Get the free INTERNAL REVENUE SERVICE DEPARTMENT CF THE TREASURY - asam

Show details

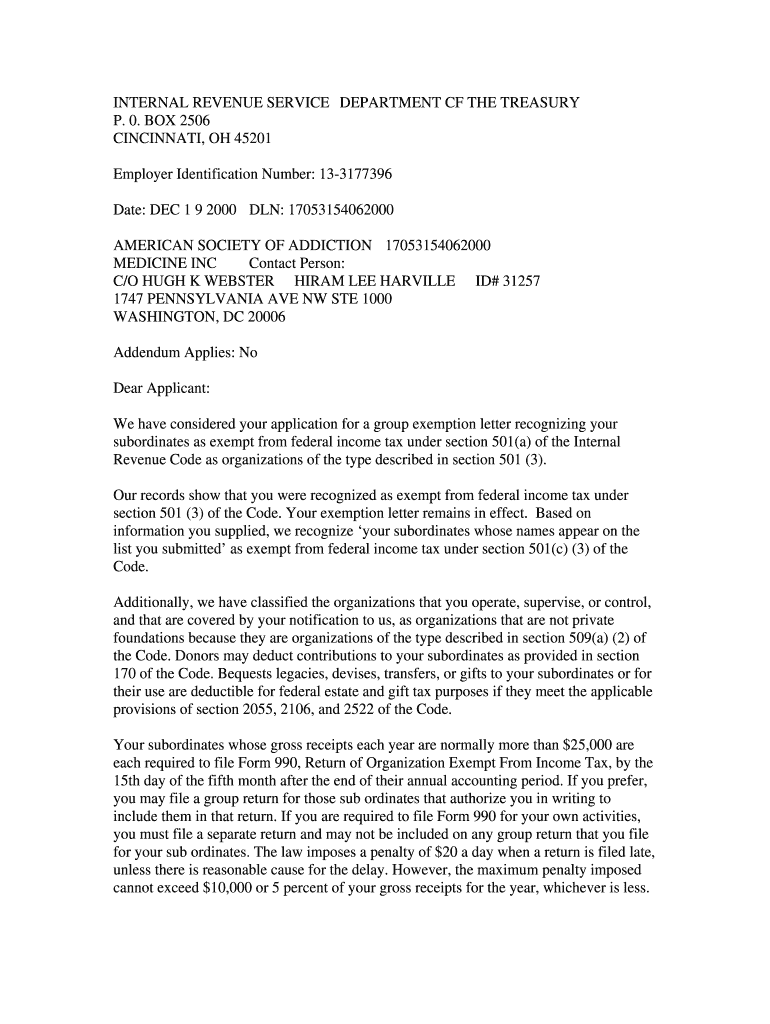

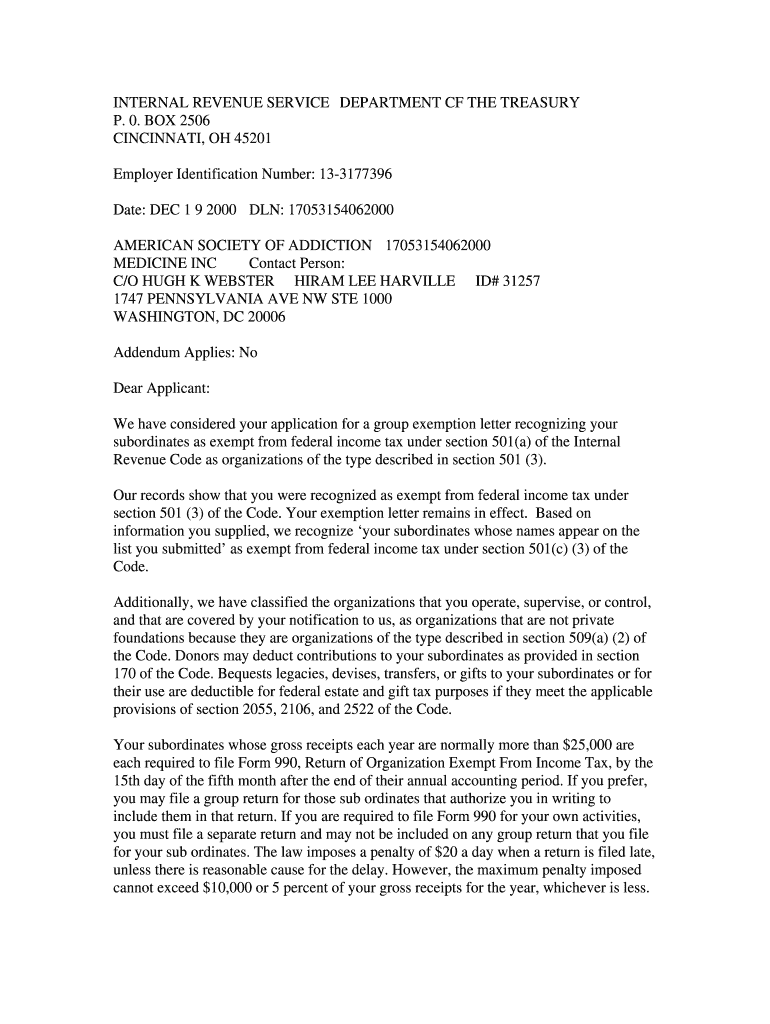

INTERNAL REVENUE SERVICE DEPARTMENT CF THE TREASURY

P. 0. BOX 2506

CINCINNATI, OH 45201

Employer Identification Number: 133177396

Date: DEC 1 9 2000 DAN: 17053154062000

AMERICAN SOCIETY OF ADDICTION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal revenue service department

Edit your internal revenue service department form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service department form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internal revenue service department online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit internal revenue service department. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue service department

How to fill out Internal Revenue Service Department:

01

Obtain the necessary forms - Start by visiting the official website of the Internal Revenue Service (IRS) and download the required forms for the specific purpose you need. You can also request the forms by calling the IRS or visiting a local IRS office.

02

Gather your financial information - Before you start filling out the forms, gather all the relevant financial documents such as W-2s, 1099s, receipts for deductions, and other documentation that may be required. This will ensure that you have all the information needed to accurately complete the forms.

03

Read the instructions carefully - The IRS provides detailed instructions for each form. Take the time to read and understand these instructions before you start filling out the forms. It will help you avoid errors and ensure that you provide all the necessary information.

04

Provide accurate information - As you fill out the forms, make sure to provide accurate and truthful information. Inaccurate or false information can lead to penalties or legal consequences.

05

Double-check your work - After completing the forms, carefully review them to ensure that you have not made any mistakes or omitted any required information. Double-check your calculations to avoid errors when reporting your income or deductions.

06

Sign and submit the forms - Once you are confident that the forms are filled out correctly, sign them and submit them to the Internal Revenue Service. Follow the recommended submission method, whether it's through mail or electronically, based on the instructions provided by the IRS.

07

Keep copies for your records - Always keep a copy of the completed forms and any supporting documents for your own records. This will serve as proof in case of any disputes or queries in the future.

Who needs Internal Revenue Service Department?

01

Individual taxpayers - If you are an individual who earns income through employment, self-employment, or other sources, you may need to interact with the IRS to file your tax returns, claim deductions, or address any tax-related matters.

