Get the free Reconciliation of receipts and expenditures - barbershop

Show details

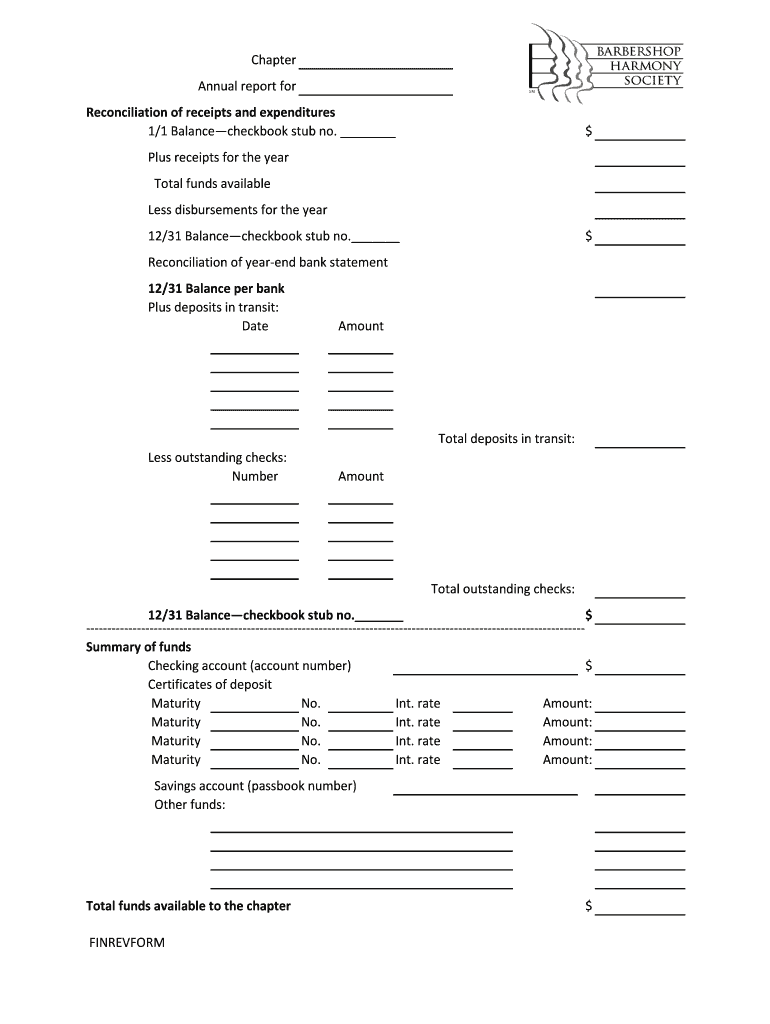

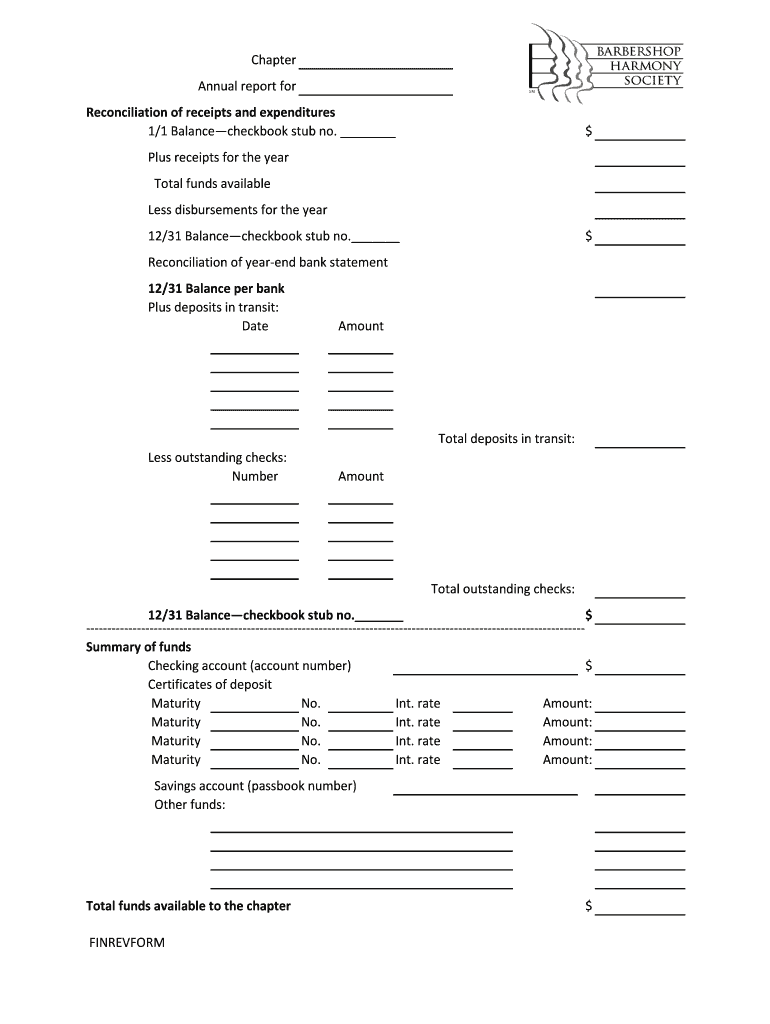

Chapter Annual report for Reconciliation of receipts and expenditures 1/1 Balance checkbook stub no. $ Plus receipts for the year Total funds available Fewer disbursements for the year 12/31 Balance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reconciliation of receipts and

Edit your reconciliation of receipts and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reconciliation of receipts and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reconciliation of receipts and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit reconciliation of receipts and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reconciliation of receipts and

How to fill out reconciliation of receipts and:

01

Gather all receipts: Start by collecting all the receipts related to your financial transactions. This can include receipts from purchases, expenses, and any other financial activities.

02

Organize the receipts: Categorize the receipts based on their nature, such as expenses, sales, or income. This step helps in identifying patterns and tracking how your money flows.

03

Compare with financial records: Take your financial records, such as bank statements or accounting software, and cross-reference them with the receipts. This will help identify any discrepancies or missing transactions.

04

Record any discrepancies: If you find any discrepancies between the receipts and your financial records, make a note of them. It can be an incorrect amount, missing transactions, or any other irregularities.

05

Investigate and resolve discrepancies: Once you've identified the discrepancies, investigate the cause behind them. It could be a simple accounting error or a more serious issue like fraud. Take necessary actions to resolve these discrepancies, such as adjusting the records or contacting the relevant parties involved.

06

Update financial records: After resolving any discrepancies, update your financial records to reflect the accurate information. This ensures that your records are up-to-date and accurate, providing a clear picture of your financial situation.

Who needs reconciliation of receipts and:

01

Businesses: Reconciliation of receipts is essential for businesses of all sizes. It allows them to track their financial transactions accurately, identify any discrepancies, and ensure the integrity of their financial records.

02

Individuals: Individuals who maintain a personal budget or have significant financial transactions can benefit from reconciliation of receipts. It helps them track their expenses, identify any unauthorized charges, and maintain a clear record of their financial activities.

