Get the free CREDIT LOAN APPLICATION

Show details

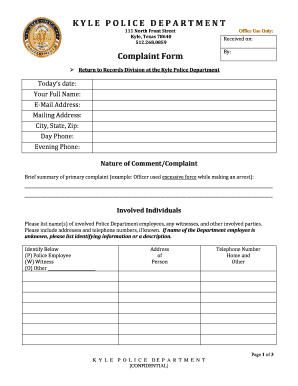

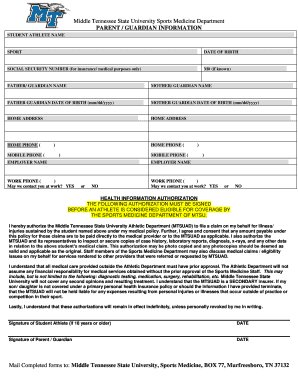

This document is an application form for a credit loan that must be completed in full and signed for processing. It includes sections for personal and financial information, employment details, debts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit loan application

Edit your credit loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit loan application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit loan application

How to fill out CREDIT LOAN APPLICATION

01

Gather necessary documentation (ID, proof of income, credit history).

02

Visit the lender's website or office to obtain the application form.

03

Fill out personal information (name, address, contact details).

04

Specify the loan amount you are seeking.

05

Indicate the purpose of the loan (e.g., home purchase, debt consolidation).

06

Provide financial information (income, expenses, debts).

07

Review the loan terms and conditions carefully.

08

Sign and date the application form.

09

Submit the application along with required documentation.

10

Follow up with the lender for any updates or additional information needed.

Who needs CREDIT LOAN APPLICATION?

01

Individuals seeking to finance a major purchase, such as a home or car.

02

People looking to consolidate existing debts into a single loan.

03

Students needing funds for education-related expenses.

04

Consumers requiring funds for personal or business use.

05

Anyone wanting to build or improve their credit history.

Fill

form

: Try Risk Free

People Also Ask about

How to ask for a debt politely?

Be Clear About the Amount: Specify the amount they owe to avoid any confusion. You could say, ``You borrowed $X from me, and I wanted to see when you might be able to pay it back.'' Suggest a Payment Plan: If appropriate, offer a flexible repayment plan.

How do you politely ask for a loan?

When asking to borrow money, it's important to be respectful and clear. You could say something like, ``Hey (Name), I'm facing a financial challenge right now, and I was wondering if it's possible to borrow some money temporarily. I'll make sure to pay you back by (specific date).

What to say when trying to get a loan?

Lenders often ask why you need a personal loan, and giving the right reason can help get your application approved. The best reasons include debt consolidation, covering medical bills, home repairs, or major purchases. These show lenders you're borrowing responsibly.

How to ask for a loan in English?

0:04 10:36 I am here to ask for a loan. Can you help me.MoreI am here to ask for a loan. Can you help me.

How to ask to borrow something politely?

Activity Can you. ---- lend. borrow. me your pen please? Can I. ---- lend. borrow. some money? Could my sister borrow. ---- her one. one. of your nice scarves? Yes, as long as she. ---- gets it back. gets back it. to me first thing tomorrow. You can. ---- lend. my tools but you have to. ---- get back them. get them back.

How to write a loan application in English?

Helpful Tips for Writing a Loan Request Letter Be Clear About Your Purpose. Money lenders appreciate knowing exactly why you need funds. Provide Complete Contact Information. Mention Your Repayment Plan. Keep It Professional. Attach Supporting Documents.

How do I do a credit application?

Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the application must contain all of the information the lender asks for in order to make a decision. Credit applicants also have a right to fair treatment under the law.

How much would a $5000 loan cost per month?

Example Monthly Payments on a $5,000 Personal Loan Payoff periodAPRMonthly payment 3 years 15% $173 4 years 15% $139 5 years 15% $119 6 years 15% $1063 more rows • Jul 1, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT LOAN APPLICATION?

A credit loan application is a formal request submitted by an individual or business to a financial institution to borrow money, where the applicant provides information to evaluate their creditworthiness.

Who is required to file CREDIT LOAN APPLICATION?

Individuals or businesses seeking to borrow money from a bank, credit union, or other lending institution need to file a credit loan application.

How to fill out CREDIT LOAN APPLICATION?

To fill out a credit loan application, the applicant must provide personal information, financial details, employment history, and the amount of money requested, along with any additional documentation required by the lender.

What is the purpose of CREDIT LOAN APPLICATION?

The purpose of a credit loan application is to assess the borrower's financial history, creditworthiness, and ability to repay the loan, enabling the lender to make an informed decision regarding the loan approval.

What information must be reported on CREDIT LOAN APPLICATION?

The information that must be reported on a credit loan application typically includes personal identification details, income, employment information, existing debts, and a consent to perform a credit check.

Fill out your credit loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.