Get the free Fixed Rate until 29 May 2019 - brokersnewburycouk - brokers newbury co

Show details

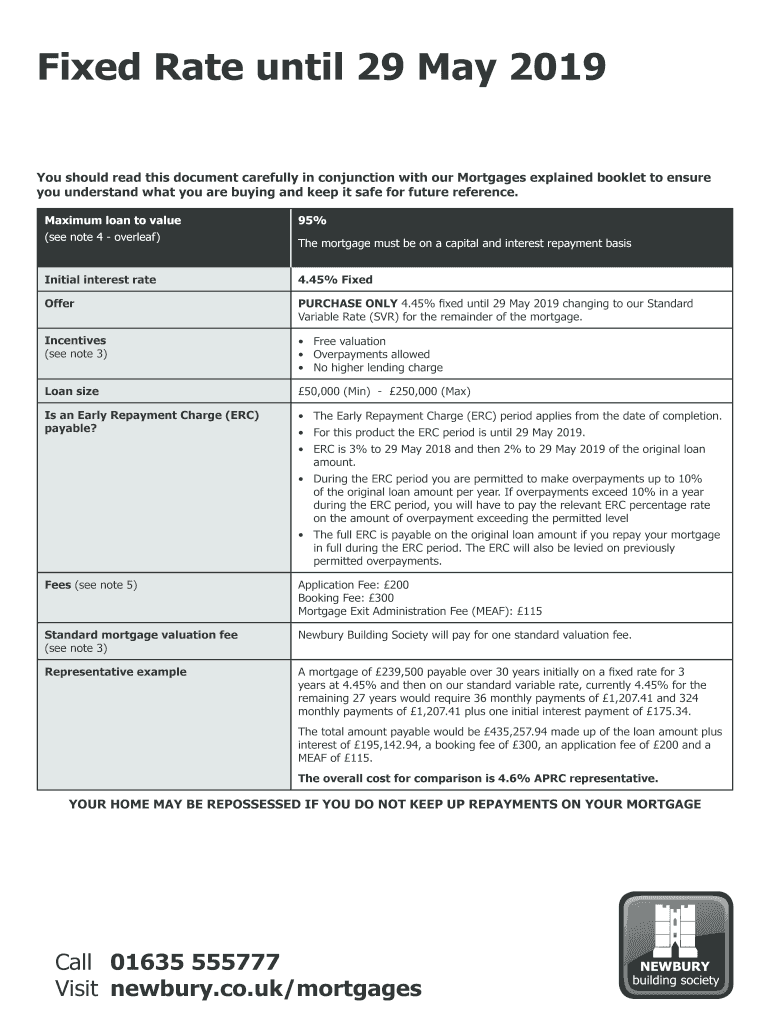

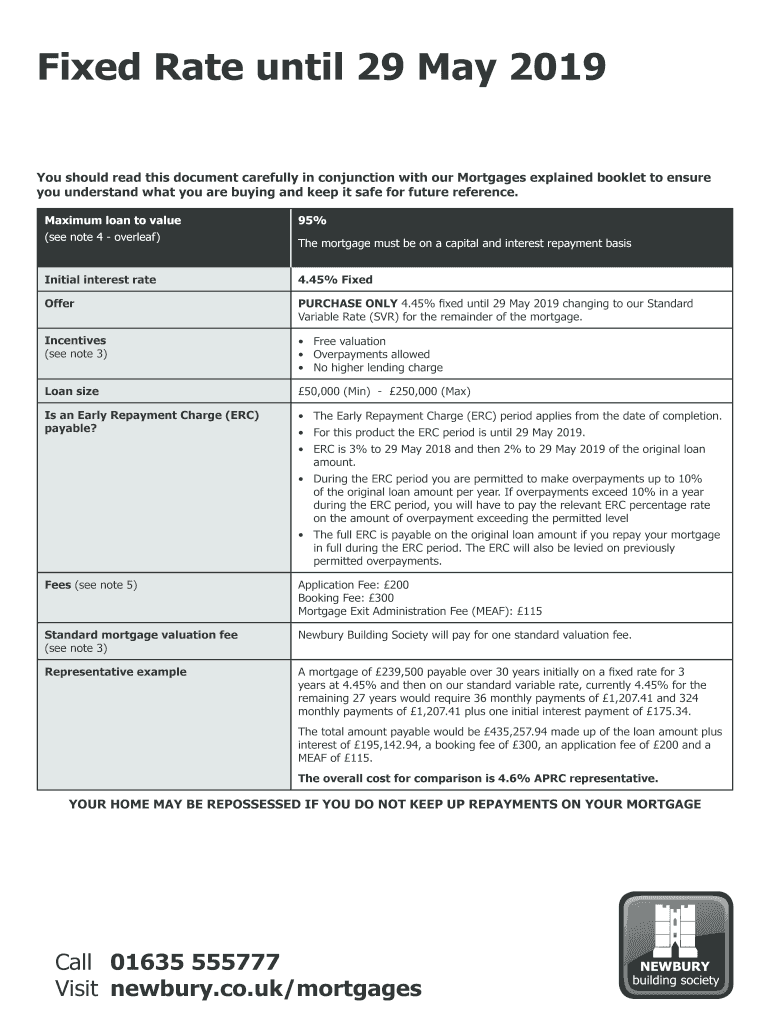

Fixed Rate until 29 May 2019 You should read this document carefully in conjunction with our Mortgages explained booklet to ensure you understand what you are buying and keep it safe for future reference.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed rate until 29

Edit your fixed rate until 29 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed rate until 29 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed rate until 29 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fixed rate until 29. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed rate until 29

How to fill out fixed rate until 29?

01

Start by gathering the necessary information. You will need to provide your personal details such as your name, address, contact information, and social security number.

02

Next, review the terms of the fixed rate until 29 that you are filling out. Understand the interest rate, the length of the fixed rate period, and any other relevant details.

03

Fill out the application form carefully. Make sure to enter all the required information accurately and double-check for any errors before submitting it.

04

Provide details about your employment or income. This may include your employer's name, your job title, and your monthly income. Some lenders may also require you to provide details about your financial assets and liabilities.

05

If you are applying for a fixed rate until 29 for a mortgage or loan, you may need to provide details about the property or asset you are financing. This could include the address, purchase price, and any other relevant information.

06

Review the completed application form to ensure all the information is accurate and complete. It's essential to provide honest and truthful information to avoid any complications in the approval process.

Who needs fixed rate until 29?

01

Individuals looking for long-term financial stability may opt for a fixed rate until 29. With a fixed-rate, their interest rate and monthly payments remain constant throughout the fixed term, providing predictability and budgeting ease.

02

