Get the free LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN - co larimer co

Show details

Este documento es un plan de jubilación que detalla las disposiciones legales y fiscales para los empleados de Larimer County, incluyendo definiciones, participación, contribuciones, beneficios,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign larimer county contributory retirement

Edit your larimer county contributory retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your larimer county contributory retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit larimer county contributory retirement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit larimer county contributory retirement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out larimer county contributory retirement

How to fill out LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN

01

Gather necessary personal information, including your Social Security number and employment details.

02

Obtain the LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN enrollment form from your HR department or the official website.

03

Fill out your personal details on the form accurately.

04

Review the plan details to understand your contribution rates and benefits.

05

Complete the sections pertaining to beneficiary designation.

06

Double-check the information for accuracy and completeness.

07

Submit the filled-out form to your HR department or the designated plan administrator.

Who needs LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

01

Current employees of Larimer County who are looking to contribute to their retirement savings.

02

Individuals seeking employer-sponsored retirement plans to enhance their financial security for retirement.

03

Employees who meet eligibility requirements for participation in the retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

Is Colorado PERA worth it?

Your PERA DB plan provides reliable monthly income you can't outlive. This benefit is an important foundation for your retirement income. You might also receive Social Security from any years you didn't work for a PERA employer.

What is the state run retirement plan in Colorado?

Colorado SecureSavings is a state-run retirement savings program that makes it easy for businesses to support their employees' financial future. The program is designed for employers that don't yet offer a retirement plan, giving workers a simple way to save through automatic payroll deduction into a personal Roth IRA.

What is the new retirement law in Colorado?

Retirement Savings Plans Are Now Required In Colorado. As of January 1st, 2023, employees in California whose employers do not offer retirement plans now have access to an optional retirement savings plan. This plan will be a state-facilitated retirement savings program through the Colorado SecureSavings Program.

How do I know if my retirement plan is a qualified plan?

If you have a 401(k) plan at your job or you're self-employed and contribute to a solo 401(k), then you have a qualified retirement plan that's also a defined contribution plan. Other types of qualified retirement plans include: 403(b) plans. SEP IRAs.

What is the state mandatory retirement plan in Colorado?

What is Colorado's state-mandated retirement savings program? In a nutshell, Colorado SecureSavings is a state-facilitated program that requires all eligible employers to provide their employees with access to a program that helps them start saving money for retirement.

How long do you have to work for the state of Colorado to get a pension?

If you have less than five years of service credit under the Denver Public Schools (DPS) benefit structure, you do not have the option to apply for a monthly benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

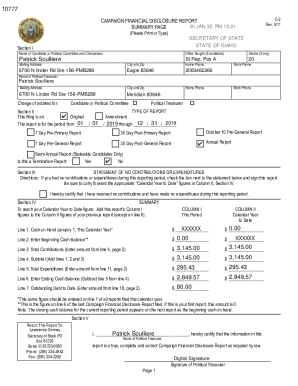

What is LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

The Larimer County Contributory Retirement Plan is a pension plan designed for employees of Larimer County, Colorado, allowing them to contribute a portion of their salary toward retirement benefits.

Who is required to file LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

Employees in eligible positions within Larimer County who are participating in the retirement program are required to file the necessary documents related to the Larimer County Contributory Retirement Plan.

How to fill out LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

To fill out the Larimer County Contributory Retirement Plan forms, employees must obtain the appropriate forms from the county's human resources department, provide personal information, employment details, and any required signatures.

What is the purpose of LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

The purpose of the Larimer County Contributory Retirement Plan is to provide employees with a structured savings and retirement option to ensure financial security in retirement through contributions made by both the employee and the county.

What information must be reported on LARIMER COUNTY CONTRIBUTORY RETIREMENT PLAN?

Required information for the Larimer County Contributory Retirement Plan includes employee identification details, salary information, contribution amounts, and any changes in employment status or beneficiary designations.

Fill out your larimer county contributory retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Larimer County Contributory Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.