Get the free Watchman Insurance Application - tsginsurance co

Show details

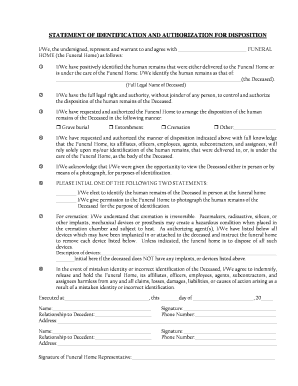

Application and declaration of facts for insurance coverage on unoccupied domestic properties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign watchman insurance application

Edit your watchman insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your watchman insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing watchman insurance application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit watchman insurance application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out watchman insurance application

How to fill out Watchman Insurance Application

01

Gather personal information: Collect your name, address, contact details, and social security number.

02

Provide details about your property: Include information about the property you want to insure, such as its address, type, and value.

03

List all occupants: Include names, ages, and relationship to you of everyone living in the property.

04

Describe your insurance history: Provide information about any past insurance policies, including claims made and reasons for cancellation if applicable.

05

Fill out specific coverage requests: Select the types of coverage you want, such as liability, property, and health.

06

Include additional information: Answer any supplemental questions about your risk factors, such as pets or home security systems.

07

Review the application: Double-check all entered information for accuracy and completeness.

08

Submit the application: Either online or via postal mail, send the completed application to the insurance provider.

Who needs Watchman Insurance Application?

01

Individuals or families owning properties that require coverage against potential damages or liabilities.

02

Homeowners looking for peace of mind and financial protection in case of accidents or disasters.

03

Landlords renting out properties who need insurance to cover possible tenant-related risks.

04

Businesses that require protection for their physical premises and assets.

Fill

form

: Try Risk Free

People Also Ask about

What are the downsides of the watchman?

Rare risks of the WATCHMAN procedure include: Blood clots. Infection. Pericardial effusion, a buildup of fluid in the membranes around your heart. Stroke.

Who is not eligible for a watchman?

A person should not receive a Watchman implant if they: have an LAA that is too large or too small for the device. cannot take blood thinners such as aspirin, warfarin, or clopidogrel. cannot undergo cardiac catheterization or other invasive heart procedures.

What are the indications for a watchman procedure?

Among patients in the NCDR LAAO Registry, the most common procedural indications for the Watchman were increased thromboembolic risk, history of major bleed, and high fall risk. A majority of patients had multiple procedural indications. High fall risk conferred a modestly increased risk of in-hospital adverse events.

What are the criteria for getting a watchman?

The WATCHMAN Implant may be suitable for a broad range of non-valvular atrial fibrillation (AFib) patients and may be an appropriate option for your NVAF patients who meet these criteria. Eligible patients must: Have an increased risk for stroke and be recommended for oral anticoagulation (OAC)

Is the watchman procedure covered by insurance?

Learn if the WATCHMAN LAAC implant may be an appropriate option for your non-valvular AFib (NVAF) patients to reduce stroke risk. WATCHMAN is covered nationally for a broad range of patients by Centers for Medicare and Medicaid Services and an ever-increasing number of commercial insurers.

What is the average cost of the watchman procedure?

Results A total of 30,175 patients underwent Watchman device implantation at a median cost of $24,500 and demonstrated significant variability across admissions (inter-decile range, $13,900-37,000).

Who is a candidate for a watchman procedure?

Who Might Be a Candidate for the WATCHMAN Device? People who have AFib that isn't caused by problems with their heart valves may be candidates for the WATCHMAN device. At Penn Medicine, our cardiologists offer the WATCHMAN device to most patients with AFib.

How do you qualify for a watchman implant?

Patient is at risk for stroke, has had a major bleeding event more than once and will not be able to withstand anticoagulation. Patient meets the criteria for having had a previous bleed, in this case a major bleed, and should be considered for WATCHMAN.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Watchman Insurance Application?

The Watchman Insurance Application is a specific form used to apply for insurance coverage related to Watchman devices, which are medical devices intended to prevent strokes by closing the left atrial appendage in patients with atrial fibrillation.

Who is required to file Watchman Insurance Application?

Healthcare providers and patients who are seeking insurance coverage for the Watchman device must file the Watchman Insurance Application as part of the insurance reimbursement process.

How to fill out Watchman Insurance Application?

To fill out the Watchman Insurance Application, ensure you provide all necessary patient information, medical history, details of the procedure, and any supporting documentation or clinical evidence required by the insurance company.

What is the purpose of Watchman Insurance Application?

The purpose of the Watchman Insurance Application is to formally request insurance coverage for the Watchman device procedure, ensuring that patients have access to the necessary medical treatment.

What information must be reported on Watchman Insurance Application?

The information that must be reported on the Watchman Insurance Application includes patient demographics, clinical data, procedure details, physician information, and any previous treatment history relevant to atrial fibrillation management.

Fill out your watchman insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Watchman Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.