Get the free AL8379 - Alabama Department of Revenue - revenue alabama

Show details

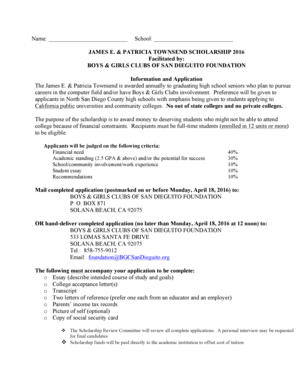

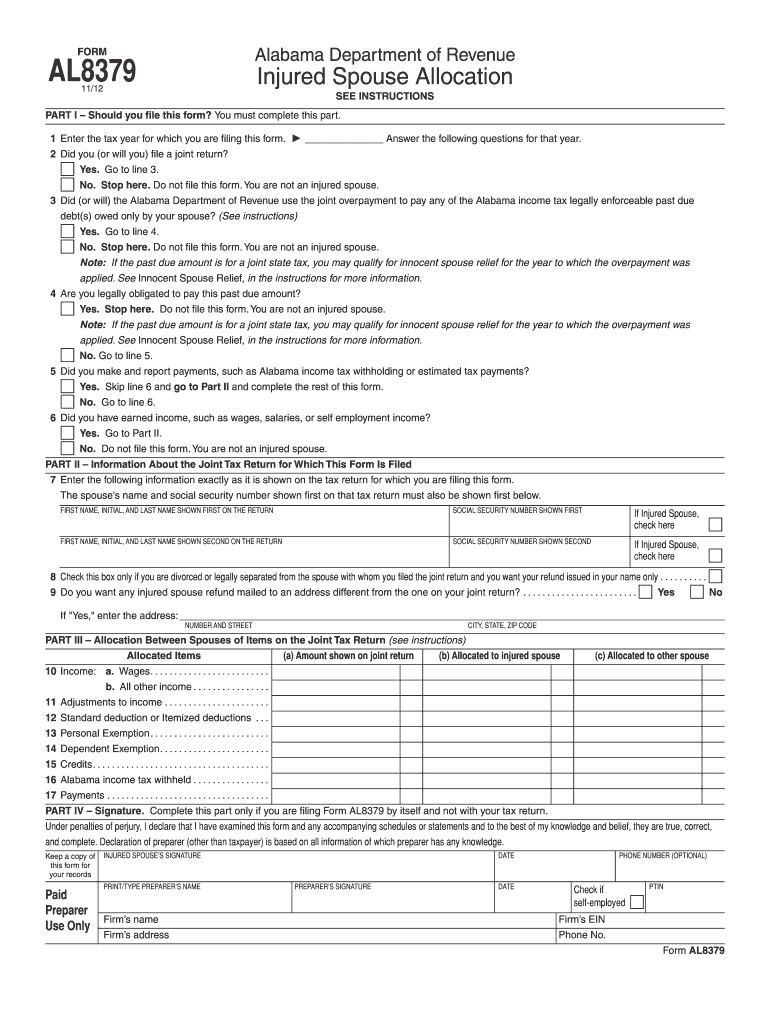

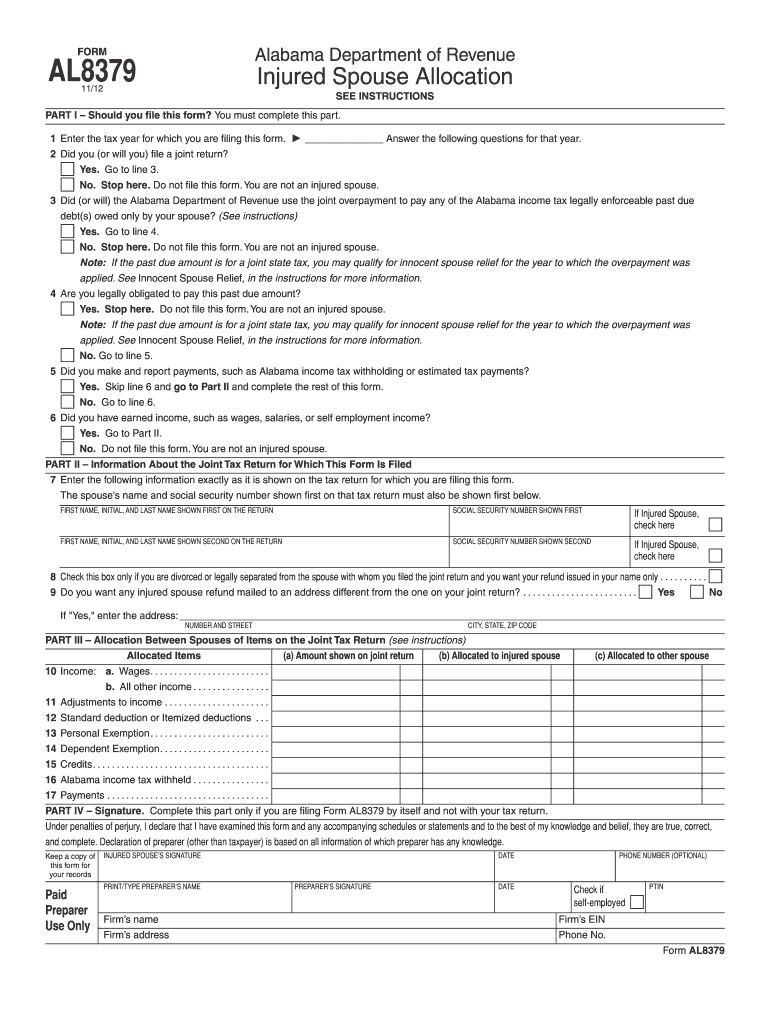

FORM AL8379 11/12 Alabama Department of Revenue Injured Spouse Allocation SEE INSTRUCTIONS Reset Form PART I ? Should you file this form? You must complete this part. 1 Enter the tax year for which

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign al8379 - alabama department

Edit your al8379 - alabama department form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your al8379 - alabama department form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing al8379 - alabama department online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit al8379 - alabama department. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1310 form in Alabama?

Use Form 1310A to claim a refund on behalf of a deceased taxpayer. You are a personal representative (defined on this page) filing an original Form 40, Form 40A, or Form 40NR for the decedent and a court certificate showing your appointment is attached to the return.

Who needs to file form 1310?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

Does a personal representative have to file form 1310?

If you're a surviving spouse filing a joint return, or a court-appointed or court-certified personal representative filing an original return for the decedent, you don't have to file Form 1310.

Why would Alabama Department of Revenue send me a letter?

If there is a question about your return, you may receive a request for information letter that asks for missing or additional information or a tax computation change letter that provides explanation of changes made to the tax return.

How long can the state of Alabama collect back taxes?

Time Limitations In most cases, the department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

How do I contact Alabama Dept of Revenue?

Tobacco Tax Section. 334-242-9627. Severance & License Tax Section. Collection Services. 334-242-1220. Commissioner. 334-242-1175. Deputy Commissioner. 334-242-1175. Tax Incentives. 334-242-1175. Processing Services. 334-242-1820. Equal Employment Opportunity Office. 334-353-5480. Financial Operations. 334-353-4655.

Why would I get a letter from the Alabama Department of Revenue?

