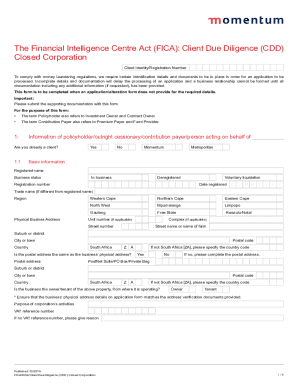

Get the free DISCLOSURE CHECKLIST – CONV / FHA

Show details

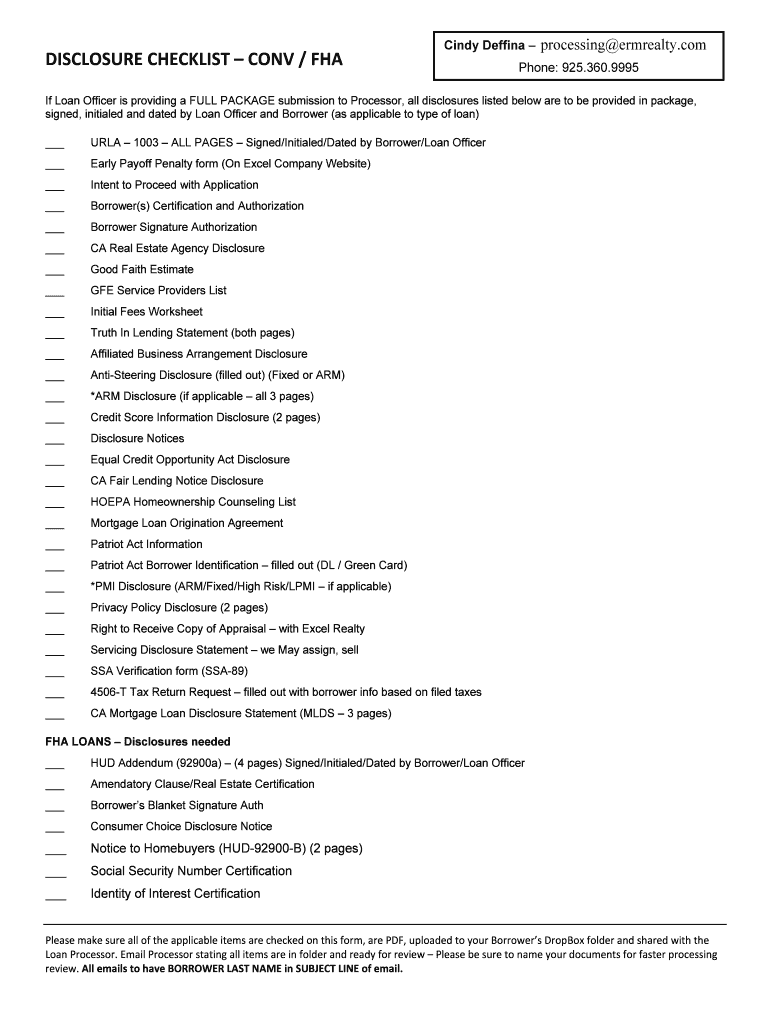

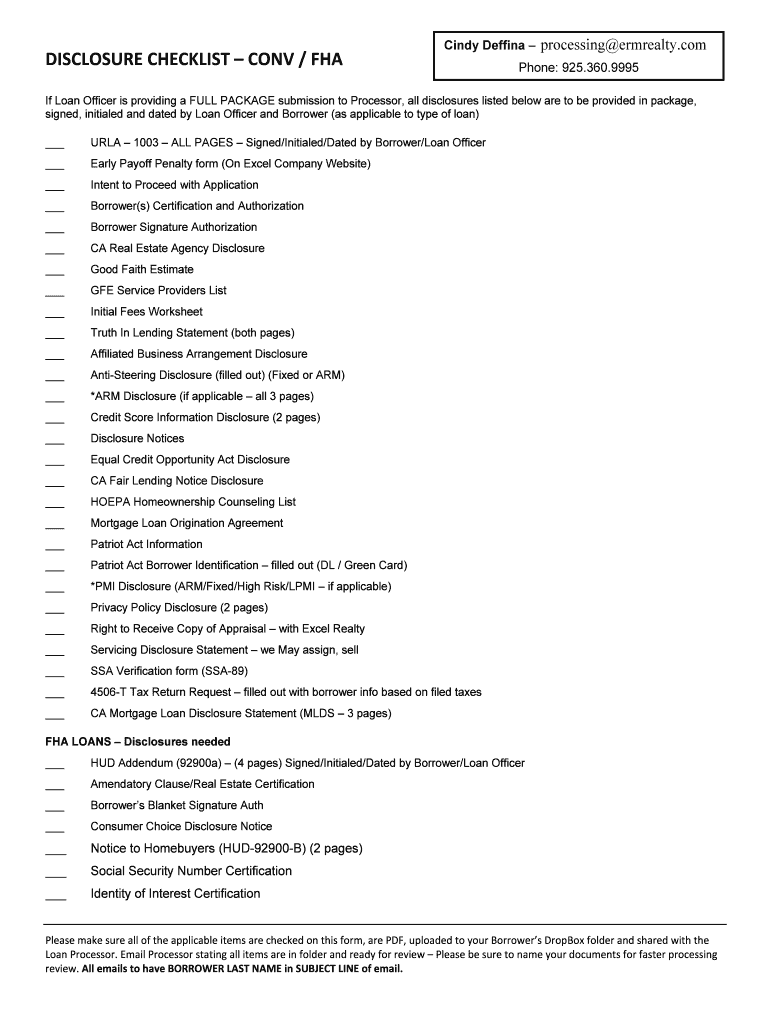

This checklist outlines the required disclosures that must be provided by the Loan Officer and signed by the Borrower when submitting a full loan package. It includes forms related to loan applications,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disclosure checklist conv fha

Edit your disclosure checklist conv fha form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure checklist conv fha form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure checklist conv fha online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit disclosure checklist conv fha. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disclosure checklist conv fha

How to fill out DISCLOSURE CHECKLIST – CONV / FHA

01

Start by gathering all necessary documents related to the transaction.

02

Review the checklist to understand each item that needs to be disclosed.

03

Fill out personal information, including names and contact details of all parties involved.

04

List the property address and any relevant identification numbers.

05

Complete each section of the checklist by indicating whether each disclosure applies.

06

Provide details and explanations for any disclosures marked as applicable.

07

Ensure all signatures are obtained from relevant parties where required.

08

Review the completed checklist for accuracy before submission.

09

Submit the checklist to the appropriate lending institution or governing body.

Who needs DISCLOSURE CHECKLIST – CONV / FHA?

01

Borrowers seeking financing through conventional or FHA loans.

02

Lenders and mortgage professionals who must ensure compliance with disclosure requirements.

03

Real estate agents assisting clients in home transactions related to these loan types.

Fill

form

: Try Risk Free

People Also Ask about

What disclosures are required by FHA?

Section 203(f) of the National Housing Act requires a disclosure to assist borrowers in comparing the costs of a FHA-insured mortgage versus similar conventional mortgages. This disclosure must be given to prospective borrowers that may qualify for both FHA-insured financing and a conventional mortgage product.

What two disclosures are required by RESPA?

ing to The Real Estate Settlement Procedures Act. The disclosures to be given at closing are the HUD-1 and the initial escrow statement which is due at closing or within 45 days of closing.

Which of the following is required by FHA?

Sufficient Income FHA Loans vs. Conventional Loans FHA LOANCONVENTIONAL LOAN Minimum Credit Score 500 Typically 620; can vary by lender Minimum Down Payment 3.5% with a credit score of 580+ and 10% for a credit score of 500 to 579 3% to 20% Loan Terms 15 to 30 years 8 to 30 years4 more rows

