Get the free 40NR

Show details

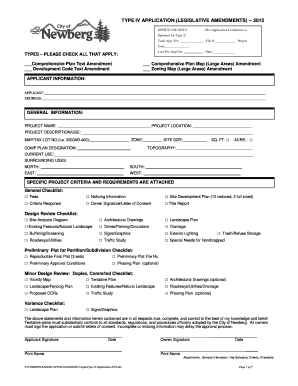

This form is used by nonresidents of Alabama to file their individual income tax return for the year 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 40nr

Edit your 40nr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 40nr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 40nr online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 40nr. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 40nr

How to fill out 40NR

01

Gather your personal information such as name, address, and Social Security number.

02

Determine your residency status to see if you meet the filing requirements.

03

Fill out your income details, including any U.S.-sourced income you have earned.

04

Complete the applicable deductions and credits sections to reduce your taxable income.

05

Check the tax rates and calculate the tax owed on the income you report.

06

Review the form for accuracy and completeness before submission.

07

Submit the form to the IRS by the appropriate filing deadline.

Who needs 40NR?

01

Non-resident aliens who earn income in the U.S.

02

Individuals not qualifying as residents for tax purposes.

03

Foreign workers and students with U.S. income.

04

Non-residents who need to report their U.S. sourced income.

Fill

form

: Try Risk Free

People Also Ask about

What if I accidentally filed 1040NR instead of 1040?

If you mistakenly filed a Form 1040 U.S. Individual Income Tax Return and you need to file Form 1040-NR U.S. Nonresident Alien Income Tax Return, or vice versa, you will need to amend your return. For steps on creating an amended return, see Form 1040-X - How to Create an Amended Return.

What is the English of HMRC?

Meaning of HMRC in English abbreviation for His Majesty's Revenue and Customs, used when a king is ruling, or Her Majesty's Revenue and Customs, used when a queen is ruling: the UK government department that is responsible for calculating and collecting taxes: According to HMRC, some investments cannot be tax-free.

What is the difference between Form 1040 and 1040NR?

Form 1040 is for US residents (or resident aliens) and citizens to report worldwide income. Form 1040NR is for non resident aliens to report income made in the US only. For reporting purposes, you will only include income made in 2024, do not include income made in 2025.

What is the minimum income to file 1040NR?

There is no minimum income threshold to file 1040NR Form as a non-resident alien. You should only report your US sourced income on this form. However, foreigners investing in the US should first determine if their US visits make them US residents for tax purposes. In such cases, you must report your worldwide income.

How much does it cost to file a 1040NR?

Average Fee for a U.S. Individual Tax Return (1040) or U.S. Nonresident Alien Income Tax Return (1040NR) with one State (return may include a few investment income and capital transactions): $400-$850 per year.

Are you required to file both Form 40 and Form 40NR for your Alabama income?

02 - Preparation And Filing Of Individual Taxpayer's Return. (1) Every resident individual taxpayer required to file a return should do so using Form 40 or Form 40A, copies of which may be obtained from the Department. Nonresidents should file using Form 40NR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 40NR?

Form 40NR is a tax form used by non-resident aliens in the United States to report their income and calculate their tax liability.

Who is required to file 40NR?

Non-resident aliens who have income from U.S. sources that is subject to taxation are required to file Form 40NR.

How to fill out 40NR?

To fill out Form 40NR, gather relevant income information, complete the identification section, report income sources, calculate deductions and exemptions, and finally sign and submit the form.

What is the purpose of 40NR?

The purpose of Form 40NR is to ensure non-resident aliens report their U.S. income and pay the appropriate taxes owed to the U.S. government.

What information must be reported on 40NR?

Form 40NR requires reporting of various types of U.S. sourced income, including wages, interest, dividends, capital gains, and any deductions or credits claimed.

Fill out your 40nr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

40nr is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.