Get the free COUNTY ASSESSOR INFORMAL PROTEST - assessor tulsacounty

Show details

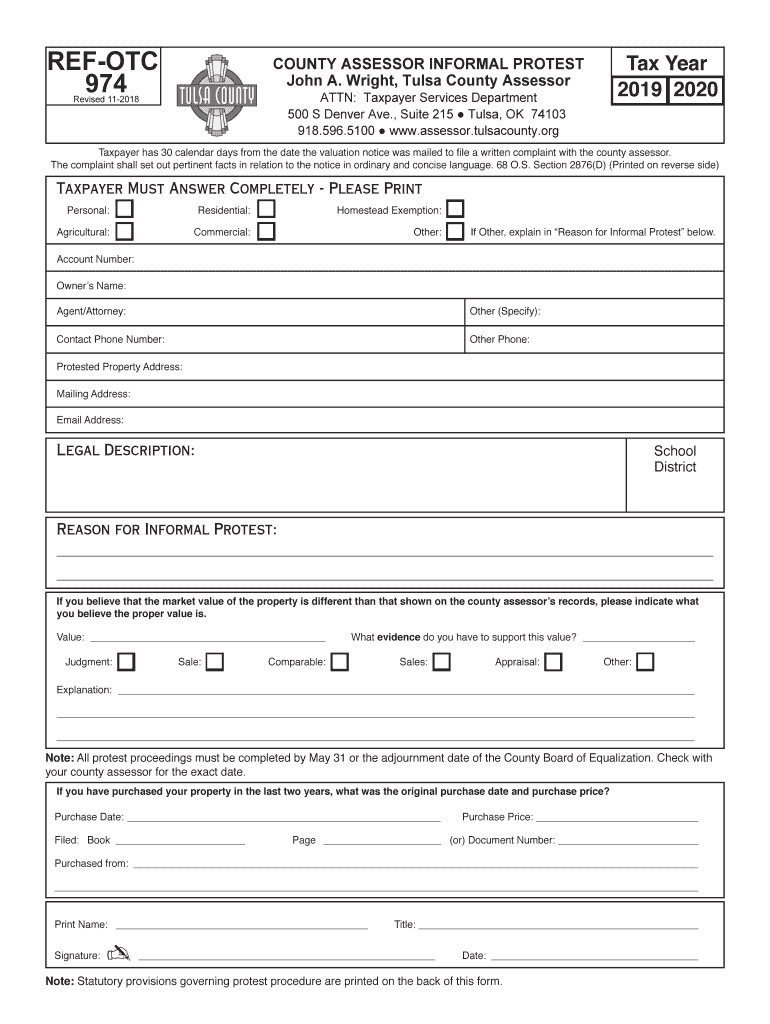

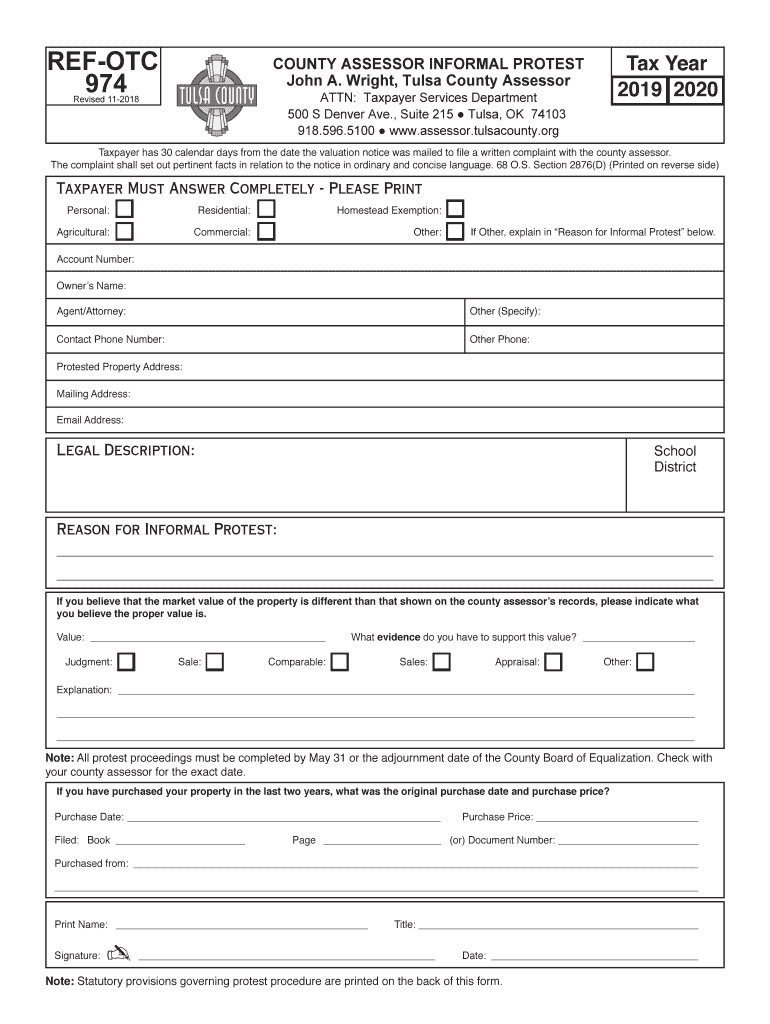

This document allows taxpayers to file a written complaint regarding property valuation with the county assessor within 30 days of receiving the valuation notice.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign county assessor informal protest

Edit your county assessor informal protest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your county assessor informal protest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit county assessor informal protest online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit county assessor informal protest. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out county assessor informal protest

How to fill out COUNTY ASSESSOR INFORMAL PROTEST

01

Obtain a copy of the COUNTY ASSESSOR INFORMAL PROTEST form.

02

Review the current property assessment details provided by the county.

03

Identify the specific reasons for your protest (e.g., overvaluation, incorrect property characteristics).

04

Fill out the form with your personal information, property details, and the reasons for your protest.

05

Attach any supporting evidence or documents that substantiate your claims.

06

Submit the completed form to the county assessor's office by the specified deadline.

07

Attend any scheduled meetings or hearings related to your protest, if required.

Who needs COUNTY ASSESSOR INFORMAL PROTEST?

01

Property owners who believe their property has been assessed at an incorrect value.

02

Individuals disputing the classification or characteristics of their property.

03

Homeowners looking to lower their property tax burden.

04

Anyone who has received a recent property assessment that seems unreasonable or inaccurate.

Fill

form

: Try Risk Free

People Also Ask about

What is a property protest?

A property tax protest is when you dispute the market value of a property as determined by the local tax authority, which directly affects the amount of property tax owed.

What is the best way to lower property taxes in Texas?

Apply for Qualified Exemptions: Homesteads, Over-65, disability, and veteran exemptions can reduce your home's taxable value. Filing the proper paperwork can lead to long-term savings.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

How much does it cost to protest property taxes in Texas?

HOMES VALUED ATFLAT FEE 0 – $200,000 $179 $200,001 – $500,000 $329 $500,001 – $1,500,000 $429 $1,500,001 – $3,000,000 $6291 more row

