Get the free SAMPLE US Customs Invoice Form - Pacific Customs Brokers Ltd

Show details

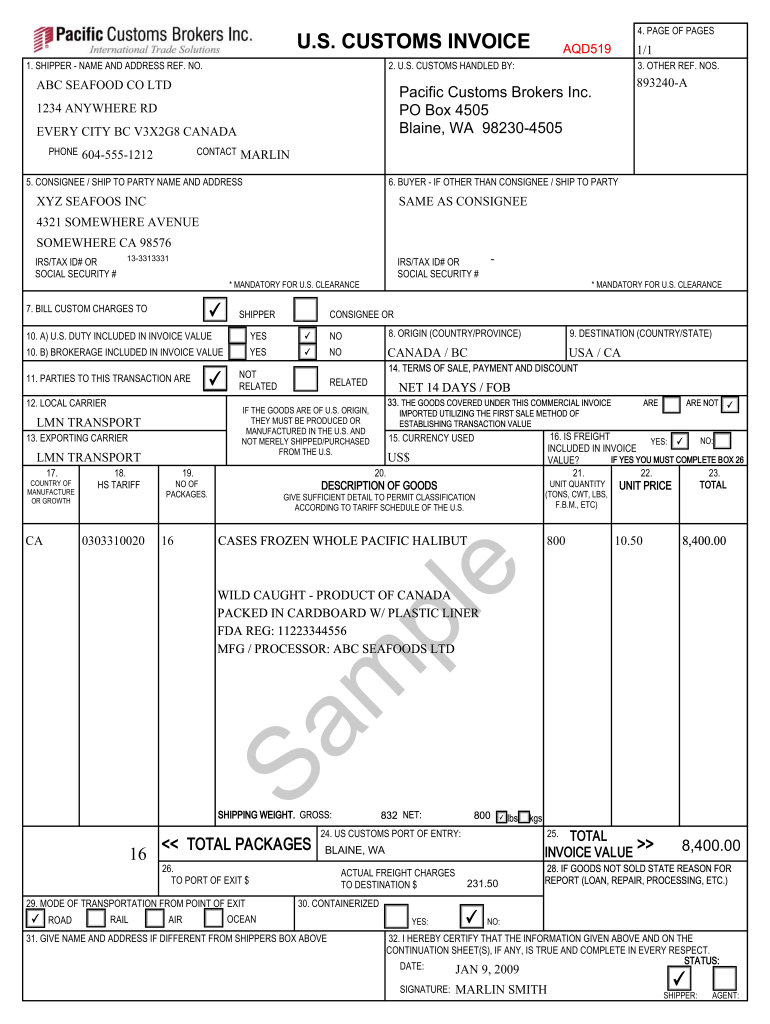

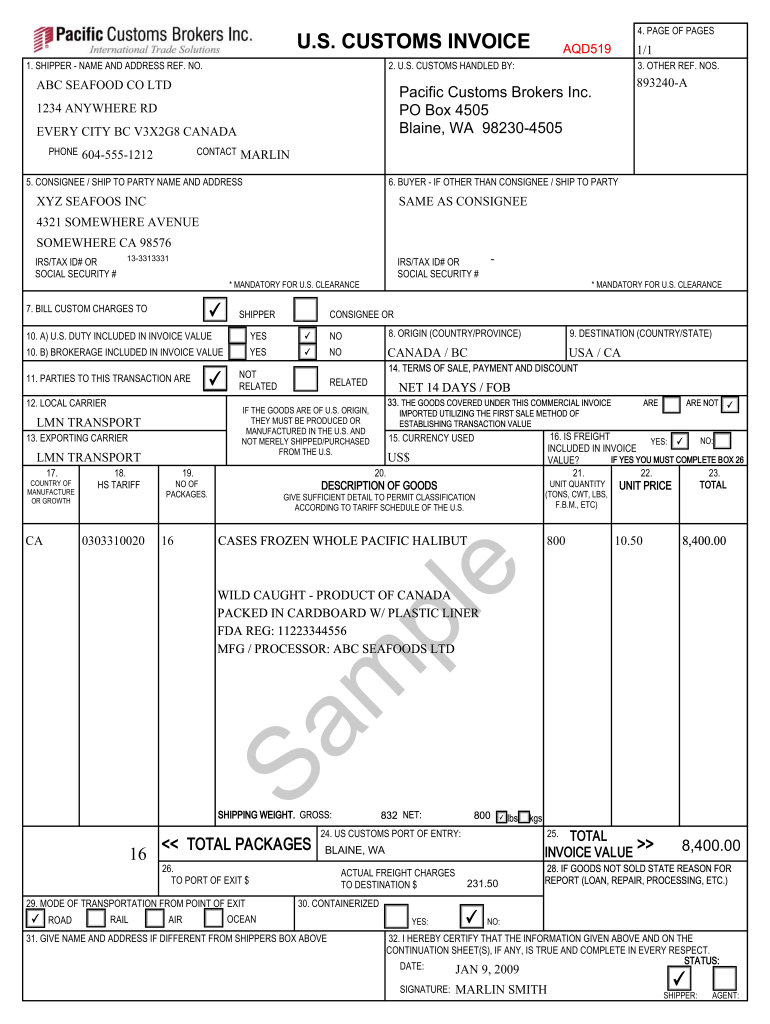

4. PAGE OF PAGES U.S. CUSTOMS INVOICE 1. SHIPPER NAME AND ADDRESS REF. NO. ABC SEAFOOD CO LTD EVERY CITY BC V3X2G8 CANADA CONTACT 6045551212 1/1 3. OTHER REF. NOS. 893240A Pacific Customs Brokers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample us customs invoice

Edit your sample us customs invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample us customs invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample us customs invoice online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sample us customs invoice. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample us customs invoice

How to fill out a sample US customs invoice:

01

Start by entering the exporter's name, address, and contact information in the designated fields.

02

Provide the importer's name, address, and contact information as well.

03

Specify the date of shipment and the mode of transportation (e.g., air, ocean, ground).

04

Include the buyer's name, as well as any reference numbers or purchase order details.

05

Describe each item being exported, including its quantity, unit value, and total value in the appropriate columns.

06

Indicate the country(ies) of origin for each item.

07

Provide the harmonized system (HS) tariff classification code for each item, if applicable.

08

Calculate and enter the total value of the shipment.

09

Fill in the payment terms, terms of delivery, and any additional information required by the customs authorities.

10

Sign and date the invoice, ensuring that it is legible and accurate.

Who needs a sample US customs invoice?

01

Individuals or businesses engaged in international trade and exporting goods from the United States.

02

Importers who require proper documentation of the goods being received and their value.

03

Customs officers and authorities who use the invoice to verify the contents of the shipment and assess any applicable duties or taxes.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a customs invoice?

1:06 2:21 How to fill in a commercial invoice - YouTube YouTube Start of suggested clip End of suggested clip Model number as well as the description. And don't just rely on the company's. Product code toMoreModel number as well as the description. And don't just rely on the company's. Product code to describe the goods. Remember to state the quantity.

What is required on a US customs invoice?

§ 142.6 Invoice requirements. (1) An adequate description of the merchandise. (2) The quantities of the merchandise. (3) The values or approximate values of the merchandise.

Where can I get customs forms?

If you didn't complete your customs form online or are using postage stamps on a package that requires a customs form, visit your local Post Office™ branch, fill out form PS 2976-R, and present your package at the counter to have the clerk create your label.