What disclosures are mandatory when disclosing a mortgage loan file?

❖ For any federally related mortgage loans, HUD/RESPA laws require that a Good Faith Estimate (GFE) be provided. A RE 882 Mortgage Loan Disclosure Statement (MLDS) is required by California law and must also be provided.

What are the seasoning rules for FHA loans?

Payment history/mortgage seasoning requirement: Borrowers must have made at least six payments on the FHA-insured mortgage that is being refinanced, at least six months must have passed since the first payment due date of the FHA-insured mortgage that is being refi- nanced, and at least 210 days must have passed from

What is the closing disclosure on a FHA loan?

Settings. Out of the numerous documents that you will come across during the mortgage process, your Closing Disclosure is one of the most important. This 5-page document specifies the terms of your home loan, such as your monthly payments, interest rates, and closing costs.

What would disqualify a house from FHA?

Common issues appraisers look for in the exterior are damaged roofs, s in foundations and anything blocking access to the property. When it comes to the interior, they look for basic things like missing handrails or chipped and peeling paint that could indicate a lead hazard.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DISCLOSURE CHECKLIST – CONV / FHA?

The DISCLOSURE CHECKLIST – CONV / FHA is a document used in the mortgage industry to ensure compliance with federal and state regulations for conventional and Federal Housing Administration (FHA) loans.

Who is required to file DISCLOSURE CHECKLIST – CONV / FHA?

Lenders and mortgage servicers who are originating or servicing conventional or FHA loans are required to file the DISCLOSURE CHECKLIST.

How to fill out DISCLOSURE CHECKLIST – CONV / FHA?

To fill out the DISCLOSURE CHECKLIST, lenders must provide accurate information about the loan, including borrower details, loan terms, and all required disclosures, ensuring to follow the guidelines set by regulatory bodies.

What is the purpose of DISCLOSURE CHECKLIST – CONV / FHA?

The purpose of the DISCLOSURE CHECKLIST is to confirm that all necessary disclosures have been provided to the borrower, ensuring transparency and compliance with lending regulations.

What information must be reported on DISCLOSURE CHECKLIST – CONV / FHA?

The information that must be reported includes the borrower's personal information, loan information, terms and conditions, and any other required disclosures as per regulatory guidelines.

Fill out your disclosure checklist conv fha online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disclosure Checklist Conv Fha is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.