Get the free Car Insurance Policy Book - Kwik-Fit Insurance

Show details

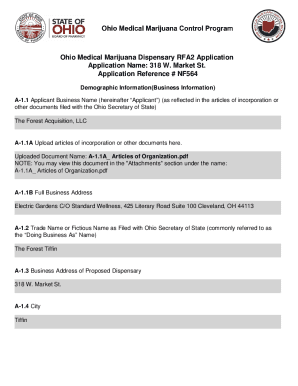

1 Contents Car Insurance How to make a claim 34 Data Protection, Finding and Stopping Fraud 56 Introduction 89 Meaning of Words 912 Changes which affect your insurance 1213 Types of Cover 13 Summary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car insurance policy book

Edit your car insurance policy book form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car insurance policy book form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit car insurance policy book online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit car insurance policy book. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out car insurance policy book

How to fill out car insurance policy book:

01

Start by gathering all the necessary information such as your personal details, vehicle information, and any previous insurance policies.

02

Carefully read and understand the terms and conditions mentioned in the car insurance policy book.

03

Fill out the required sections in the policy book accurately, providing your full name, address, contact information, and driver's license details.

04

Provide comprehensive information about your vehicle, including its make, model, year of manufacture, vehicle identification number (VIN), and current mileage.

05

Specify the type of coverage you require, such as liability, collision, comprehensive, or uninsured/underinsured motorist coverage.

06

Determine the policy period for which you want coverage and indicate the effective date of the policy.

07

Based on your desired coverage, mention the limit of liability or the maximum amount the insurance company will pay in case of a claim.

08

If you have any additional drivers who will be using the insured vehicle, provide their details in the designated section.

09

Review all the information you have provided to ensure accuracy and completeness before submitting the policy book.

10

Sign the policy book using your legally recognized signature to confirm your understanding and acceptance of the terms and conditions outlined in it.

Who needs car insurance policy book:

01

Individuals who own a car and drive it on public roads are legally required to have car insurance.

02

Car insurance policy books are necessary for anyone who wants financial protection in case of accidents, damages, theft, or other unforeseen events involving their vehicle.

03

Car insurance policy books are especially crucial for responsible drivers who prioritize the safety and security of themselves, their passengers, and other road users.

04

If you plan to lease a car or take a loan to purchase a vehicle, the leasing or financing company will require you to have car insurance and provide proof of it, often in the form of a policy book.

05

Even if car insurance is not mandatory in your region, it is highly recommended to have a car insurance policy book to protect your financial well-being and avoid potential legal and financial liabilities in the event of an accident or loss.

06

Whether you are a new driver or an experienced one, having a car insurance policy book gives you peace of mind and protection against unexpected expenses that may arise due to automotive incidents.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send car insurance policy book to be eSigned by others?

To distribute your car insurance policy book, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete car insurance policy book online?

pdfFiller has made filling out and eSigning car insurance policy book easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my car insurance policy book in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your car insurance policy book right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is car insurance policy book?

Car insurance policy book is a document that contains all details and terms of the car insurance policy purchased by the policyholder.

Who is required to file car insurance policy book?

The policyholder or the owner of the vehicle is required to file the car insurance policy book.

How to fill out car insurance policy book?

The car insurance policy book should be filled out by providing accurate and up-to-date information about the vehicle, policyholder, and insurance coverage.

What is the purpose of car insurance policy book?

The purpose of car insurance policy book is to have a record of the insurance coverage and terms agreed upon by the policyholder and the insurance company.

What information must be reported on car insurance policy book?

The car insurance policy book must contain information such as the vehicle details, policyholder information, coverage details, premium amount, and policy terms.

Fill out your car insurance policy book online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car Insurance Policy Book is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.