Get the free Form 65

Show details

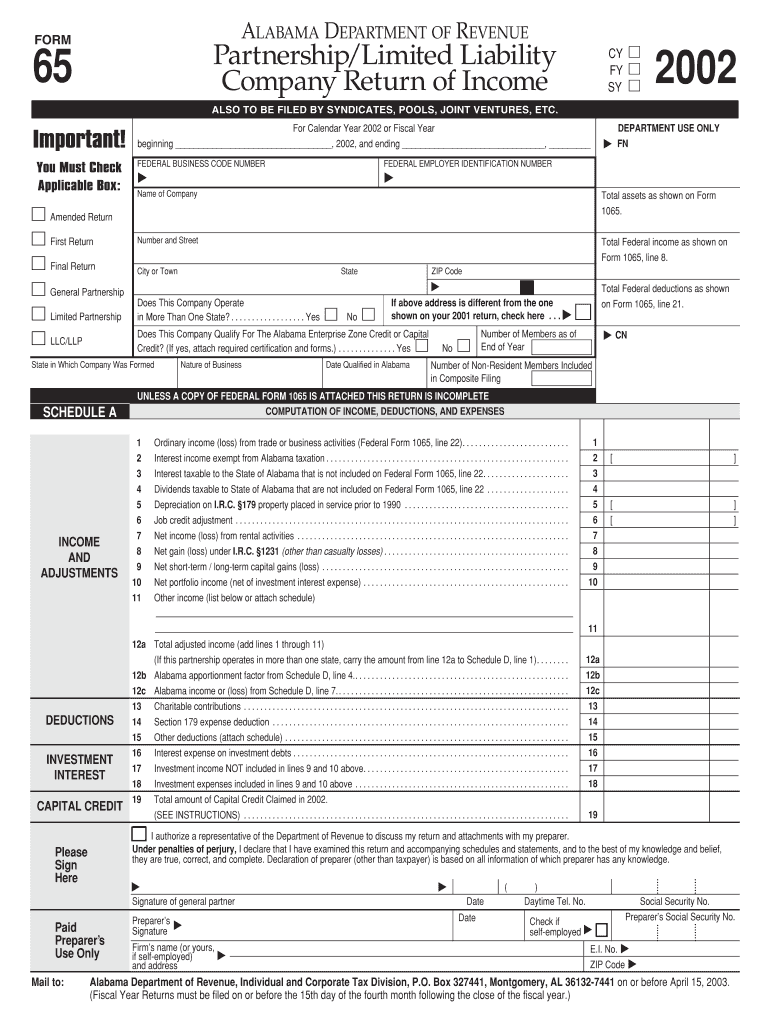

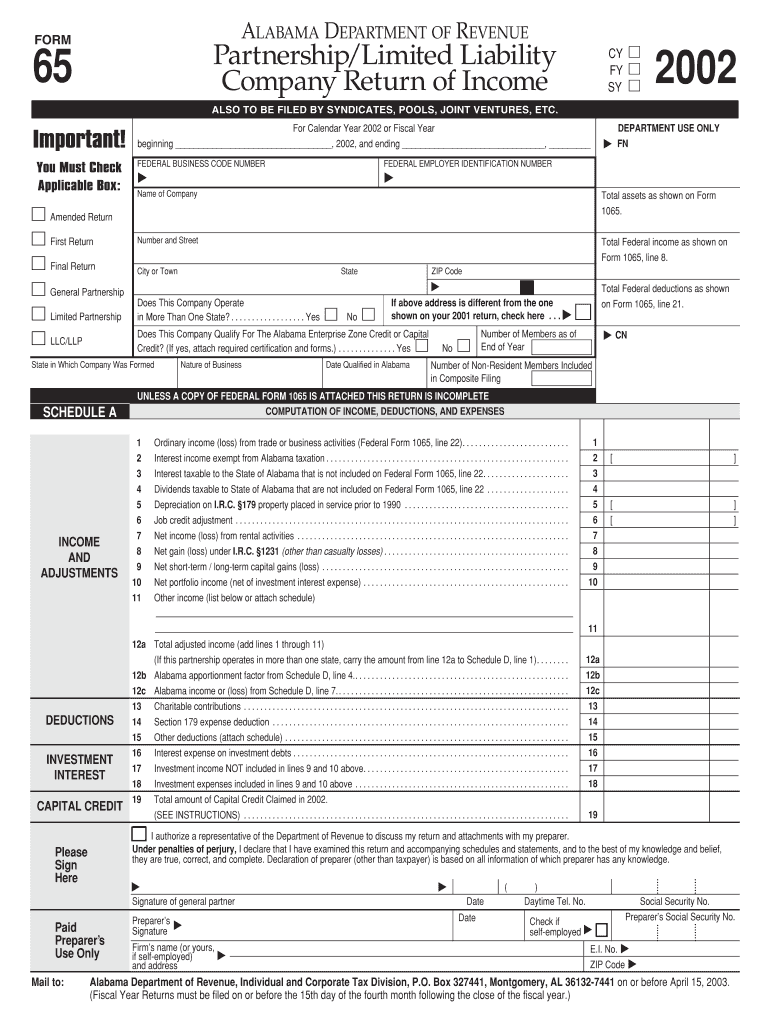

This document is used by partnerships and limited liability companies in Alabama to report income, deductions, and other tax-related information for the taxable year 2002.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 65

Edit your form 65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 65 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 65. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 65

How to fill out Form 65

01

Obtain Form 65 from the official source or website.

02

Read the instructions and guidelines provided on the form thoroughly.

03

Fill in your personal details, including name, address, and contact information.

04

Provide any relevant identification numbers as required, such as social security number or tax ID.

05

Follow the prompts to provide any necessary financial information or details related to the purpose of the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as directed, either electronically or by mail, to the appropriate authority.

Who needs Form 65?

01

Individuals or entities required to report specific financial or personal information.

02

Those applying for certain benefits or licenses that necessitate the use of Form 65.

03

Individuals engaged in legal or financial activities that require formal disclosures.

Fill

form

: Try Risk Free

People Also Ask about

Should I use 1040 or 1040 NR?

The choice between Form 1040 and Form 1040NR largely depends on your residency status, which influences both income reporting and deductions. For nonresident aliens, Form 1040NR should be used to report U.S.-sourced income only, while Form 1040 requires U.S. residents and citizens to report their worldwide income.

What is Form or 65?

150-101-065-1 (Rev. 10-03-23) 2023 Form OR-65 Instructions. Purpose of this form. Form OR-65 is an information return used to report Oregon modifications to federal taxable income and credits passed through to partners along with other information from the operation of a partnership.

What is the Oregon form or 65?

Oregon Form 65 is the income tax return form specifically designed for partnerships, including general partnerships, limited partnerships, and limited liability partnerships (LLPs) that are required to file a return and report their income to the state of Oregon.

What is form or 65?

