Get the free Invoice that calculates total - Bakersfield City School

Show details

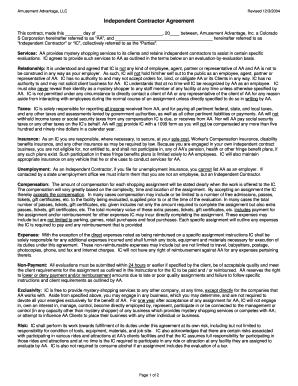

INVOICE Vendor Name Street address City, State Zip code Phone number and Fax number Invoice date Unique invoice # DATE: INVOICE # FOR: Consultant must provide a unique invoice number on each invoice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invoice that calculates total

Edit your invoice that calculates total form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice that calculates total form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice that calculates total online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit invoice that calculates total. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invoice that calculates total

How to fill out an invoice that calculates total:

01

Start by entering your business information at the top of the invoice. This includes your company name, address, contact details, and logo if you have one.

02

Next, input the customer's information on the invoice. You will need their name, address, and contact details. Make sure to double-check the accuracy of this information to avoid any issues with delivery or communication.

03

Create a unique invoice number and input it on the invoice. This will help with organization and tracking of payments.

04

Add the date of the invoice. This is the date you are issuing the invoice and requesting payment.

05

Include a description of the products or services provided. List each item along with its quantity, price per unit, and the total for each line item.

06

If applicable, include any discounts or promotional codes that should be applied to the invoice. Subtract these discounts from the total to calculate the final amount owed.

07

Include any applicable taxes or fees. If your business is required to charge sales tax or any other fees, make sure to clearly state them on the invoice. Calculate the tax or fee amount and add it to the total.

08

Calculate the overall total by adding up the subtotal, taxes, and any additional charges or fees.

09

Provide payment details, such as the accepted payment methods (e.g., credit card, bank transfer) and any specific payment terms or deadlines.

10

Finally, include any additional notes or terms and conditions that are relevant to the invoice. This may include warranty information, return policies, or specific instructions for payment.

Who needs an invoice that calculates total:

01

Small business owners: Invoices that calculate the total amount owed can be beneficial for small business owners who want to streamline their billing process and ensure accuracy in their financial records.

02

Freelancers and independent contractors: For individuals who work on a project-by-project basis, having an invoice that calculates the total makes it easier to track payment and ensure proper compensation for their services.

03

E-commerce businesses: Online businesses that sell products or services often rely on invoices that calculate the total, especially when dealing with multiple orders and variable pricing.

04

Service providers: Professionals such as consultants, lawyers, or healthcare providers benefit from invoices that calculate the total as it simplifies the billing process for their clients and helps avoid disputes over payment.

05

Any business or individual who wants to maintain transparency and professionalism in their financial transactions can benefit from using invoices that calculate the total. It provides a clear breakdown of costs, simplifies the payment process, and reduces the chances of errors or misunderstandings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is invoice that calculates total?

An invoice that calculates total is a document that shows the total amount due for goods or services provided, including any applicable taxes or fees.

Who is required to file invoice that calculates total?

Businesses or individuals who provide goods or services and wish to receive payment are required to file an invoice that calculates total.

How to fill out invoice that calculates total?

To fill out an invoice that calculates total, you need to include the following information: contact information for the provider, a description of the goods or services provided, the quantity, unit price, total amount due, and any applicable taxes or fees.

What is the purpose of invoice that calculates total?

The purpose of an invoice that calculates total is to provide a clear breakdown of the costs associated with goods or services provided and to request payment from the recipient.

What information must be reported on invoice that calculates total?

The information that must be reported on an invoice that calculates total includes: contact information for the provider and recipient, a description of the goods or services provided, the quantity, unit price, total amount due, and any applicable taxes or fees.

How do I execute invoice that calculates total online?

Filling out and eSigning invoice that calculates total is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit invoice that calculates total on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing invoice that calculates total.

How do I complete invoice that calculates total on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your invoice that calculates total. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your invoice that calculates total online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice That Calculates Total is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.