How do I write a customs invoice?

A customs invoice should include all the information necessary for the shipment to clear customs, including: The type of imported goods. Shipping weight. The value of goods. Import duty and taxes.

How do I fill out a US customs invoice?

This invoice is best used for bulk package shipments. The US Customs Invoice requires the shipper's name, consignee's name, IRS#, description of the goods, the value of the goods, and the country of manufacture. Please indicate the US Customs Port of Entry. Calculated by manifested quantity.

How to fill out customs declaration form?

0:16 2:28 How to Fill Out a USPS Customs Form (Customs Declaration - YouTube YouTube Start of suggested clip End of suggested clip And in detail. You can pick up a customs form at the post. Office create and print your own from theMoreAnd in detail. You can pick up a customs form at the post. Office create and print your own from the usps. Website or use their click and ship service to pay for postage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the sample us customs invoice in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your sample us customs invoice directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the sample us customs invoice form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign sample us customs invoice and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out sample us customs invoice on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your sample us customs invoice. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is sample us customs invoice?

A sample US Customs invoice is a document that provides detailed information about goods being imported into the United States, including descriptions, values, quantities, and the origin of the merchandise.

Who is required to file sample us customs invoice?

Any importer or their agent, who is bringing goods into the United States, is required to file a US Customs invoice for those goods.

How to fill out sample us customs invoice?

To fill out a sample US Customs invoice, you need to provide details such as the seller and buyer information, complete descriptions of the merchandise, quantity, value, country of origin, and any applicable terms of sale.

What is the purpose of sample us customs invoice?

The purpose of a sample US Customs invoice is to declare the contents of imported goods to customs authorities, facilitate the assessment of duties and taxes, and ensure compliance with trade regulations.

What information must be reported on sample us customs invoice?

The information that must be reported on a sample US Customs invoice includes the names and addresses of the buyer and seller, invoice number, date of the invoice, item descriptions, quantities, unit values, total value, and country of origin.

Fill out your sample us customs invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Us Customs Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.