected income for the year.

04

Research tax credits and deductions you might be eligible for and list them.

05

Calculate your estimated tax liability based on the gathered information.

06

Develop a plan to minimize your tax liability through legal deductions and credits.

07

Review your personal situation to determine if adjustments to withholding or estimated payments are necessary.

08

Consider consulting with a tax professional for personalized advice and review.

09

Create a timeline for your tax obligations including filing dates and payment due dates.

10

Keep your Personal Tax Plan updated throughout the year as your finances change.

Who needs Personal Tax Plan?

01

Individuals with multiple income sources.

02

Self-employed professionals and freelancers.

03

Individuals seeking to maximize tax deductions and credits.

04

People going through significant life changes, such as marriage, divorce, or retirement.

05

Anyone looking to manage their tax liability effectively.

Fill

form

: Try Risk Free

People Also Ask about

How much of a difference is claiming 0 vs 1?

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

How much do the English pay in taxes?

The basic rate of tax in the UK is 20%, which applies to income above the personal allowance and up to a higher threshold. The UK has a higher rate of tax of 40% and an additional rate of tax of 45% for the highest earners.

Is it better to claim 1 or 0 on your taxes?

Thus, claiming ``0'' results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (ie 1, 2, 3, etc) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

How much does tax planning cost?

Between $1,500 and $10,000 or more annually, depending on complexity. A CPA may charge $8,000 for annual tax planning to a business owner advising on equity compensation, retirement and estate planning, investment management, charitable giving, and small business planning.

Do you get a bigger tax refund if you claim 1 or 0?

Thus, claiming ``0'' results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (ie 1, 2, 3, etc) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

How do you do a tax plan?

Understand your tax bracket. Review your withholding amounts. Reduce your taxable income and liability. Know if you need to make estimated tax payments. Determine whether to itemize or take the standard deduction. Plan ahead for what you may owe the IRS. Keep your tax records in a central location.

Is it a good idea to do a payment plan with the IRS?

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.

Why do I owe taxes if I claim 0?

Probably the most common reason is working multiple jobs. It's also possible that your job did not withhold the correct amount of tax, but that's still on you. You don't come out any worse, by the way--any money that wasn't withheld came in your paycheck.

Will I owe money if I claim 1?

Claiming 1 on Your Taxes Claiming 1 reduces the amount of taxes that are withheld, which means you will get more money each paycheck instead of waiting until your tax refund. You could still get a small refund while having a larger paycheck if you claim 1. It just depends on your situation.

What is the 90% rule for taxes?

Generally, an underpayment penalty can be avoided if you use the safe harbor rule for payments described below. The IRS will not charge you an underpayment penalty if: You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year, or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Tax Plan?

A Personal Tax Plan is a strategic approach to managing an individual's taxes, aiming to minimize tax liability and maximize tax benefits while ensuring compliance with tax laws.

Who is required to file Personal Tax Plan?

Individuals with taxable income, those who want to optimize their tax savings, or anyone seeking to benefit from available tax deductions and credits are generally encouraged or required to file a Personal Tax Plan.

How to fill out Personal Tax Plan?

To fill out a Personal Tax Plan, individuals should gather their financial documents, assess their income sources, identify deductions and credits applicable to them, and complete the relevant forms or worksheets provided by tax authorities.

What is the purpose of Personal Tax Plan?

The purpose of a Personal Tax Plan is to strategically manage tax obligations, enhance tax efficiency, and ensure that individuals can take advantage of all available tax benefits while remaining compliant with tax regulations.

What information must be reported on Personal Tax Plan?

The information that must be reported on a Personal Tax Plan typically includes personal identification details, income sources, deductible expenses, tax credits, and any other relevant financial data impacting tax liability.

Fill out your personal tax plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Tax Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.