Get the free Taxpayer Petition to the County Board of Equalization for Review of Real Property Va...

Show details

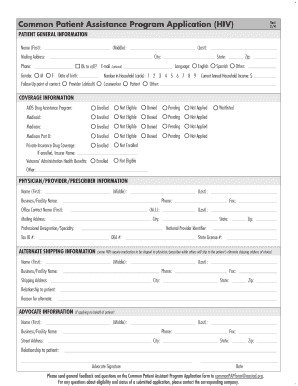

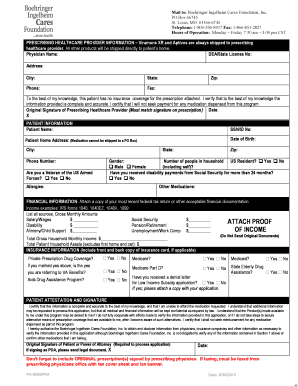

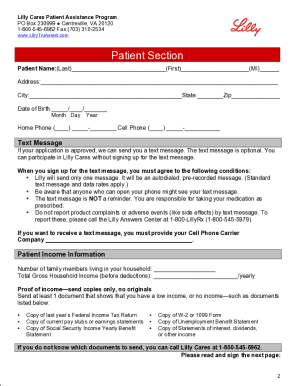

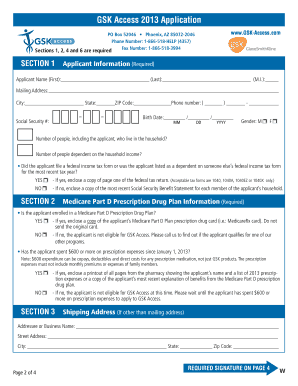

This document outlines the process for taxpayers to appeal the Assessor's valuation of their property, detailing required information, filing procedures, and appeal processes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayer petition to form

Edit your taxpayer petition to form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer petition to form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxpayer petition to form

How to fill out Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination

01

Obtain the Taxpayer Petition form from the local County Board of Equalization's website or office.

02

Fill out the property owner's information, including name, address, and contact details.

03

Provide the property's assessment details, such as parcel number and current assessed value.

04

Clearly state the reason for the appeal, including evidence or reasons why the valuation is believed to be incorrect.

05

Gather supporting documentation such as comparable property assessments or appraisals.

06

Sign and date the petition to certify that all information provided is true and correct.

07

Submit the completed petition form to the County Board of Equalization by the specified deadline, either in person or via mail.

Who needs Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

01

Property owners who believe their property has been overvalued by the county assessor.

02

Individuals seeking a fair assessment of their property taxes.

03

Anyone who has received a notice of property valuation from their County Board of Equalization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

The Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination is a formal request made by a property owner to challenge the assessed value of their real property as determined by the local tax authority.

Who is required to file Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

Any property owner who disagrees with the valuation of their real property as assessed by the county tax assessor is required to file this petition in order to seek a review of their property's valuation.

How to fill out Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

To fill out the Taxpayer Petition, property owners must complete the designated form provided by the county, ensuring they include all required information such as the property address, the current assessed value, and the reason for the appeal. Supporting documentation should also be attached.

What is the purpose of Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

The purpose of the Taxpayer Petition is to provide a formal mechanism for property owners to dispute and request a re-evaluation of the assessed value of their real property for tax purposes, ensuring fairness in property taxation.

What information must be reported on Taxpayer Petition to the County Board of Equalization for Review of Real Property Valuation Determination?

The information that must be reported includes the petitioner's name and contact information, the property address, the current assessed value, the reasons for the petition, and any supporting evidence or documentation to substantiate the request for review.

Fill out your taxpayer petition to form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayer Petition To Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.