Get the free Craft Accounting Service Business Income Expense Worksheet

Show details

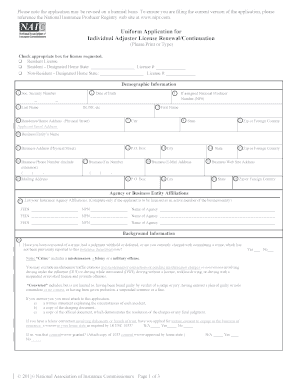

Craft Accounting Service Business Income Expense Worksheet General Information Business Name: Business Address Street Address: City, State & Zip: Principle Business Profession: Tax Identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign craft accounting service business

Edit your craft accounting service business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your craft accounting service business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit craft accounting service business online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit craft accounting service business. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out craft accounting service business

How to fill out craft accounting service business:

01

Start by determining your target market and identifying specific craft businesses that would benefit from your accounting services. Research their needs and challenges in order to tailor your services accordingly.

02

Develop a comprehensive business plan that outlines your services, pricing structure, target market, marketing strategies, and financial projections. This will serve as a roadmap for your craft accounting service business.

03

Register your business and obtain any necessary licenses and certifications. Consult with a legal professional to ensure compliance with local regulations and best practices.

04

Set up a professional workspace and invest in the necessary accounting software and tools to efficiently manage client accounts and financial data.

05

Establish a strong online presence through a website, social media channels, and online directories. This will help potential clients find and learn about your craft accounting service business.

06

Network within the craft industry by attending trade shows, conventions, and industry events. This will allow you to connect with potential clients and establish valuable partnerships.

07

Create a pricing structure that aligns with the needs and budgets of craft businesses. Consider offering different packages or services to cater to a variety of clients.

08

Develop a marketing strategy to promote your craft accounting service business. Utilize online advertising, content marketing, and targeted outreach to increase awareness and attract clients.

09

Provide exceptional customer service by being responsive, reliable, and knowledgeable. Building strong relationships with your clients will help drive customer loyalty and referrals.

10

Continuously educate yourself on current accounting standards, tax regulations, and industry trends. This will allow you to stay up-to-date and provide the best possible service to your craft business clients.

Who needs craft accounting service business?

01

Craft business owners who struggle with managing their financial records and bookkeeping.

02

Small craft businesses that are looking to grow and expand their operations.

03

Craft businesses that need help with tax preparation and compliance.

04

Creative entrepreneurs who want to focus on their craft and outsource their accounting needs.

05

Craft businesses that need assistance with budgeting, forecasting, and financial planning.

06

Start-up craft businesses that need guidance in setting up their accounting systems and processes.

07

Established craft businesses that want to improve their financial management and increase profitability.

08

Craft businesses that need assistance with inventory management, costing, and pricing strategies.

09

Innovative craft businesses that want to explore new financing options or apply for grants and loans.

10

Craft businesses that want to gain insights and analysis from their financial data to make informed business decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete craft accounting service business online?

pdfFiller has made it easy to fill out and sign craft accounting service business. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in craft accounting service business?

With pdfFiller, it's easy to make changes. Open your craft accounting service business in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the craft accounting service business in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your craft accounting service business in seconds.

What is craft accounting service business?

Craft accounting service business involves providing specialized accounting services to small businesses and craft businesses.

Who is required to file craft accounting service business?

Craft accounting service businesses are required to file their financial reports with the appropriate regulatory authorities.

How to fill out craft accounting service business?

Craft accounting service businesses can fill out their financial reports by accurately recording their income, expenses, and financial transactions.

What is the purpose of craft accounting service business?

The purpose of craft accounting service business is to help small businesses manage their finances effectively and make informed business decisions.

What information must be reported on craft accounting service business?

Craft accounting service businesses must report their revenue, expenses, assets, liabilities, and other financial information.

Fill out your craft accounting service business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Craft Accounting Service Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.