Get the free Estate Details

Show details

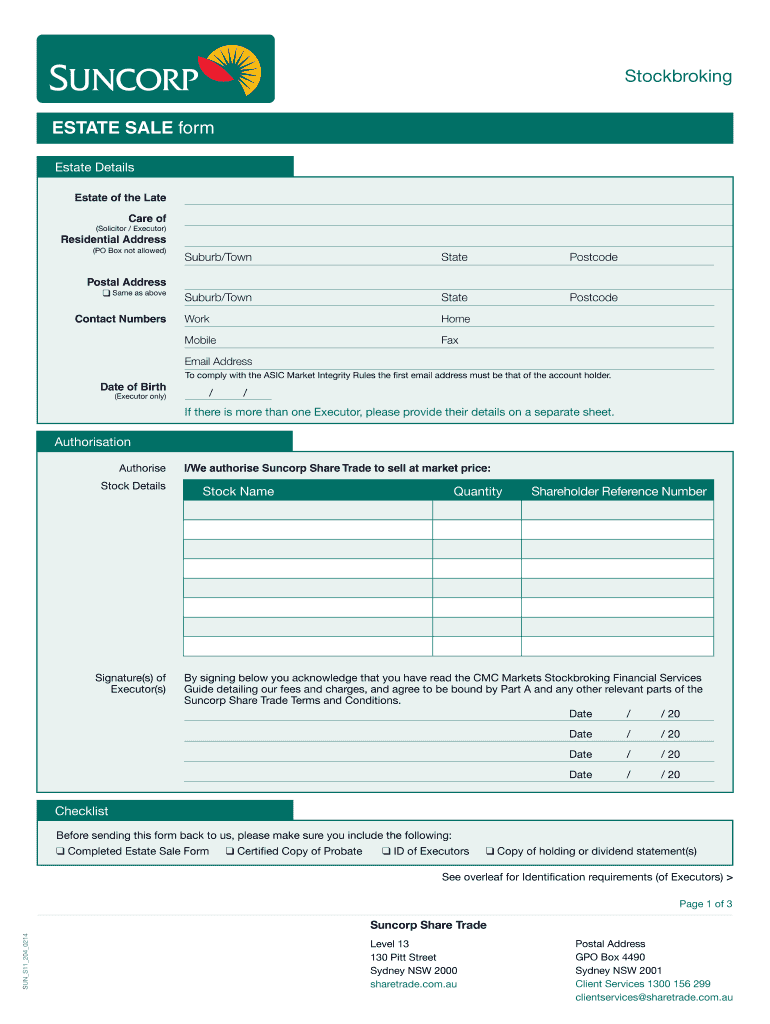

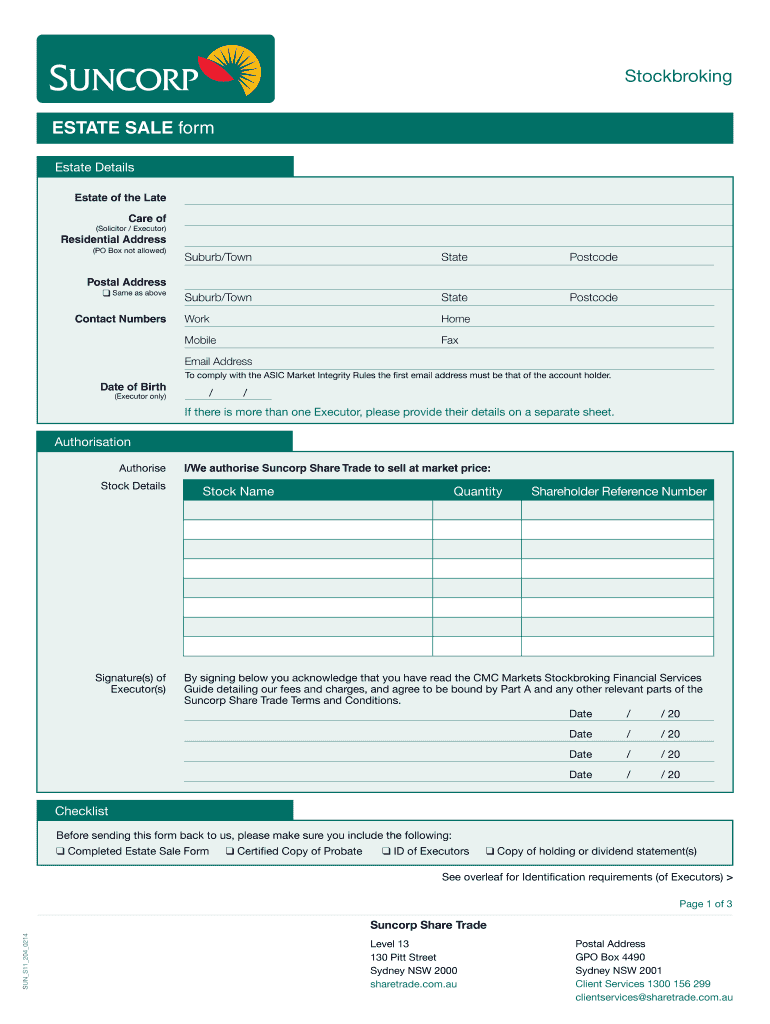

Stockbroking ESTATE SALE form Estate Details Estate of the Late Care of (Solicitor / Executor) Residential Address (PO Box not allowed) Suburb/Town Postal Address Same as above q Suburb/Town State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate details

Edit your estate details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate details form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate details online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit estate details. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate details

How to fill out estate details:

01

Gather necessary documents: Start by collecting all the relevant documents related to the estate, such as the will, property deeds, financial statements, and any other important paperwork.

02

Identify the assets and liabilities: Go through the estate's assets and liabilities and make a comprehensive list. This may include real estate, bank accounts, investments, debts, and any other financial obligations.

03

Evaluate the value of the estate: Determine the value of each asset and liability to calculate the overall net worth of the estate. Seek professional help, if required, to assess the value of complex assets like properties or businesses.

04

Assign beneficiaries: Identify and designate the beneficiaries who are entitled to inherit a portion of the estate. This can be specified in the will or determined by law, based on the relationship with the deceased.

05

Distribute assets: Once the beneficiaries have been determined, distribute the assets according to the will or applicable laws. This may involve selling properties, transferring ownership of assets, or distributing funds from financial accounts.

06

Settle outstanding debts and taxes: Prioritize settling any outstanding debts, including mortgage payments, loans, and taxes owed by the estate. This should be done before distributing the remaining assets among the beneficiaries.

07

Maintain accurate records: Keep a detailed record of all the transactions, including dates, amounts, and parties involved, throughout the estate settlement process. This will help ensure transparency and facilitate any future audits or legal requirements.

Who needs estate details?

01

