Get the free CHILDRENS FITNESS TAX CREDIT RECEIPT FORM SM24 Dec2011 clr - hpedsb on

Show details

Hastings and Prince Edward District School Board A Great Place to Learn and A Great Place to Work Dwayne Inch, Chair of the Board Rob McCall, Director of Education CHILDREN FITNESS TAX CREDIT RECEIPT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign childrens fitness tax credit

Edit your childrens fitness tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your childrens fitness tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing childrens fitness tax credit online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit childrens fitness tax credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out childrens fitness tax credit

How to fill out children's fitness tax credit:

01

Obtain the necessary forms - To claim the children's fitness tax credit, you will need to complete Form T2201, Disability Tax Credit Certificate, and Schedule 1, Federal Tax, to report the credit.

02

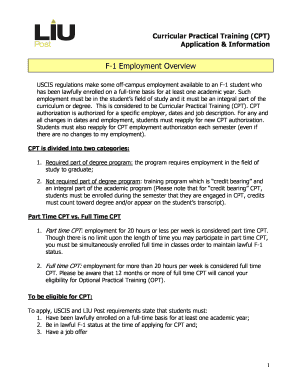

Determine eligibility - Ensure that the child is eligible for the fitness tax credit. The child must be under 16 years of age at the beginning of the tax year and must have participated in eligible fitness activities.

03

Collect receipts - Gather receipts and supporting documentation for the fees paid towards eligible fitness activities. These activities could include organized sports, dance classes, swimming lessons, or fitness programs offered by qualified instructors.

04

Calculate the credit - Determine the eligible amount of fitness expenses paid during the tax year. The maximum eligible amount for the credit is $1,000 per child, resulting in a non-refundable tax credit of up to $150.

05

Complete the forms - Fill out Form T2201, providing any required information about the child's disability, if applicable. Then, complete Schedule 1, specifically lines 458 and 459, to claim the children's fitness tax credit.

06

File your tax return - Submit your completed forms, along with your tax return, to the Canada Revenue Agency (CRA) by mail or electronically through a certified tax software.

07

Keep supporting documents - Retain copies of your receipts and any other supporting documents for a minimum of six years in case the CRA requests verification.

Who needs children's fitness tax credit:

01

Parents or legal guardians - Individuals who have children under 16 years of age participating in eligible fitness activities may be eligible to claim the children's fitness tax credit.

02

Caregivers - If you are the primary caregiver of a child and responsible for their fitness-related expenses, you may also be eligible for the credit.

03

Eligible children - Children who have participated in eligible fitness activities during the tax year and meet the age requirement are eligible for the credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send childrens fitness tax credit to be eSigned by others?

childrens fitness tax credit is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete childrens fitness tax credit online?

pdfFiller has made filling out and eSigning childrens fitness tax credit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the childrens fitness tax credit in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your childrens fitness tax credit in seconds.

What is childrens fitness tax credit?

The childrens fitness tax credit is a tax credit offered to parents or guardians who enroll their children in eligible fitness programs.

Who is required to file childrens fitness tax credit?

Parents or guardians of children who participated in eligible fitness programs are required to file the childrens fitness tax credit.

How to fill out childrens fitness tax credit?

To fill out the childrens fitness tax credit, parents or guardians must provide information on the fitness program their children participated in and submit any required receipts or documentation.

What is the purpose of childrens fitness tax credit?

The purpose of the childrens fitness tax credit is to incentivize parents to enroll their children in fitness programs and promote healthy lifestyles.

What information must be reported on childrens fitness tax credit?

Information on the fitness program, such as the name of the program, the amount spent, and the duration of participation, must be reported on the childrens fitness tax credit.

Fill out your childrens fitness tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Childrens Fitness Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.