OH CMHA Monthly Self-Employment Worksheet 2010-2025 free printable template

Show details

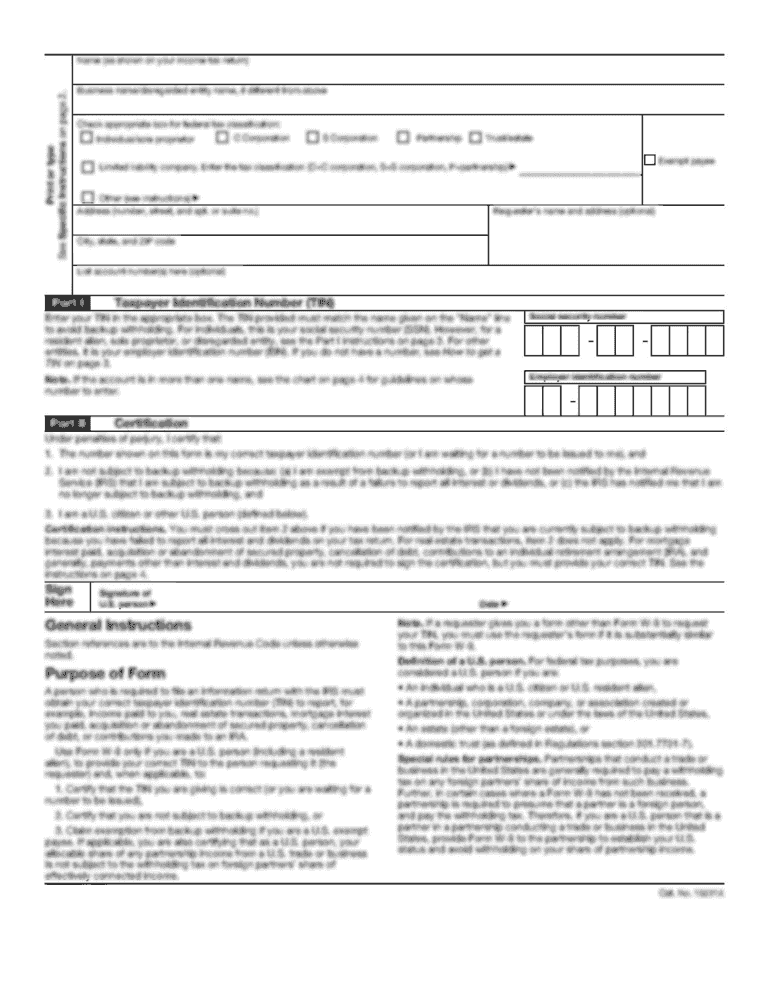

MONTHLY REEMPLOYMENT WORKSHEET Client Name SSN Reporting for the Month of, 200 Date Income Source Client Signature Income Amount Date Nature of Expense Amount

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign online llc form

Edit your tax income online form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax income online form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax income online form online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax income online form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax income online form

How to fill out OH CMHA Monthly Self-Employment Worksheet

01

Gather all necessary financial documents, including income statements and expense records.

02

Download the OH CMHA Monthly Self-Employment Worksheet from the official website.

03

Begin by filling out your personal information at the top of the worksheet.

04

List your sources of income for the month, including any self-employment income.

05

Detail your business expenses in the appropriate section, categorizing them as needed.

06

Calculate your total income and total expenses to determine your net income.

07

Review the completed worksheet for accuracy and completeness.

08

Submit the worksheet along with any required documentation to your caseworker.

Who needs OH CMHA Monthly Self-Employment Worksheet?

01

Individuals who are self-employed and receiving assistance from the Ohio CMHA.

02

People who need to report their monthly earnings to determine eligibility for housing assistance.

03

Anyone who has fluctuating income and needs to provide financial documentation for their case.

Fill

form

: Try Risk Free

People Also Ask about

What is taxable income Malaysia?

ing to LHDN, Malaysian employees are required to pay taxes if they earn an annual income of at least RM34,000 (after EPF* deduction).

How do I find my tax income?

Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040NR. It is located on different lines on forms from earlier years.

How much is taxable in the Philippines 2022?

Income of residents in Philippines is taxed progressively up to 32%. Resident citizens are taxed on all their net income derived from sources within and without the Philippines.

