Get the free Debt agreement

Show details

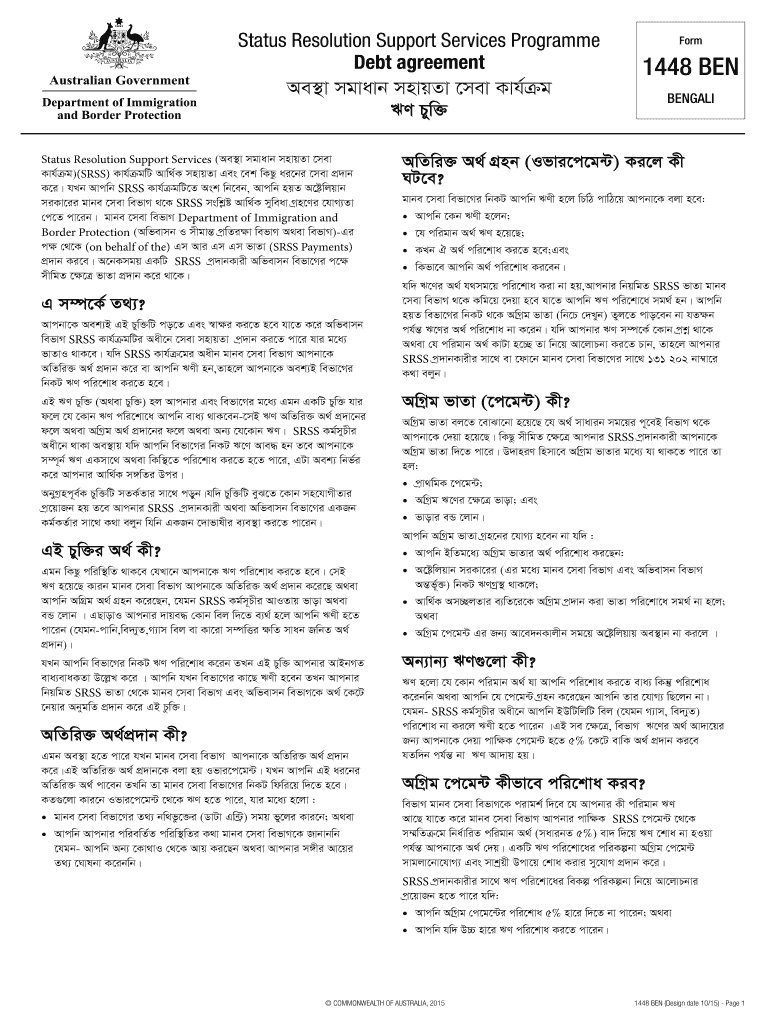

Status Resolution Support Services Program Debt agreement AEV gave mnvqZv MeV King Form 1448 BEN BENGALI FY Paw Status Resolution Support Services (AEV gave mnvqZv MeV King)(RSS) Khufu AVW K mnvqZv

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt agreement

Edit your debt agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debt agreement online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit debt agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt agreement

How to Fill Out Debt Agreement:

01

Start by gathering all necessary information: This includes your personal details, such as your name, address, and contact information, as well as the creditor's information, such as their name, address, and contact information. Make sure to have all relevant account numbers and debt details ready.

02

Read through the agreement carefully: Take the time to thoroughly read the debt agreement form. Understand the terms and conditions, including the interest rate, payment terms, any penalties or fees, and any other important clauses.

03

Fill in your personal information: Begin by filling out your personal details accurately in the designated fields. Ensure that your name, address, and contact information are all correct and up to date.

04

Specify the debt details: In the agreement form, provide all the necessary information regarding the debt, including the creditor's name, account number, and the amount owed. Be precise and double-check the accuracy of the details provided.

05

Review the payment terms: Understand the payment terms outlined in the debt agreement. This includes knowing the minimum payment required, the frequency of payments, and any other specifications regarding repayment.

06

Agree to the terms and sign: Once you have carefully reviewed all the information and are comfortable with the terms, sign the debt agreement form. By doing so, you are legally bound to fulfill the obligations outlined.

Who Needs a Debt Agreement?

01

Individuals with overwhelming debts: A debt agreement can be beneficial for individuals who are struggling to manage their debts and need a structured plan to repay their creditors.

02

People facing financial hardship: If you are undergoing a financial crisis or are experiencing difficulties making regular debt payments, a debt agreement can provide you with relief by consolidating your debts and reducing the overall repayment amount.

03

Individuals seeking to avoid bankruptcy: For those who wish to avoid filing for bankruptcy, a debt agreement can be a viable alternative. It allows you to negotiate with your creditors and establish a repayment plan that suits your financial situation.

04

Individuals with multiple creditors: Managing debts from various lenders can become overwhelming. A debt agreement can simplify the process by combining these debts into a single repayment plan, making it easier to track and manage your obligations.

05

Individuals seeking legal protection: A debt agreement provides legal protection against legal actions, wage garnishments, or harassment from creditors, offering a more secure and stable financial situation.

Remember, it is always advisable to consult with a financial advisor or debt counselor before entering into a debt agreement to ensure it is the most suitable option for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find debt agreement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific debt agreement and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit debt agreement on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing debt agreement, you need to install and log in to the app.

How do I fill out debt agreement using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign debt agreement and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is debt agreement?

A debt agreement is a legally binding agreement between a debtor and their creditors to repay debts.

Who is required to file debt agreement?

Anyone who is struggling to repay their debts and is seeking assistance from creditors may be required to file a debt agreement.

How to fill out debt agreement?

To fill out a debt agreement, you typically need to work with a debt agreement administrator who will assist you in preparing the necessary documentation.

What is the purpose of debt agreement?

The purpose of a debt agreement is to provide a formalized plan for repaying debts, often with adjusted payment terms and reduced overall debt.

What information must be reported on debt agreement?

A debt agreement must include details of the debtor, creditors, debt amounts, payment schedule, and any agreed upon changes to the original debt terms.

Fill out your debt agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.