Get the free DEPOSIT HOLD NOTICE revised - yccubcredituniondocscomb

Show details

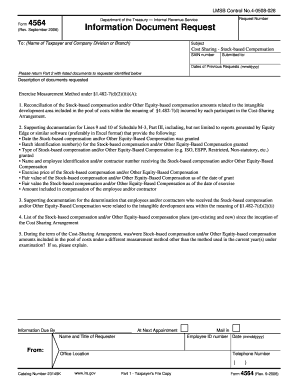

DEPOSITHOLDNOTICE DATEOFDEPOSIT DEPOSITAMOUNT AMOUNTED CHECK NO(S). MEMBER NO. Wearedelayingtheavailabilityoffundsfromyourdeposit. Thesefundswillbeavailableasindicatedbelow. Evenifwemakefundsavailabletoyou,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit hold notice revised

Edit your deposit hold notice revised form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit hold notice revised form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deposit hold notice revised online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deposit hold notice revised. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deposit hold notice revised

Point by point instructions on how to fill out the deposit hold notice revised and identifying who needs it are as follows:

How to fill out deposit hold notice revised:

01

Begin by filling out the heading of the notice, which typically includes the name and address of the bank or financial institution issuing the notice.

02

Indicate the date on which the notice is being issued, usually located below the bank's information.

03

Provide the recipient's information, including their name and address, ensuring accuracy to avoid any miscommunication.

04

Clearly state the reason for the deposit hold, explaining the circumstances that have led to this decision. It is essential to provide specific details and any relevant policies associated with the hold.

05

Clarify the length of the hold, whether it is for a specific number of days, weeks, or until further notice. Be sure to adhere to any legal requirements or regulations regarding deposit holds.

06

Inform the recipient of any available options or steps they can take to resolve the hold promptly. This may include contacting a specific department or providing additional documentation for further review.

07

Conclude the notice by providing contact information for the bank or financial institution, enabling the recipient to reach out if they have any questions or concerns regarding the hold.

08

Ensure all the necessary signatures and dates are included, as required by the bank or financial institution.

Who needs deposit hold notice revised:

01

Individuals who have recently deposited funds into a bank account that is subject to a hold may need the deposit hold notice revised. This can include both personal and business account holders.

02

Financial institutions, such as banks and credit unions, utilize deposit hold notices to inform customers or account holders of any temporary restrictions on the availability of deposited funds.

03

Account holders who have experienced specific situations, such as suspicious activities, overdrafts, or a history of bounced checks, may be subject to deposit holds. In such cases, a revised deposit hold notice may be necessary to provide updated information and ensure clear communication between the account holder and the financial institution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit deposit hold notice revised online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your deposit hold notice revised to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit deposit hold notice revised straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing deposit hold notice revised right away.

Can I edit deposit hold notice revised on an iOS device?

You certainly can. You can quickly edit, distribute, and sign deposit hold notice revised on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is deposit hold notice revised?

The deposit hold notice revised is a form used to notify individuals or organizations of a hold on deposited funds.

Who is required to file deposit hold notice revised?

Financial institutions and other entities that place a hold on deposited funds are required to file a deposit hold notice revised.

How to fill out deposit hold notice revised?

The deposit hold notice revised can be filled out by providing information about the account holder, the amount and nature of the hold, and the reason for the hold.

What is the purpose of deposit hold notice revised?

The purpose of the deposit hold notice revised is to inform affected parties of a hold on deposited funds and to provide details about the hold.

What information must be reported on deposit hold notice revised?

The deposit hold notice revised must include information about the account holder, the amount and nature of the hold, the reason for the hold, and contact information for the filing entity.

Fill out your deposit hold notice revised online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit Hold Notice Revised is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.