Get the free MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION - delawareinsurance

Show details

This document provides notice of the Receiver’s Petition for Approval of a Plan of Rehabilitation for Manhattan Re-Insurance Company, detailing the rights of policyholders and other interested parties,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manhattan re-insurance company in

Edit your manhattan re-insurance company in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manhattan re-insurance company in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manhattan re-insurance company in online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manhattan re-insurance company in. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manhattan re-insurance company in

How to fill out MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION

01

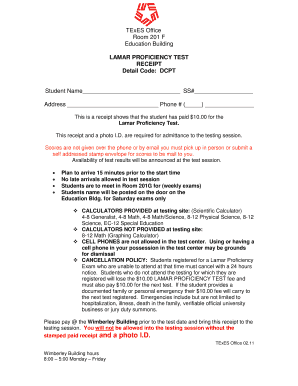

Obtain the official form for the MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION.

02

Fill in the required personal and contact information at the top of the form.

03

Provide details about your insurance policy with MANHATTAN RE-INSURANCE COMPANY, including policy number and coverage type.

04

Include any relevant documentation or evidence to support your case.

05

Review the completed form for accuracy and completeness.

06

Submit the form according to the instructions provided, ensuring that it is sent to the correct rehabilitation office.

Who needs MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

01

Policyholders of MANHATTAN RE-INSURANCE COMPANY seeking to understand their rights and options during the rehabilitation process.

02

Investors who have stakes in the company and need clarity on the company's status.

03

Other insurance companies that may need to know about potential claims or policy transfers.

Fill

form

: Try Risk Free

People Also Ask about

What are the 4 functions of reinsurance?

The Fundamentals of Property and Casualty Reinsurance - Purposes of Reinsurance. Insurers purchase reinsurance for essentially four reasons: (1) to limit liability on specific risks; (2) to stabilize loss experience; (3) to protect against catastrophes; and (4) to increase capacity.

How do insurance and reinsurance work?

Insurance offers coverage against unforeseen risks to individuals. Reinsurance, on the contrary, offers coverage to the insurance provider against certain losses and risks. Insurance and reinsurance are two important risk management concepts in the world of finances.

How do insurance companies use reinsurance?

Issue: Reinsurance, often referred to as “insurance for insurance companies,” is a contract between a reinsurer and an insurer. In this contract, the insurance company — the cedent — transfers risk to the reinsurance company, and the latter assumes all or part of one or more insurance policies issued by the cedent.

What is the amount of insurance retained by the ceding company?

The ceding company retains a maximum fixed monetary amount and knows what is exactly the maximum liability to its net account whereas in a Quota Share Treaty the monetary amount can vary depending on the sum insured while the percentage remains fixed.

What does it mean when a life insurance company is in rehabilitation?

Rehabilitation is a court proceeding authorized under Insurance Law Section 7403 in which the Superintendent takes possession of an insurance company and continues its operations.

What is the concept of re insurance?

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event.

What is the process of insurance and reinsurance?

In the case of insurance, the insured transfers risk arising from unforeseen events to the insurer in exchange for premium payment. On the other hand, reinsurance involves transferring the risk of one insurance company to another in exchange for premiums paid at regular intervals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION refers to an insurance company that is under the supervision of regulatory authorities due to financial instability, operating in a rehabilitative state to restore its financial health.

Who is required to file MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

The filing is typically required by the insurance regulatory authority overseeing the reinsurance industry, as well as the management team of the company undergoing rehabilitation.

How to fill out MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

Filling out the rehabilitation documentation involves providing detailed financial statements, operational reports, and plans for rehabilitation as guided by the state's insurance regulations.

What is the purpose of MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

The purpose is to protect the interests of policyholders, restore the financial viability of the company, and ensure its continued ability to meet obligations.

What information must be reported on MANHATTAN RE-INSURANCE COMPANY IN REHABILITATION?

Reporting must include financial statements, details on claims reserves, policyholder information, operational changes, and a rehabilitation plan outlining steps to restore financial stability.

Fill out your manhattan re-insurance company in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manhattan Re-Insurance Company In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.