AL ADoR INT-2 2001 free printable template

Show details

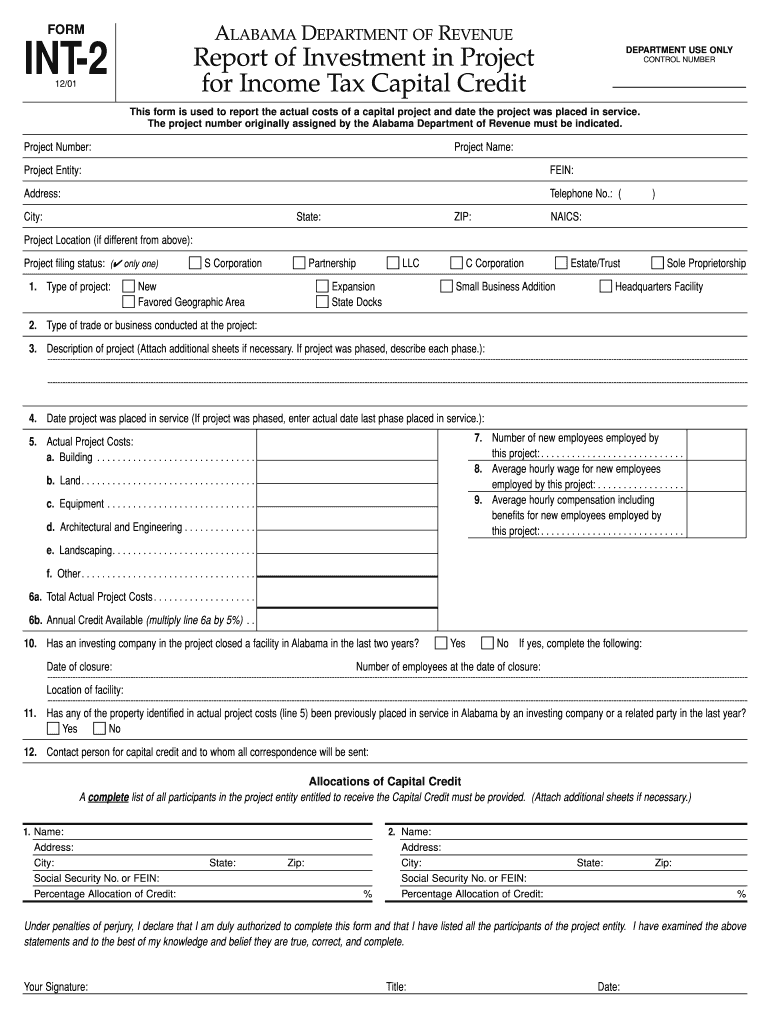

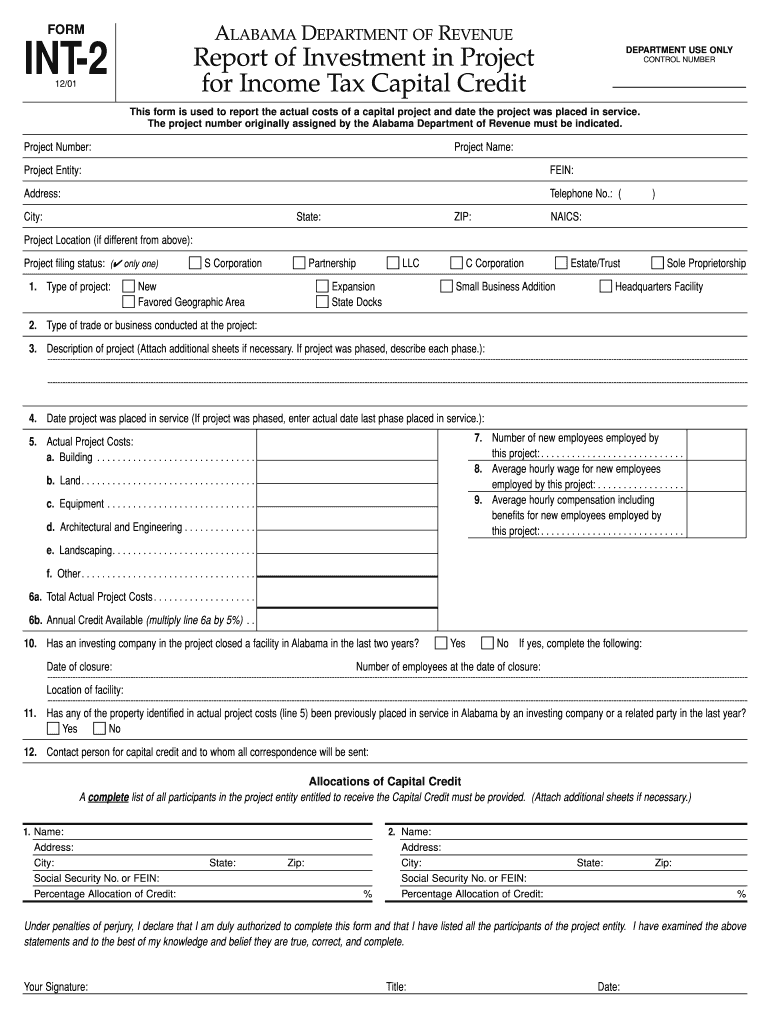

FORM ALABAMA DEPARTMENT OF REVENUE INT-2 DEPARTMENT USE ONLY Report of Investment in Project for Income Tax Capital Credit 12/01 CONTROL NUMBER This form is used to report the actual costs of a capital project and date the project was placed in service. Projects that were originally approved using a SIC code must convert to the NAICS code. Line 1 Indicate whether this project is a new expansion small business addition headquarters facility favored geographic area or a state docks project as...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR INT-2

Edit your AL ADoR INT-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR INT-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR INT-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR INT-2

How to fill out AL ADoR INT-2

01

Obtain the AL ADoR INT-2 form from the official website or the relevant authority.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information such as name, address, and contact details in the designated fields.

04

Provide detailed information required for each section, including financial data or background information as applicable.

05

Review all the entries to ensure they are accurate and complete.

06

Sign and date the form at the designated section to verify your submission.

07

Submit the completed form via the specified method (e.g., online, mail, or in person) as indicated in the instructions.

Who needs AL ADoR INT-2?

01

Individuals or organizations that are required to report certain financial or operational information to regulatory authorities.

02

Businesses seeking compliance with specific reporting requirements.

03

Professionals assisting clients with regulatory submissions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AL ADoR INT-2?

AL ADoR INT-2 is a form required by the Alabama Department of Revenue for reporting certain types of income or transactions for tax purposes.

Who is required to file AL ADoR INT-2?

Individuals and entities that earn specific types of income that are subject to reporting requirements in Alabama are required to file AL ADoR INT-2.

How to fill out AL ADoR INT-2?

To fill out AL ADoR INT-2, taxpayers must provide information related to their income, including details about the sources of income and any applicable deductions or credits, ensuring accuracy and clarity in the information provided.

What is the purpose of AL ADoR INT-2?

The purpose of AL ADoR INT-2 is to ensure compliance with state tax laws by accurately reporting income earned, facilitating the collection of taxes and maintaining transparency in financial activities.

What information must be reported on AL ADoR INT-2?

The information that must be reported on AL ADoR INT-2 includes the taxpayer's identification details, the types and amounts of income earned, the period during which the income was earned, and any additional relevant financial information necessary for accurate tax reporting.

Fill out your AL ADoR INT-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR INT-2 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.