Get the free 32-90040-06 HRA Employer Information 2013-12-31indd

Show details

Questions? Call our National Service Center at 18887247526. Security Benefit Group Healthcare Reimbursement Account (HRA) Employer Information Instructions Complete this form for each employee group

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 32-90040-06 hra employer information

Edit your 32-90040-06 hra employer information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 32-90040-06 hra employer information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 32-90040-06 hra employer information online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 32-90040-06 hra employer information. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 32-90040-06 hra employer information

How to fill out 32-90040-06 HRA employer information:

01

Start by gathering all the necessary information about your employer. This includes their legal name, address, and employer identification number (EIN).

02

On the form 32-90040-06, locate the section titled "Employer Information" or a similar heading. This is where you will provide the required details about your employer.

03

Begin by entering the employer's legal name in the designated field. Make sure to input the name exactly as it appears on official documents.

04

Next, write the complete address of your employer, including street name and number, city, state, and zip code. Make sure the address is accurate and up to date.

05

Finally, enter the employer's EIN in the provided field. The EIN is a unique nine-digit number assigned to each employer by the Internal Revenue Service (IRS).

Who needs 32-90040-06 HRA employer information?

01

Employees who are enrolled in a Health Reimbursement Arrangement (HRA) typically need to provide their employer's information on the 32-90040-06 form. This form is often required when seeking reimbursement for qualified medical expenses.

02

Employers may also need the 32-90040-06 HRA employer information form in order to properly administer the HRA benefit and fulfill their reporting obligations.

03

Insurance companies, third-party administrators, or healthcare providers may request the 32-90040-06 HRA employer information form to verify the employer's participation in the HRA program and facilitate claim processing.

In summary, filling out the 32-90040-06 HRA employer information form requires gathering accurate details about the employer, including their legal name, address, and EIN. This information is needed by employees, employers, and other parties involved in the management and processing of HRA benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 32-90040-06 hra employer information for eSignature?

Once your 32-90040-06 hra employer information is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete 32-90040-06 hra employer information online?

pdfFiller has made filling out and eSigning 32-90040-06 hra employer information easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my 32-90040-06 hra employer information in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 32-90040-06 hra employer information right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

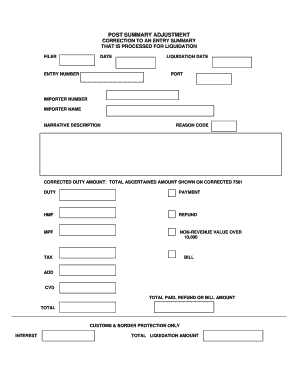

What is 32-90040-06 hra employer information?

The 32-90040-06 hra employer information is a form provided by the IRS that employers must fill out to report their contributions to a health reimbursement arrangement (HRA) for their employees.

Who is required to file 32-90040-06 hra employer information?

Employers who offer a health reimbursement arrangement (HRA) to their employees are required to file the 32-90040-06 hra employer information form.

How to fill out 32-90040-06 hra employer information?

Employers must provide information about their HRA contributions, employee eligibility, and other relevant details on the 32-90040-06 hra employer information form.

What is the purpose of 32-90040-06 hra employer information?

The purpose of the 32-90040-06 hra employer information form is to report employer contributions to health reimbursement arrangements (HRAs) and ensure compliance with IRS regulations.

What information must be reported on 32-90040-06 hra employer information?

Employers must report their HRA contributions, employee names, social security numbers, and other relevant information on the 32-90040-06 hra employer information form.

Fill out your 32-90040-06 hra employer information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

32-90040-06 Hra Employer Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.