DTE 101 1999-2025 free printable template

Show details

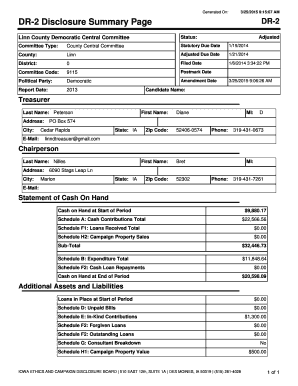

Do FORM 101 Revised 10/99 STATEMENT OF CONVEYANCE OF HOMESTEAD PROPERTY To be attached to Conveyance Fee Forms, DUE 100, 100(EX), 100M & 100M(EX) Granter's (Seller's) Name Granter's Address Grantee's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer property form

Edit your property owner transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio acknowledgement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer property ohio online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit purchaser title section form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer property acknowledgement form

How to fill out DTE 101

01

Obtain the DTE 101 form from the appropriate agency or online.

02

Read the instructions carefully to ensure you understand what information is needed.

03

Fill out the date at the top of the form.

04

Provide your personal information including your name, address, and contact details.

05

Indicate the type of request or information you are seeking.

06

Provide any relevant account or identification numbers.

07

Sign and date the form at the bottom to verify the information is correct.

08

Submit the completed form to the specified agency or department.

Who needs DTE 101?

01

Individuals or businesses that wish to request information related to their utility accounts.

02

Persons requiring adjustments or clarifications concerning their utility services.

03

Those who are filing for a property tax exemption related to energy-efficient improvements.

Fill

property title ohio

: Try Risk Free

People Also Ask about

What are the 2 methods of transfer of property?

There are two types of deeds commonly used in real estate transactions: warranty deeds and quitclaim deeds. Warranty Deed: The most common way to transfer property is through a warranty deed (sometimes called a "grant deed").

How do I transfer a property title in South Carolina?

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann. 12-24-70(A)(1)).

How do you transfer property in Indiana?

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property. Create the new deed. Sign the new deed. Record the original deed.

What are written proofs of ownership?

Proof of Ownership Deed or title. Mortgage documentation. Homeowners insurance documentation. Property tax receipt or bill.

What is a written document that transfers ownership of property?

DEEDS IN GENERAL When properly executed, delivered and accepted, a deed transfers title to real property from one person (the grantor) to another person (the grantee). Transfer may be voluntary, or involuntary by act of law, such as a foreclosure sale.

Who can legally prepare a deed in Indiana?

Signing (IC § 32-21-2-3) – All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property transfer title form for eSignature?

Once your property transfer title form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete property transfer title form online?

Completing and signing property transfer title form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit property transfer title form in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing property transfer title form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is DTE 101?

DTE 101 is a form used by certain taxpayers in the United States to report specific financial information to state tax authorities.

Who is required to file DTE 101?

Typically, entities or individuals engaged in certain activities or transactions, such as corporations or businesses operating in specific industries, are required to file DTE 101.

How to fill out DTE 101?

To fill out DTE 101, taxpayers must provide detailed financial information as per the instructions provided with the form, including income, deductions, and other relevant data.

What is the purpose of DTE 101?

The purpose of DTE 101 is to ensure that taxpayers comply with state tax regulations by reporting their taxable activities and financial information.

What information must be reported on DTE 101?

DTE 101 requires taxpayers to report information such as gross receipts, deductions, credits, and any other relevant financial data required by state tax authorities.

Fill out your property transfer title form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Transfer Title Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.