Get the free 20C

Show details

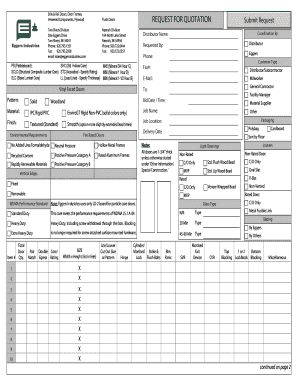

This document is the Corporation Income Tax Return for the State of Alabama, used for reporting taxable income for the year 2003 or other specified tax years.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 20c

Edit your 20c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 20c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 20c online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 20c. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20c

How to fill out 20C

01

Gather all necessary documents and information required to complete Form 20C.

02

Start filling out the personal details section, including your name, address, and contact information.

03

Include details about the income sources you are reporting.

04

Carefully fill out the sections regarding any deductions and exemptions applicable to you.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed Form 20C to the relevant authority either electronically or via mail.

Who needs 20C?

01

Individuals or entities who have income subject to taxation and need to report their income to the tax authorities.

02

Taxpayers who qualify for specific deductions and exemptions that are outlined in Form 20C.

Fill

form

: Try Risk Free

People Also Ask about

What is the 20th century in English?

The 20th century was the century that began on 1 January 1901 (MCMI), and ended on 31 December 2000 (MM).

Which 20th century English writer known for a feminist and magical realist works?

Angela Olive Pearce (formerly Carter, née Stalker; 7 May 1940 – 16 February 1992), who published under the name Angela Carter, was an English novelist, short story writer, poet, and journalist, known for her feminist, magical realism, and picaresque works.

What is 20th?

Twentieth Century, n. meanings, etymology and more Oxford English Dictionary.

How do you spell 20th in words?

1:04 5:06 But if it's 20th. Um then you have um that T in there. So 20th ends with the I vowel and the th.MoreBut if it's 20th. Um then you have um that T in there. So 20th ends with the I vowel and the th. Sound this is a lax vowel iith. It should be short.

What do you learn in English 20:1?

English Language Arts 20-1 - ELA 2105. Build the foundations of literary theory, style appreciation, and analytical skills that are needed for English 30-1. Analyze short stories, drama, poetry, non-fiction, a novel, a feature film, and media. Create essays and reports.

How do you spell 20th in English?

twentieth American Dictionary (in the position of) the number 20 in a series; 20th: This is our twentieth wedding anniversary.

How do you pronounce the 20th date?

The twentieth item in a series is the one that you count as number twenty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 20C?

20C refers to a specific tax form used in various jurisdictions, often related to the reporting of certain types of income or tax-related information.

Who is required to file 20C?

Individuals and entities that meet specific criteria set by tax authorities, typically those earning income that needs to be reported or those eligible for certain deductions or credits.

How to fill out 20C?

To fill out 20C, gather all necessary financial documents, enter the required information accurately on the form, and ensure it is signed before submission by the relevant deadline.

What is the purpose of 20C?

The purpose of 20C is to provide tax authorities with information about income earned, deductions claimed, and to ensure compliance with tax regulations.

What information must be reported on 20C?

Information typically reported on 20C includes personal details, income sources, deductions, credits, and other relevant tax information required by the tax authorities.

Fill out your 20c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

20c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.