How to protest property taxes in Travis County?

What Is The Process To Protest Property Taxes? Step 1: Review Your Notice Of Appraised Value. Step 2: File A Notice Of Protest. Step 3: Prepare Your Case. Step 4: Informal Review. Step 5: Formal Appraisal Review Board (ARB) Hearing. Step 6: Final Determination.

How to successfully protest your Texas property taxes?

How to File a Notice of Protest in Texas Step 1: Know Your Deadline. Step 2: Get the Right Form. Step 3: Fill Out and Submit Your Protest. Step 4: Start Preparing Evidence. Conduct a Comparative Market Analysis (CMA) Document Property Conditions. Review the Appraisal District's Records. Leverage Data and Technology.

How to appeal property taxes in Oklahoma?

Appeal-Decision of County Assessor The appeal must be made on the current Formal Appeal County Board of Equalization Form 976 available from the county assessor's office. One copy of the form must be mailed or delivered to the county assessor and one copy must be mailed or delivered to the county board of equalization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COUNTY ASSESSOR INFORMAL PROTEST?

COUNTY ASSESSOR INFORMAL PROTEST is a process that allows property owners to contest their property assessments before the county assessor in an informal setting.

Who is required to file COUNTY ASSESSOR INFORMAL PROTEST?

Property owners or any individuals who believe their property assessments are incorrect are required to file a COUNTY ASSESSOR INFORMAL PROTEST.

How to fill out COUNTY ASSESSOR INFORMAL PROTEST?

To fill out a COUNTY ASSESSOR INFORMAL PROTEST, property owners need to complete the designated form provided by the county assessor's office, providing details about the property, the grounds for protest, and supporting evidence.

What is the purpose of COUNTY ASSESSOR INFORMAL PROTEST?

The purpose of COUNTY ASSESSOR INFORMAL PROTEST is to give property owners the opportunity to dispute their property assessments and potentially reduce their property tax liability.

What information must be reported on COUNTY ASSESSOR INFORMAL PROTEST?

The information that must be reported includes the property owner's details, property description, assessment value being contested, reasons for the protest, and any supporting documentation.

Fill out your county assessor informal protest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

County Assessor Informal Protest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.