Get the free International Tax Seminar - tei

Show details

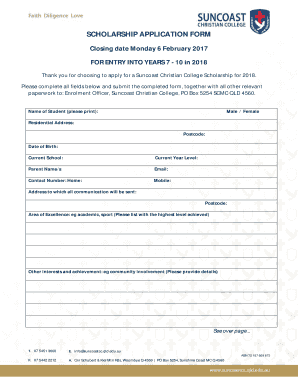

Registrant List Event Name: 2016 U.S. International Tax Seminar Event Date: 04/28/2016 Registration Date Range: All Dates Registrant Full Name Organization Name City, State, Zip Don S. Armstrong Alliance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international tax seminar

Edit your international tax seminar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international tax seminar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international tax seminar online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international tax seminar. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international tax seminar

How to fill out an international tax seminar:

01

Research and understand the purpose of the international tax seminar. Familiarize yourself with the various topics and discussions that will be covered to ensure your participation is relevant to your needs.

02

Register for the seminar by completing the necessary forms or online registration process. Provide accurate and up-to-date information to ensure smooth communication and logistics.

03

Prepare any required documents or materials prior to the seminar. This may include tax documents, financial statements, or any other relevant paperwork that will be discussed during the seminar.

04

Review the agenda or schedule of the seminar to plan your attendance and make note of any sessions or workshops that are of particular interest to you.

05

Arrive at the seminar venue on time and be prepared to actively participate. Bring any necessary stationary, notebooks, or electronic devices to take notes or engage in group activities.

06

Listen attentively to the speakers and ask questions when appropriate. Take notes to retain important information and refer back to them later if needed.

07

Network with fellow attendees during breaks or social events to exchange ideas and experiences. This can be a valuable opportunity to establish professional connections and gain insights from others in the field.

08

Evaluate your learning experience and apply what you have learned to your own tax planning or business practices. Reflect on the seminar content and identify any areas for further development or research.

09

Follow up with any post-seminar tasks or actions, such as completing evaluation forms or implementing new strategies discussed during the seminar.

10

Stay updated on future international tax seminars or related events to continue expanding your knowledge and professional network.

Who needs an international tax seminar?

01

Individuals or businesses involved in international transactions or operations may benefit from attending an international tax seminar. This includes multinational corporations, expatriates, foreign investors, and professionals working in international taxation.

02

Accountants, tax advisors, and financial professionals seeking to enhance their knowledge and expertise in international tax regulations and compliance may find an international tax seminar particularly valuable.

03

Government officials, policymakers, and legal professionals involved in international tax law and regulations can benefit from attending these seminars to stay updated on the latest developments in the field.

04

Students studying taxation or international business may find attending an international tax seminar beneficial in gaining practical insights and networking opportunities.

05

Individuals or businesses considering expanding their operations globally or entering foreign markets should consider attending an international tax seminar to understand the tax implications and requirements of conducting business internationally.

06

Executives or decision-makers responsible for the financial planning and management of international companies may find attending an international tax seminar crucial in ensuring compliance and optimizing tax strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify international tax seminar without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your international tax seminar into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in international tax seminar without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing international tax seminar and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete international tax seminar on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your international tax seminar. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is international tax seminar?

International tax seminar is a conference or workshop focused on discussing and analyzing international tax laws and regulations.

Who is required to file international tax seminar?

There is no requirement to file an international tax seminar. However, individuals or businesses with international tax obligations may attend or participate in such seminars.

How to fill out international tax seminar?

There is no specific form or template for an international tax seminar. Participants may take notes, ask questions, and engage in discussions during the seminar.

What is the purpose of international tax seminar?

The purpose of an international tax seminar is to educate individuals and businesses about international tax laws, compliance requirements, and potential tax planning strategies.

What information must be reported on international tax seminar?

Participants in an international tax seminar may report details of the seminar, key takeaways, and any action items identified during the event.

Fill out your international tax seminar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Tax Seminar is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.