What are the three main types of taxes income?

Individual and Consumption Taxes Individual Income Taxes. Excise Taxes. Estate & Gift Taxes.

What are the three types of taxable income?

Types of Taxable Income Employee compensation and benefits. These are the most common types of taxable income and include wages and salaries, as well as fringe benefits. Investment and business income. Miscellaneous taxable income.

How do I know what my tax income is?

To calculate your taxable income, first determine your filing status. Next, collect documents for all sources of income. After that, calculate your adjusted gross income. Finally, subtract your deductions from your adjusted gross income to determine your taxable income.

How much income is tax exempt in Philippines?

You are not obliged to file ITRs if you are a minimum wage earner, an individual earning purely compensation income that does not exceed PHP250, 000, or if your employer has withheld your income tax correctly.

What type of income is not taxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What is considered tax income?

The term taxable income refers to any gross income earned that is used to calculate the amount of tax you owe. Put simply, it is your adjusted gross income less any deductions. This includes any wages, tips, salaries, and bonuses from employers.

How much is taxable income in Philippines?

2020 national income tax rates Taxable income band PHPTax rates1 to 250,0000%250,001 to 400,00020%400,001 to 800,00025%800,001 to 2,000,00030%2 more rows

How much salary is taxable in the Philippines?

Computing for Your Salary BIR TAX TABLESALARY RANGE (ANNUAL)INCOME TAX RATE250000 and below0%250000.01 to 40000020% of the excess over 250000400000.01 to 80000030000 + 25% of the excess over 4000003 more rows

What are 10 types of taxable income?

What is taxable income? wages, salaries, tips, bonuses, vacation pay, severance pay, commissions. interest and dividends. certain types of disability payments. unemployment compensation. jury pay and election worker pay. strike and lockout benefits. bank “gifts” for opening or adding to accounts if more than “nominal” value.

What types of income are taxable?

Taxable income includes wages, salaries, bonuses, and tips, as well as investment income and various types of unearned income.

What does not count as taxable income?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What is considered my taxable income?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What income is not taxable in Malaysia?

Company special service cash or prize awards are eligible for a tax exemption of up to RM1,000. Grants for all types of approved green SRI (Socially Responsible Investing) sukuk and bonds are exempted from income tax for applications for issuance from 2021 to 2025.

What should I include in taxable income?

Taxable income is the amount you receive after you take away all your allowable deductions from your assessable or gross income. Gross income includes: Salary and wages, lump sum payments, money from business or self employment, rent, interest, investments and dividends.

Is 20000 salary taxable in the Philippines?

If you make ₱ 20,000 a year living in Philippines, you will be taxed ₱ 2,756. That means that your net pay will be ₱ 17,244 per year, or ₱ 1,437 per month. Your average tax rate is 13.8% and your marginal tax rate is 9.9%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax income online form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax income online form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify tax income online form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your tax income online form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit tax income online form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your tax income online form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is OH CMHA Monthly Self-Employment Worksheet?

The OH CMHA Monthly Self-Employment Worksheet is a form used by self-employed individuals who receive assistance from the Ohio County Metropolitan Housing Authority (CMHA) to report their monthly income and expenses.

Who is required to file OH CMHA Monthly Self-Employment Worksheet?

Self-employed individuals who are receiving housing assistance and are required to provide proof of their income and expenses to the OH CMHA must file the Monthly Self-Employment Worksheet.

How to fill out OH CMHA Monthly Self-Employment Worksheet?

To fill out the OH CMHA Monthly Self-Employment Worksheet, individuals must provide detailed information about their business income, including gross income, allowable business expenses, and any net income derived from self-employment for the reporting period.

What is the purpose of OH CMHA Monthly Self-Employment Worksheet?

The purpose of the OH CMHA Monthly Self-Employment Worksheet is to accurately assess and verify the income of self-employed individuals, ensuring that the assistance they receive is appropriate and reflects their current financial situation.

What information must be reported on OH CMHA Monthly Self-Employment Worksheet?

The information that must be reported on the OH CMHA Monthly Self-Employment Worksheet includes gross receipts from the business, allowable expenses (such as operating costs, materials, and labor), and the net income after expenses are deducted.

Fill out your tax income online form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Income Online Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.