Get the free BANKING CORPORATIONS

Show details

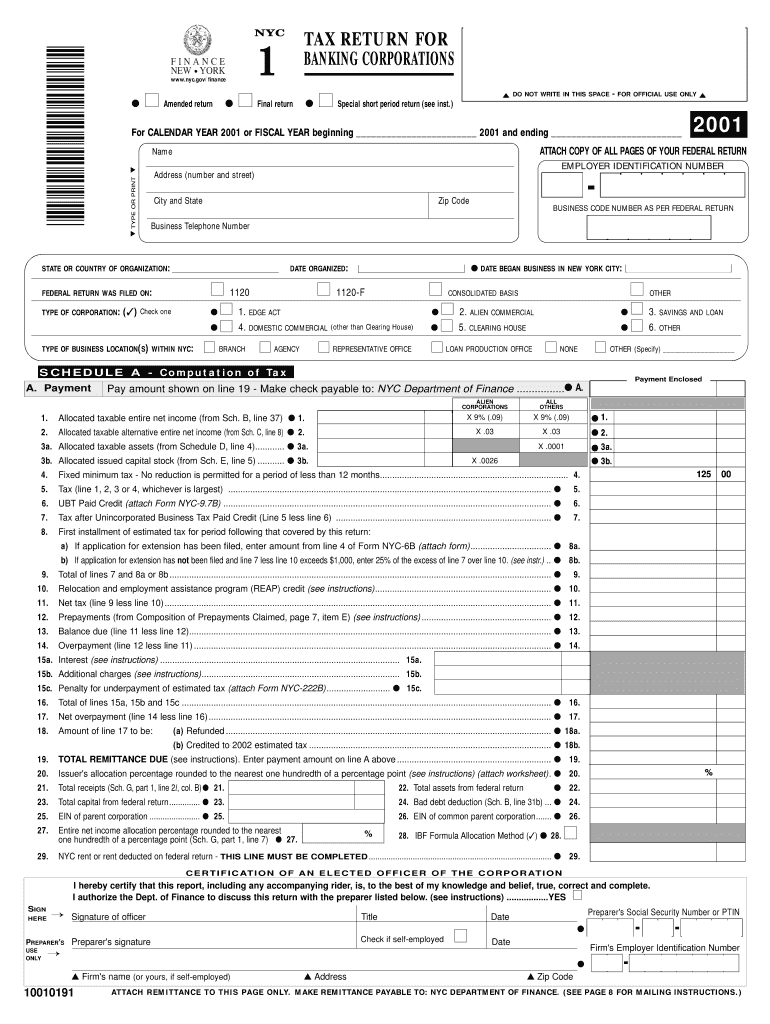

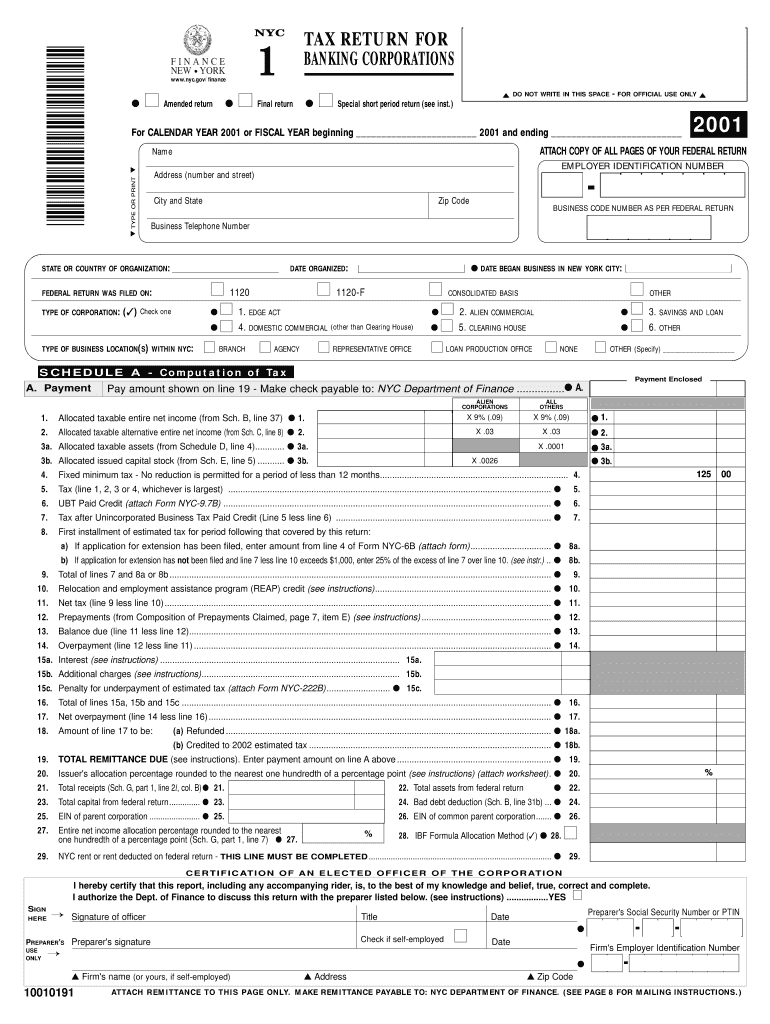

*10010191* NYC 1 FINANCE NEW YORK q www.nyc.gov/finance q s Amended return TAX RETURN FOR BANKING CORPORATIONS q s Final return q s Special short period return (see inst.) v DO NOT WRITE IN THIS SPACE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign banking corporations

Edit your banking corporations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your banking corporations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit banking corporations online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit banking corporations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out banking corporations

How to fill out banking corporations?

01

Research and understand the requirements: Start by conducting thorough research on the regulations and guidelines set forth by the regulatory authorities for setting up a banking corporation. It is crucial to have a comprehensive understanding of the legal and financial aspects involved.

02

Formulate a business plan: Develop a detailed business plan that outlines your vision, mission, target market, products and services, marketing strategy, and financial projections. This plan will serve as a roadmap for the establishment and operation of your banking corporation.

03

Arrange necessary capital: Determine the amount of capital required to meet the minimum capital requirements specified by the regulatory authorities. Explore various funding options such as equity investments, loans, or partnerships to secure the necessary capital for your banking corporation.

04

Obtain all necessary licenses and permits: Contact the relevant regulatory authorities and apply for the required licenses and permits to operate a banking corporation. This typically includes obtaining a banking license, registering with financial regulatory bodies, and complying with anti-money laundering and know-your-customer regulations.

05

Establish corporate governance and infrastructure: Set up a robust corporate governance structure that includes a board of directors, executive management team, and necessary support functions such as finance, operations, risk management, and compliance. Develop and implement policies and procedures to ensure governance, risk management, and regulatory compliance.

06

Recruit and train competent staff: Hire qualified professionals with expertise in banking and finance to fill key positions within your banking corporation. Invest in their training and development to ensure they have the necessary skills and knowledge to effectively perform their roles.

07