Homebuyers who plan to stay in their home for an extended period may find a fixed rate until 29 appealing. This allows them to lock in a specific interest rate, protecting them from potential interest rate fluctuations in the future.

03

Investors or borrowers who are concerned about rising interest rates may choose a fixed rate until 29. By selecting a fixed rate, they can avoid the risk of their interest rate increasing during the fixed term, providing them with financial security.

04

Individuals who prefer a simple and straightforward mortgage or loan structure might opt for a fixed rate until 29. With consistent monthly payments, it becomes easier to manage and budget for other financial obligations.

Note: It's essential to consider individual financial circumstances and consult with a financial advisor or mortgage specialist to determine if a fixed rate until 29 is the best option for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed rate until 29 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including fixed rate until 29. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete fixed rate until 29 online?

pdfFiller makes it easy to finish and sign fixed rate until 29 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the fixed rate until 29 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your fixed rate until 29 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is fixed rate until 29?

The fixed rate until 29 refers to a set interest rate that remains the same until the year 2029.

Who is required to file fixed rate until 29?

Individuals or entities who have loans or investments tied to the fixed rate until 29 may be required to file.

How to fill out fixed rate until 29?

The fixed rate until 29 can be filled out by providing relevant financial information and following the instructions provided by the financial institution.

What is the purpose of fixed rate until 29?

The purpose of the fixed rate until 29 is to provide stability and predictability for borrowers and lenders.

What information must be reported on fixed rate until 29?

Information such as loan amounts, interest rates, and payment schedules must be reported on the fixed rate until 29.

Fill out your fixed rate until 29 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Rate Until 29 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.