03

Accountants and bookkeepers: Accountants and bookkeepers play a crucial role in reconciling receipts on behalf of their clients. They ensure accurate record-keeping, identify any errors or discrepancies, and provide valuable insights into financial health.

04

Auditors: Auditors often rely on reconciled receipts to perform a thorough examination of a company's financial records. Reconciliation provides them with evidence of financial integrity and helps in identifying any potential issues or fraud.

In conclusion, filling out reconciliation of receipts involves gathering, organizing, comparing, and resolving any discrepancies between receipts and financial records. It is a crucial process for businesses, individuals, accountants, bookkeepers, and auditors to ensure accurate financial reporting and track financial activities effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit reconciliation of receipts and from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your reconciliation of receipts and into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out the reconciliation of receipts and form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign reconciliation of receipts and and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete reconciliation of receipts and on an Android device?

Complete your reconciliation of receipts and and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is reconciliation of receipts and?

Reconciliation of receipts and is the process of matching the payments received with the corresponding sales or services provided.

Who is required to file reconciliation of receipts and?

Businesses, organizations, or individuals that receive payments for goods or services are required to file reconciliation of receipts and.

How to fill out reconciliation of receipts and?

Reconciliation of receipts and can be filled out by providing a detailed breakdown of the payments received and matching them with corresponding transactions.

What is the purpose of reconciliation of receipts and?

The purpose of reconciliation of receipts and is to ensure accuracy in financial records and to identify any discrepancies or errors in payments received.

What information must be reported on reconciliation of receipts and?

The information reported on reconciliation of receipts and typically includes payment amounts, dates, and details of the corresponding transactions.

Fill out your reconciliation of receipts and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reconciliation Of Receipts And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.