Get the free Up to 102% LTV / NO PMI / GOVERNMENT BACKED

Show details

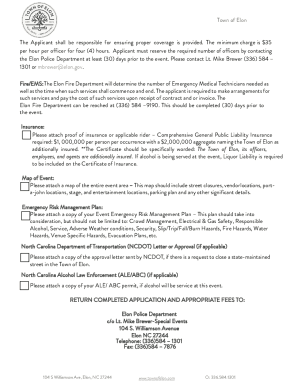

4/20/09Up to 102% LTV / NO PMI / GOVERNMENT BACKED GUARANTEED RURAL HOUSING LOANS (GEORGIA)LTV Guarantee fee Cash to close Appraised value is limits fact sheet applies to manual underwriting / GUS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign up to 102 ltv

Edit your up to 102 ltv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your up to 102 ltv form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing up to 102 ltv online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit up to 102 ltv. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out up to 102 ltv

How to Fill Out up to 102 LTV:

01

Research LTV Requirements: Begin by understanding what LTV (Loan-to-Value) is and what the specific requirements are for achieving up to a 102% LTV. This typically involves borrowing more than the value of the property being purchased, which may require additional steps and considerations.

02

Choose the Right Lender: Look for lenders who offer loans with high LTVs, as not all lenders may provide options for financing up to 102% LTV. Conduct thorough research, compare lenders, and consider consulting with a mortgage broker to find the best fit for your needs.

03

Evaluate Your Finances: Determine your financial situation, including your income, credit score, and debt-to-income ratio. Meeting the requirements for a high LTV loan may involve demonstrating financial stability and a good credit history.

04

Gather Necessary Documentation: Prepare the documentation typically required for a mortgage loan application, which may include proof of income, bank statements, employment history, and any other relevant financial documents. Different lenders may have specific requirements, so be sure to check with your chosen lender.

05

Provide Detailed Property Information: When filling out the loan application, provide accurate and detailed information about the property you intend to purchase. This includes its appraised value, location, and any additional factors that may affect the loan approval process.

Who Needs up to 102% LTV:

01

Homebuyers with Limited Down Payments: One common reason someone may need up to a 102% LTV is if they have limited funds available for a down payment. High LTV loans can provide an opportunity to purchase a property with minimal upfront cash requirements.

02

Real Estate Investors: Investors seeking to finance the purchase of an investment property may benefit from high LTV loans. It allows investors to leverage their capital and potentially secure multiple properties with minimal initial investment.

03

Homeowners with Existing Debt: Individuals who have existing debts, such as car loans or credit card debt, may choose to maximize their borrowing potential by opting for a high LTV loan. This allows them to consolidate their debts and potentially obtain more favorable interest rates.

04

Borrowers with Stable Financial Situations: People with stable and strong financial backgrounds, including consistent income and a good credit score, may be more likely to qualify for up to 102% LTV loans. Lenders may view these borrowers as lower risk due to their financial stability.

Remember, it's essential to consult with a financial advisor or mortgage professional to evaluate your specific circumstances and determine if applying for a high LTV loan is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in up to 102 ltv without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your up to 102 ltv, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit up to 102 ltv on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing up to 102 ltv.

How do I fill out up to 102 ltv on an Android device?

On an Android device, use the pdfFiller mobile app to finish your up to 102 ltv. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is up to 102 ltv?

Up to 102 LTV refers to the Loan-to-Value ratio that is equal to or less than 102%.

Who is required to file up to 102 ltv?

Financial institutions and lenders are required to file up to 102 LTV.

How to fill out up to 102 ltv?

Up to 102 LTV can be filled out electronically through the designated regulatory platform.

What is the purpose of up to 102 ltv?

The purpose of up to 102 LTV is to monitor and regulate the loan-to-value ratios in the financial sector to prevent excessive lending.

What information must be reported on up to 102 ltv?

Up to 102 LTV requires reporting on the loan amounts, property values, and loan-to-value ratios for each transaction.

Fill out your up to 102 ltv online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Up To 102 Ltv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.