WV Commercial Business Property Return 2011-2025 free printable template

Get, Create, Make and Sign west virginia commercial business property return form

How to edit 32c kanawha fillable online

Uncompromising security for your PDF editing and eSignature needs

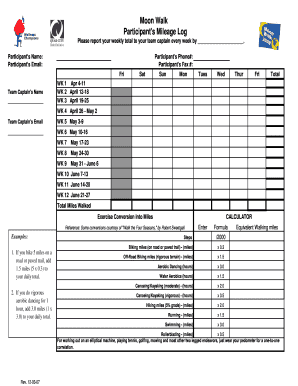

How to fill out stc kanawha wv sample form

How to fill out WV Commercial Business Property Return

Who needs WV Commercial Business Property Return?

Video instructions and help with filling out and completing 12 32c

Instructions and Help about 12 32c form

When we think of property tax we normally think of something like real estate right, so you own your home you're assessed property taxes and those fund the school district in your area, but there's also a different type of property taxed and that's called personal property tax and personal property tax normally is going to pertain to an out a little thing here normally it's going to be something like a vehicle it's like a car a boat and in some cases in some states this actually could be something like tools right there's some kind of equipment that you use in your business, so it depends on the locale it depends on where you live and for the most part personal property tax is assessed at the local level or at the state level right so and let me just cross this out, so I mean no you're not talking about that so the state or local level, so there's no federal personal property tax right this isn't something you file with your annual tax returns to the federal government so not all states have a personal property tax, so it depends on where you live and so when they assess the personal property tax whether it be your local government in the state it's what's known as an ad valor em tax and what that means is that similar to real estate my property tax it's based on the value right so let me just actually will just say the assessed value it's just very important right so you might be thinking hey my car I think it's worth fifty-seven hundred dollars well maybe the Kelley blue book says it's worth seven thousand and maybe that's what the local area that that government uses to assess personal property in that region so whatever they have for their assessment process they're going to come up with an assessed value of your personal property and then you're going to be assessed taxes on that basis assuming that you have a personal property tax where you live so I'm just going to walk you through a short law example I know that that's probably some of you already got it but we'll just kind of walk through let's say that you own two cars right so you own two different vehicles and you have personal property tax where you lived and so let's say that the assessed value and let's see here so I've got a couple values here we're going to say these are the assessed values not what you think the value is or necessarily from what you the vehicle for although that might be relevant is depending on where you live but let's just say for whatever reason the assessed values of the cars are twenty-nine hundred dollars and seventeen hundred dollars okay however those numbers were arrived at those are the assessed values in this example and the personal property tax rate where you live is one percent so all you would do then is just take these assessed values and you just multiply it by the tax rate of one percent, so it's pretty simple it's its in that sense it's not all that different from real estate property tax and in this case the tax that would be due would be...

People Also Ask about

Who is exempt from personal property tax in West Virginia?

Does West Virginia have a personal property tax?

Does West Virginia have business personal property tax?

How much is the transfer tax in West Virginia?

What is WV business use tax?

What is Class 4 property in WV?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 12 32c form without leaving Google Drive?

Can I create an electronic signature for signing my 12 32c form in Gmail?

How can I edit 12 32c form on a smartphone?

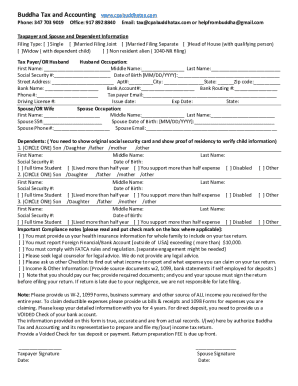

What is WV Commercial Business Property Return?

Who is required to file WV Commercial Business Property Return?

How to fill out WV Commercial Business Property Return?

What is the purpose of WV Commercial Business Property Return?

What information must be reported on WV Commercial Business Property Return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.