TX Comptroller 50-132 2008 free printable template

Show details

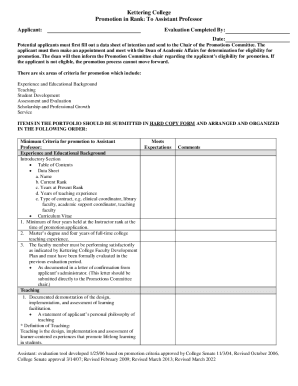

Property Tax Notice of Protest Property Tax Form 50132 Appraisal district name Phone (Area code and number) Address INSTRUCTIONS: If you want the appraisal review board to hear and decide your case,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-132

Edit your TX Comptroller 50-132 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-132 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 50-132 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 50-132. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-132 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-132

How to fill out TX Comptroller 50-132

01

Download the TX Comptroller Form 50-132 from the official website.

02

Fill in the 'Property Owner Information' section with your name, address, and contact details.

03

Complete the 'Property Description' by providing the location, type of property, and any relevant identification numbers.

04

In the 'Request for Exception' section, specify the nature of the exemption you are applying for.

05

Attach any necessary supporting documents that validate your request.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate office as instructed, either electronically or via mail.

Who needs TX Comptroller 50-132?

01

Property owners who are seeking property tax exemptions in Texas.

02

Individuals or entities that qualify for specific exemptions under Texas law, such as those related to charitable organizations, educational institutions, or specific property types.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a property owners notice of protest Texas?

How to Properly Fill Out the Notice of Protest Prerequisites: Section 1: Property Owner or Lessee. Section 2: Property Description. Section 3: Reasons for Protest. Section 4 – Additional Facts. Section 5 – Hearing Type. Section 6 ARB Hearing Procedures. Section 7 Certification & Signature.

How do I win a Texas property tax appeal?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

What can I say to lower my property taxes in Texas?

File a Notice of Protest Your contact information, address, and property description. Your appraisal district account number. Reasons for protesting. Your opinion of your property's value and any additional information. The type of hearing you would prefer (in-person, by telephone, or a written affidavit)

How do I protest an appraised value in Texas?

If you are unsatisfied with your appraised value or if errors exist in the property's appraisal records, you may file a Form 50-132, Notice of Protest with the ARB. In most cases, you have until May 15, or 30 days from the date the appraisal district notice is delivered — whichever date is later.

Is it worth protesting property taxes in Texas?

Consequently, as a homeowner, you're likely to pay more taxes than what is fair at some point. That's a reason to protest your tax appraisal in Texas. Statistics from Dallas County in Texas reveal that about 50% of tax protests are usually successful and that those who protest typically save an average of $600.

What is the best way to protest property taxes in Texas?

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest (PDF) with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered — whichever date is later.

How to protest property taxes and win Texas?

At an informal protest, you simply need to present data on your home to your appraisal district. In most cases, you can simply visit your appraisal district office and wait to meet with an appraiser. The number one recommendation for winning an informal protest is simple – be kind.

What evidence do I need to protest property taxes in Texas?

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX Comptroller 50-132?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the TX Comptroller 50-132. Open it immediately and start altering it with sophisticated capabilities.

How do I edit TX Comptroller 50-132 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your TX Comptroller 50-132 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit TX Comptroller 50-132 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share TX Comptroller 50-132 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is TX Comptroller 50-132?

TX Comptroller 50-132 is a form used in Texas for reporting information related to the state-funded ad valorem tax exemptions for certain nonprofit organizations.

Who is required to file TX Comptroller 50-132?

Nonprofit organizations that are claiming an ad valorem tax exemption in Texas are required to file TX Comptroller 50-132.

How to fill out TX Comptroller 50-132?

To fill out TX Comptroller 50-132, organizations must provide their legal name, address, type of exemption being requested, and other relevant organizational information as specified on the form.

What is the purpose of TX Comptroller 50-132?

The purpose of TX Comptroller 50-132 is to formally request an ad valorem tax exemption for qualifying nonprofit organizations and to provide the necessary information for the Comptroller's office to determine eligibility.

What information must be reported on TX Comptroller 50-132?

The information that must be reported on TX Comptroller 50-132 includes the organization’s name, address, type of exemption requested, and any additional details required by the Comptroller's office to evaluate the exemption request.

Fill out your TX Comptroller 50-132 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-132 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.