Build relationships with stakeholders: Establish strong relationships with key stakeholders such as customers, regulators, shareholders, suppliers, and business partners. This includes developing a customer acquisition and retention strategy, maintaining open communication with regulatory authorities, conducting shareholder meetings, and fostering strategic partnerships.

Who needs banking corporations?

01

Individuals and businesses seeking financial services: Banking corporations cater to a wide range of customers, including individuals, small and medium enterprises, and large corporations. They provide essential financial services such as savings accounts, checking accounts, loans, mortgages, investments, and various other banking products.

02

Investors and shareholders: Banking corporations offer investment opportunities to individuals and institutional investors. They allow individuals to invest in shares of the banking corporation, providing potential returns through dividends and capital appreciation.

03

The economy and society as a whole: Banking corporations play a crucial role in the economic development of a country. They facilitate economic growth by providing financing to businesses, supporting entrepreneurship, and fostering innovation. They also promote financial inclusion by offering banking services to underserved populations, helping to alleviate poverty and improve living standards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my banking corporations in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your banking corporations as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find banking corporations?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the banking corporations in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit banking corporations on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as banking corporations. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is banking corporations?

Banking corporations are financial institutions that provide services such as accepting deposits, making loans, and managing investments.

Who is required to file banking corporations?

Banking corporations are required to file financial reports with regulatory authorities such as the SEC and the Federal Reserve.

How to fill out banking corporations?

Banking corporations must fill out financial statements and reports, detailing their assets, liabilities, income, and expenses.

What is the purpose of banking corporations?

The purpose of banking corporations is to provide financial services to individuals, businesses, and governments, and to facilitate the flow of capital in the economy.

What information must be reported on banking corporations?

Information such as balance sheet, income statement, cash flow statement, and notes to financial statements must be reported on banking corporations.

Fill out your banking corporations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banking Corporations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.