If there is a question about your return, you may receive a request for information letter that asks for missing or additional information or a tax computation change letter that provides explanation of changes made to the tax return.

What is Alabama Department of Revenue Collection Services Division?

About the Division Collection Services is an in-house collections agency for the Alabama Department of Revenue. When the taxpayer's assessment reaches Collection Services, the tax liability already has the full force and effect of a court judgment.

Where do I file injured spouse form 8379?

You must file a new Form 8379 for each year when you want to reclaim a refund. Mail Form 8379 to the IRS Service Center where you filed your original return.

What is the difference between injured spouse and innocent spouse?

There are two types of tax relief for spouses: Injured spouse relief lets you reclaim money taken from your tax refund to cover your spouse's debts. Innocent spouse relief relieves you from paying additional federal income tax owed by your spouse due to errors on a joint tax return.

What is the innocent spouse rule?

Innocent spouse relief can relieve you from paying additional taxes if your spouse understated taxes due on your joint tax return and you didn't know about the errors. Innocent spouse relief is only for taxes due on your spouse's income from employment or self-employment.

What qualifies as an injured spouse?

You're an injured spouse if your share of the refund on your joint tax return was (or is expected to be) applied against a separate past-due debt that belongs just to your spouse, with whom you filed the joint return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute al8379 - alabama department online?

pdfFiller has made it simple to fill out and eSign al8379 - alabama department. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit al8379 - alabama department on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign al8379 - alabama department on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out al8379 - alabama department on an Android device?

On an Android device, use the pdfFiller mobile app to finish your al8379 - alabama department. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your al8379 - alabama department online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

al8379 - Alabama Department is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.