02

Businesses - Business entities such as corporations, partnerships, and sole proprietorships need to engage with the IRS to fulfill their tax obligations, including filing tax returns, paying taxes, and seeking guidance on specific tax matters.

03

Tax professionals - Certified public accountants, tax attorneys, and enrolled agents often work on behalf of individuals and businesses to navigate the complexities of the tax code and ensure compliance with IRS regulations. They may interact with the IRS on behalf of their clients for various tax-related purposes.

04

Non-profit organizations - Non-profit organizations also need to interact with the IRS for tax-exempt status, filing annual returns, and addressing any tax-related inquiries or issues.

05

Estate administrators - Executors or administrators responsible for handling the financial affairs of deceased individuals may need to work with the IRS to fulfill their tax obligations, such as filing the final individual income tax return and estate tax returns.

Overall, anyone who earns income, runs a business, or deals with taxes in any capacity may need to engage with the Internal Revenue Service Department at some point to comply with tax laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in internal revenue service department without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your internal revenue service department, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the internal revenue service department in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your internal revenue service department in minutes.

How do I fill out the internal revenue service department form on my smartphone?

Use the pdfFiller mobile app to complete and sign internal revenue service department on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is internal revenue service department?

Internal Revenue Service (IRS) is the revenue service of the United States federal government.

Who is required to file internal revenue service department?

Individuals, businesses, and organizations that meet certain income or filing requirements are required to file with the IRS.

How to fill out internal revenue service department?

You can fill out the IRS forms online, by mail, or through a tax professional.

What is the purpose of internal revenue service department?

The purpose of the IRS is to collect taxes and enforce tax laws in the United States.

What information must be reported on internal revenue service department?

Information such as income, deductions, credits, and other financial details must be reported on IRS forms.

Fill out your internal revenue service department online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service Department is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.