SC Vehicle High Mileage Appeal Form - Greenville County 2012-2025 free printable template

Show details

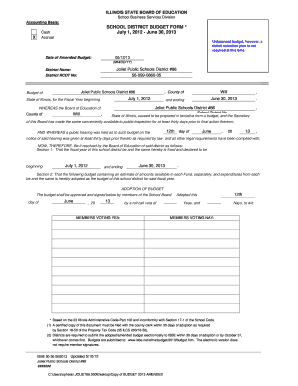

Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601 Phone 864-467-7040 Fax 864-467-5960 www. greenvillecounty. org/CountyAuditor Vehicle High Mileage Appeal Form This form is used to appeal the taxable value of a vehicle with high mileage. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601 Phone 864-467-7040 Fax 864-467-5960 www. greenvillecounty. org/CountyAuditor Vehicle High Mileage Appeal Form This form is used to appeal the taxable value...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign greenville county high mileage form

Edit your high mileage appeal spartanburg sc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your high mileage appeal sc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC Vehicle High Mileage Appeal Form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC Vehicle High Mileage Appeal Form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out SC Vehicle High Mileage Appeal Form

How to fill out SC Vehicle High Mileage Appeal Form

01

Obtain the SC Vehicle High Mileage Appeal Form from the official website or your local DMV office.

02

Fill out the vehicle owner's information including name, address, and contact details.

03

Provide the vehicle information such as make, model, year, and VIN (Vehicle Identification Number).

04

Enter the current mileage of the vehicle as accurately as possible.

05

Attach any required documentation to support your high mileage claim, such as maintenance records or receipts.

06

Review the form for accuracy and completeness.

07

Submit the form either online, by mail, or in person at your local DMV office.

Who needs SC Vehicle High Mileage Appeal Form?

01

Any vehicle owner in South Carolina who believes their vehicle has high mileage that should be considered for an appeal regarding tax assessments or fees.

Fill

form

: Try Risk Free

People Also Ask about

What is high mileage appeal South Carolina?

The high mileage chart is determined by the South Carolina Department of Revenue. Taxpayers may appeal the appraised value of a vehicle for high mileage if the vehicle averages over 15,000 miles, annually, based on the age of the vehicle (total miles divided by age of vehicle).

How much are Greenville County property taxes?

Located in northwest South Carolina, along the border with North Carolina, Greenville County is the most populous county in the state and has property tax rates higher than the state average. The county's average effective rate is 0.70%.

What is the sales tax on a car in Greenville SC?

South Carolina Sales Tax on Car Purchases: South Carolina collects a 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in South Carolina may be subject to other fees like registration, title, and plate fees.

What is the mileage rate in SC?

Effective July 1, 2022 Beginning on July 1, 2022, the Internal Revenue Service rate will be 62.5 cents per mile (IRS Announcement 2022-13).

What are rollback taxes in Greenville County SC?

Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as non- agricultural property. The rollback taxes can be applied to the property for the preceding three (3) years.

What is the property tax on vehicles in Greenville County SC?

All other motor vehicles are assessed at 10.5%. When are vehicle taxes due? Personal property taxes on motor vehicles and recreational vehicles must be paid before a license plate can be issued or renewed. Taxes are due in the month corresponding to a vehicle registration date.

How do I appeal high mileage in Anderson County?

If the mileage on your vehicle qualifies for a high mileage reduction per the High Mileage Chart published by the South Carolina Department of Revenue, you may apply by mail, email, or in person before the tax due date on your bill. High mileage appeals can also be made directly through our website.

How much is the property tax on my car in SC?

Privately owned passenger vehicles: 6% of retail value. Business owned vehicles: 10.5% of retail value. Trucks with an empty weight over 9,000 lb or a gross weight over 11,000 lb: 10.5% of retail value (the weight used is provided by the manufacturer) including privately owned vehicles.

How do I appeal high mileage in Anderson SC?

If the mileage on your vehicle qualifies for a high mileage reduction per the High Mileage Chart published by the South Carolina Department of Revenue, you may apply by mail, email, or in person before the tax due date on your bill. High mileage appeals can also be made directly through our website.

What is South Carolina high mileage appeal?

The high mileage chart is determined by the South Carolina Department of Revenue. Taxpayers may appeal the appraised value of a vehicle for high mileage if the vehicle averages over 15,000 miles, annually, based on the age of the vehicle (total miles divided by age of vehicle).

How are property taxes calculated in Greenville County SC?

The amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the property used to determine assessed value, and (3) the millage rate imposed by the taxing jurisdictions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in SC Vehicle High Mileage Appeal Form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing SC Vehicle High Mileage Appeal Form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit SC Vehicle High Mileage Appeal Form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign SC Vehicle High Mileage Appeal Form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit SC Vehicle High Mileage Appeal Form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute SC Vehicle High Mileage Appeal Form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is SC Vehicle High Mileage Appeal Form?

The SC Vehicle High Mileage Appeal Form is a document used by South Carolina vehicle owners to appeal the assessed value of their vehicle based on high mileage, which may affect its market value.

Who is required to file SC Vehicle High Mileage Appeal Form?

Vehicle owners in South Carolina who believe their vehicle's assessed value is too high due to high mileage are required to file the SC Vehicle High Mileage Appeal Form.

How to fill out SC Vehicle High Mileage Appeal Form?

To fill out the SC Vehicle High Mileage Appeal Form, complete the required sections including personal information, vehicle details, and documentation of mileage, and submit it to your local tax office.

What is the purpose of SC Vehicle High Mileage Appeal Form?

The purpose of the SC Vehicle High Mileage Appeal Form is to allow vehicle owners to contest and potentially lower the assessed value of their vehicles based on the high mileage, which may not reflect their actual value.

What information must be reported on SC Vehicle High Mileage Appeal Form?

The information that must be reported on the SC Vehicle High Mileage Appeal Form includes the vehicle owner's name, contact information, vehicle identification number (VIN), mileage, and any supporting documentation such as odometer readings.

Fill out your SC Vehicle High Mileage Appeal Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC Vehicle High Mileage Appeal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.