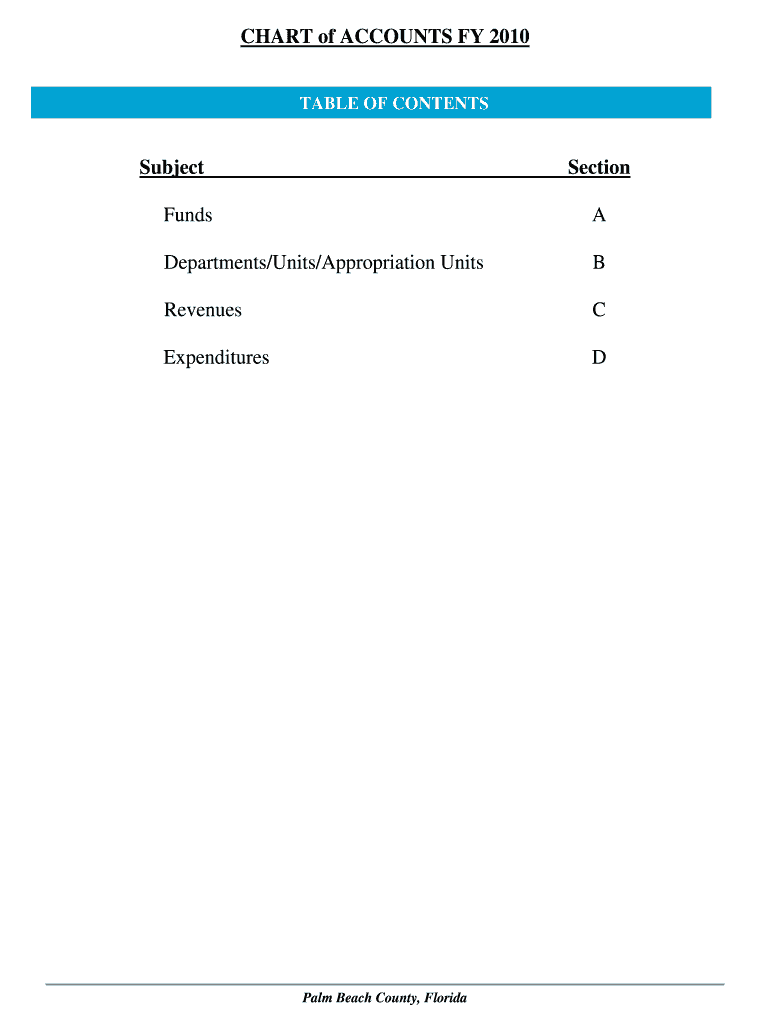

Get the free CHART of ACCOUNTS FY 2010

Show details

This document serves as a comprehensive guide to the financial structure and reporting of Palm Beach County, Florida. It outlines the various funds, departments, revenue sources, and expenditure categories

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chart of accounts fy

Edit your chart of accounts fy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chart of accounts fy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chart of accounts fy online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit chart of accounts fy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chart of accounts fy

How to fill out CHART of ACCOUNTS FY 2010

01

Start by selecting the accounting software or template you will use for the chart of accounts.

02

Organize accounts into categories such as assets, liabilities, equity, revenues, and expenses.

03

Assign a unique account number to each account for easy identification.

04

Write clear and concise account names that accurately describe the purpose of each account.

05

Include subcategories where necessary for more detailed tracking, especially for larger organizations.

06

Review and revise the chart to ensure all necessary accounts are included and correctly categorized.

07

Validate the chart of accounts by comparing it with previous years or accounting standards.

08

Finalize the chart by sharing it with relevant stakeholders for confirmation and input.

Who needs CHART of ACCOUNTS FY 2010?

01

Accountants and financial analysts responsible for financial reporting.

02

Business owners needing an organized financial overview.

03

Auditors who require detailed records for compliance checks.

04

Financial planners who develop budgets and forecasts based on financial data.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 basic types of accounts?

A typical chart of accounts has five primary types of accounts: Assets. Liabilities. Equity. Revenue. Expenses.

What are the 5 main in accounting?

5 types of accounts in accounting Assets. Asset accounts usually include the tangible and intangible items your company owns. Expenses. An expense account can include the products or services a company purchases to help generate additional income. Income. Liabilities. Equity.

What are the 7 chart of accounts?

A seven-digit chart of accounts is a structured numbering system used in accounting to classify and organize financial transactions recorded in the general ledger. The length of the account number, in this case seven digits, indicates a more detailed or complex chart of accounts.

What is a chart of accounts pdf?

The document outlines a chart of accounts for a company organized into sections for current assets, property and equipment, current liabilities, long-term liabilities, stockholders' equity, operating revenues, cost of goods sold, marketing expenses, payroll expenses, and other general ledger accounts.

What are the 5 categories of the chart of accounts?

A Chart of Accounts is a list of accounts used to classify and record financial transactions. A well-designed CoA provides a framework for accurate and consistent financial reporting. A CoA typically consists of five main categories of accounts: assets, liabilities, equity, revenues, and expenses.

How to find a chart of accounts?

The chart of accounts page View reports that show general ledger entries and balances. Close your income statement. Open the General Ledger Account Card, where you can add or change settings. See a list of posting groups for that account. View separate debit and credit balances for a single account.

What are the 5 basic charts of accounts?

The chart of accounts is an index of all financial accounts in a company's general ledger (GL). There are five major account types in the CoA: assets, liabilities, equity, income, and expenses.

What are the 7 chart of accounts?

A seven-digit chart of accounts is a structured numbering system used in accounting to classify and organize financial transactions recorded in the general ledger. The length of the account number, in this case seven digits, indicates a more detailed or complex chart of accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHART of ACCOUNTS FY 2010?

The CHART of ACCOUNTS for FY 2010 is a financial organization tool that provides a complete listing of all accounts used by an entity to record transactions and prepare financial statements for that fiscal year.

Who is required to file CHART of ACCOUNTS FY 2010?

Entities including government agencies, nonprofit organizations, and private companies thatFollow fiscal regulations and accounting standards for the financial year 2010 are required to file the CHART of ACCOUNTS.

How to fill out CHART of ACCOUNTS FY 2010?

To fill out the CHART of ACCOUNTS for FY 2010, entities should list each account with its unique account number, name, description, and categorize them based on their purpose (e.g., assets, liabilities, equity, revenue, expenses).

What is the purpose of CHART of ACCOUNTS FY 2010?

The purpose of the CHART of ACCOUNTS for FY 2010 is to ensure accurate and organized financial reporting, facilitate budget preparation and analysis, and maintain compliance with accounting standards.

What information must be reported on CHART of ACCOUNTS FY 2010?

The information required on the CHART of ACCOUNTS for FY 2010 includes account numbers, account names, descriptions, and categories for each account to accurately reflect the entity's financial activity.

Fill out your chart of accounts fy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chart Of Accounts Fy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.