Executors: Executors, or personal representatives, are responsible for handling the estate settlement process. They need the estate details to fulfill their duties, including managing and distributing the assets according to the deceased's wishes or applicable laws.

02

Beneficiaries: Beneficiaries have a vested interest in knowing the estate details as they are entitled to inherit a share of the assets. The information helps them understand the value of the estate and what they can expect to receive.

03

Lawyers and financial advisors: Legal professionals and financial advisors may require estate details to provide legal advice, assist with tax planning, or guide the estate settlement process. They rely on accurate information to fulfill their professional obligations effectively.

04

Tax authorities: Local tax authorities may require estate details to assess and collect any applicable taxes, such as estate tax or inheritance tax. Providing accurate estate information ensures compliance with tax laws and facilitates the resolution of any tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my estate details in Gmail?

estate details and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send estate details to be eSigned by others?

When your estate details is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out estate details using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign estate details. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is estate details?

Estate details refer to the documentation providing information about the assets, liabilities, and beneficiaries of a deceased individual.

Who is required to file estate details?

The executor or administrator of the deceased individual's estate is required to file estate details with the relevant authorities.

How to fill out estate details?

Estate details can be filled out by providing accurate information about the deceased individual's assets, liabilities, and beneficiaries in the designated forms.

What is the purpose of estate details?

The purpose of estate details is to ensure that the deceased individual's estate is properly accounted for and distributed according to their wishes or legal requirements.

What information must be reported on estate details?

Information such as the value of assets, outstanding debts, and names of beneficiaries must be reported on estate details.

Fill out your estate details online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Details is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.