Get the free REQUEST TO FILE APPEAL AFTER FILING DEADLINE - www2 borough kenai ak

Show details

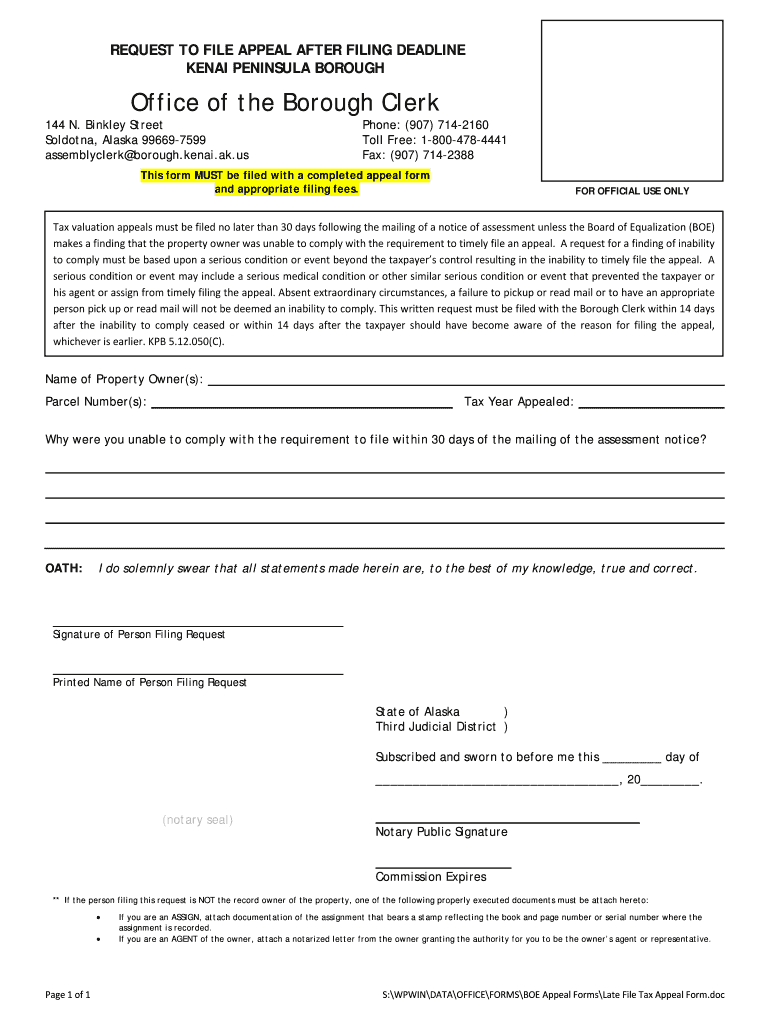

This document serves as a formal request to file an appeal concerning tax valuation after the initial deadline. It includes the necessary information for submission and outlines the requirements and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request to file appeal

Edit your request to file appeal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request to file appeal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request to file appeal online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request to file appeal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request to file appeal

How to fill out REQUEST TO FILE APPEAL AFTER FILING DEADLINE

01

Review the original decision and the reason for the appeal.

02

Obtain the REQUEST TO FILE APPEAL AFTER FILING DEADLINE form from the appropriate authority or website.

03

Fill out the form with your personal information, including your name, contact details, and case number.

04

Clearly outline the reasons for the appeal, making sure to address why the appeal is being filed after the deadline.

05

Gather any necessary supporting documents that substantiate your case for filing the appeal late.

06

Sign and date the form, certifying that all information provided is accurate to the best of your knowledge.

07

Submit the completed form and supporting documents to the designated office or authority before the specified deadline for late appeals.

Who needs REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

01

Individuals who have missed the deadline for filing an appeal but still wish to contest a decision.

02

Applicants seeking reconsideration of adverse decisions made by administrative or judicial bodies.

03

People who can demonstrate a valid reason for their late appeal and wish to present their case.

Fill

form

: Try Risk Free

People Also Ask about

What is the time frame for an appeal?

Appeals generally in civil actions, in which the United States or an officer or agency thereof is a party (including cases in which an officer of the United States is sued in his individual capacity), from judgments of the district courts to the courts of appeals, must be taken within 60 days after entry of the

What is the maximum time for appeal?

The Limitation Act 1963, however, provides the period for filing appeals. It states that appeals against a decree or order can be filed in a high court within 90 days and in any other court within 30 days from the date of the decree or order appealed against.

What are the 5 steps of the appeal process?

After a Decision is Issued Step 1: File the Notice of Appeal. Step 2: Pay the filing fee. Step 3: Determine if/when additional information must be provided to the appeals court as part of opening your case. Step 4: Order the trial transcripts. Step 5: Confirm that the record has been transferred to the appellate court.

How do I write a request for an appeal?

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. Be Factual. Include factual detail but avoid dramatizing the situation. Be Specific. Documentation. Stick to the Point. Do Not Try to Manipulate the Reader. How to Talk About Feelings. Be Brief.

What is the time limit for an appeal?

Time limits for appealing 21 days to appeal against a county court, family court or High Court decision. 28 days if it's an Upper Tribunal decision.

What is the period to file an appeal?

The appeal shall be taken within fifteen (15) days from notice of the judgment or final order appealed from. Where a record on appeal is required, the appellant shall file a notice of appeal and a record on appeal within thirty (30) days from notice of the judgment or final order.

How to ask for permission to appeal?

(a)an application for permission to appeal must be made to the Court of Appeal; (b)the application must be made within 28 days after the date of the decision of the Court of Appeal which the appellant wishes to appeal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

REQUEST TO FILE APPEAL AFTER FILING DEADLINE is a formal request submitted to a court or administrative body seeking permission to file an appeal after the standard deadline has passed.

Who is required to file REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

Any party who wishes to appeal a decision but has missed the deadline for filing the initial appeal is required to submit a REQUEST TO FILE APPEAL AFTER FILING DEADLINE.

How to fill out REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

To fill out the REQUEST TO FILE APPEAL AFTER FILING DEADLINE, you need to provide your name, contact information, details of the original case, the reasons for the late filing, and any supporting documentation that justifies the request.

What is the purpose of REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

The purpose of the REQUEST TO FILE APPEAL AFTER FILING DEADLINE is to seek judicial permission to proceed with an appeal despite missing the deadline, usually due to extenuating circumstances.

What information must be reported on REQUEST TO FILE APPEAL AFTER FILING DEADLINE?

The information that must be reported includes the case number, the specific ruling being appealed, the reasons for missing the deadline, any related documents, and the contact details of the person filing the request.

Fill out your request to file appeal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request To File Appeal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.