150-101-065-1 (Rev. 10-03-23) 2023 Form OR-65 Instructions. Purpose of this form. Form OR-65 is an information return used to report Oregon modifications to federal taxable income and credits passed through to partners along with other information from the operation of a partnership.

Who must file Alabama Form 65?

All partnerships having "substantial nexus" from property owned or business conducted in this state shall file the Alabama Form 65 on or before the due date, including extension.

Should I use Form 1040 or 1040-SR?

There has not been a 1040A since 2017 returns were filed. Now everyone uses either Form 1040 or Form 1040SR. The only difference between those forms is the larger print on the 1040SR. All of the calculations are the same.

What is the tax form for 65 and over?

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

How to pay or-65-V?

Make your check, money order, or cashier's check payable to the Oregon Department of Revenue. Write “Form OR-65-V,” your daytime phone, the entity's federal employer identi- fication number (FEIN), and the tax year on the payment. Don't mail cash.

What is Alabama form 65?

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

What is the difference between form 1040 and 1040SR?

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return. Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 65?

Form 65 is a tax form used for reporting income and expenses by partnerships, specifically in certain jurisdictions. It is designed to provide necessary financial information to tax authorities.

Who is required to file Form 65?

Partnerships that operate in jurisdictions that require this form are obligated to file Form 65. This includes entities that generate income and need to report their profits, losses, and distributions to partners.

How to fill out Form 65?

To fill out Form 65, partners should gather their financial records, including income statements and expense reports, complete each section of the form as required, double-check for accuracy, and submit it by the deadline set by the tax authority.

What is the purpose of Form 65?

The purpose of Form 65 is to provide the tax authorities with information about a partnership's income, losses, and distributions, enabling proper tax assessment and compliance with tax laws.

What information must be reported on Form 65?

Form 65 typically requires reporting of the partnership's gross income, deductible expenses, other losses, the income allocated to each partner, and any additional pertinent financial details related to the partnership's operations.

Fill out your form 65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.