Get the free AICPA Statement on Auditing Standard No. 112 - auditor ky

Show details

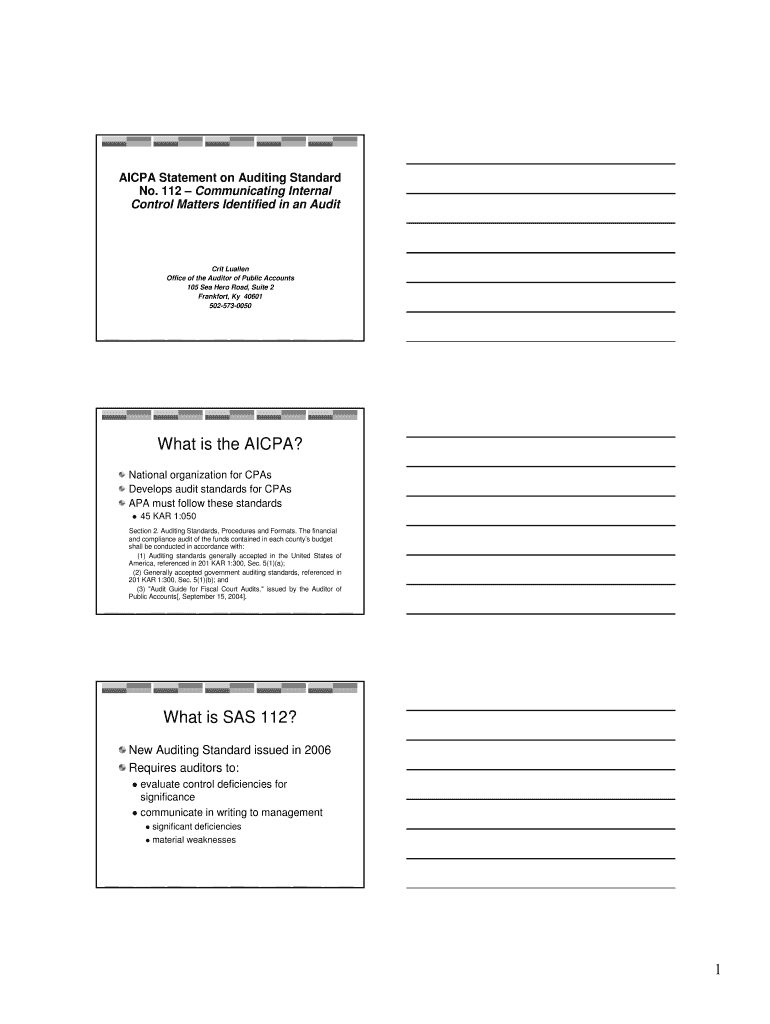

This document outlines the AICPA Statement on Auditing Standard No. 112, providing guidance on internal control matters identified during audits, including the roles and responsibilities of auditors,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aicpa statement on auditing

Edit your aicpa statement on auditing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aicpa statement on auditing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aicpa statement on auditing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aicpa statement on auditing. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aicpa statement on auditing

How to fill out AICPA Statement on Auditing Standard No. 112

01

Review the AICPA Statement on Auditing Standard No. 112 guidelines.

02

Identify the engagement to which the AICPA standard applies.

03

Gather necessary documentation and data relevant to the auditing process.

04

Fill out the preliminary assessment, detailing the nature of the audit.

05

Document the risks associated with the engagement.

06

Detail the audit procedures to be performed, including testing and sampling methods.

07

Outline the steps for reporting findings and any identified deficiencies.

08

Review and finalize the document, ensuring compliance with AICPA standards.

09

Obtain appropriate approvals and signatures before submitting the statement.

Who needs AICPA Statement on Auditing Standard No. 112?

01

Public accounting firms conducting audits.

02

CPA professionals involved in audit engagements.

03

Organizations required to adhere to AICPA auditing standards.

04

Internal auditors seeking guidance on audit practices.

05

Regulatory bodies evaluating compliance with auditing standards.

Fill

form

: Try Risk Free

People Also Ask about

What is auditing 101?

This Audit 101 Training provides an overview of a financial statement audit and gives examples of what auditors might ask for during a financial statement audit.

What is the difference between PCAOB and AICPA auditing standards?

Perhaps the most significant difference in the two audit standards is the requirement of the PCAOB to perform a test of detail to address a significant risk and/or fraud risk, regardless of controls reliance, while the AICPA only requires a test of detail if there is no controls reliance.

Has SAS 114 been superseded?

As of the date of these FAQs, SAS 114 “The Auditor's Communication with Those Charged with Governance” has been superseded by AU-C section 260, and SAS 112/115 “Communicating Internal Control Related Matters Identified in an Audit” has been superseded by AU-C section 265.

What is the Statement on auditing standards 115?

The Statement of Auditing Standards (SAS 115) provides guidance to external auditors on how they should communicate internal control related matters identified in their audit of an organization's financial statements.

What is the auditing standard 114 and 115?

These communications are usually issued via one of two communication letters: (1) the SAS 114: The Auditor's Communication with Those Charged with Governance letter or (2) the SAS 115 Letter: Communicating Internal Control Related Matters Identified in an Audit.

What are the AICPA statements on auditing standards?

Statements on Auditing Standards (SASs) are applicable to the preparation and issuance of audit reports for nonissuers (that is, entities who are not issuers as defined by the Sarbanes-Oxley Act, and entities whose audits are not required to be conducted according to the PCAOB standards).

What is the Statement of auditing standards 110?

110, "Responsibilities and Functions of the Independent Auditor"), states that "The auditor has a responsibility to plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether caused by error or fraud." This Statement provides guidance to

What is the Statement of audit standards?

Statements on Auditing Standards (SASs) are applicable to the preparation and issuance of audit reports for nonissuers (that is, entities who are not issuers as defined by the Sarbanes-Oxley Act, and entities whose audits are not required to be conducted according to the PCAOB standards).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

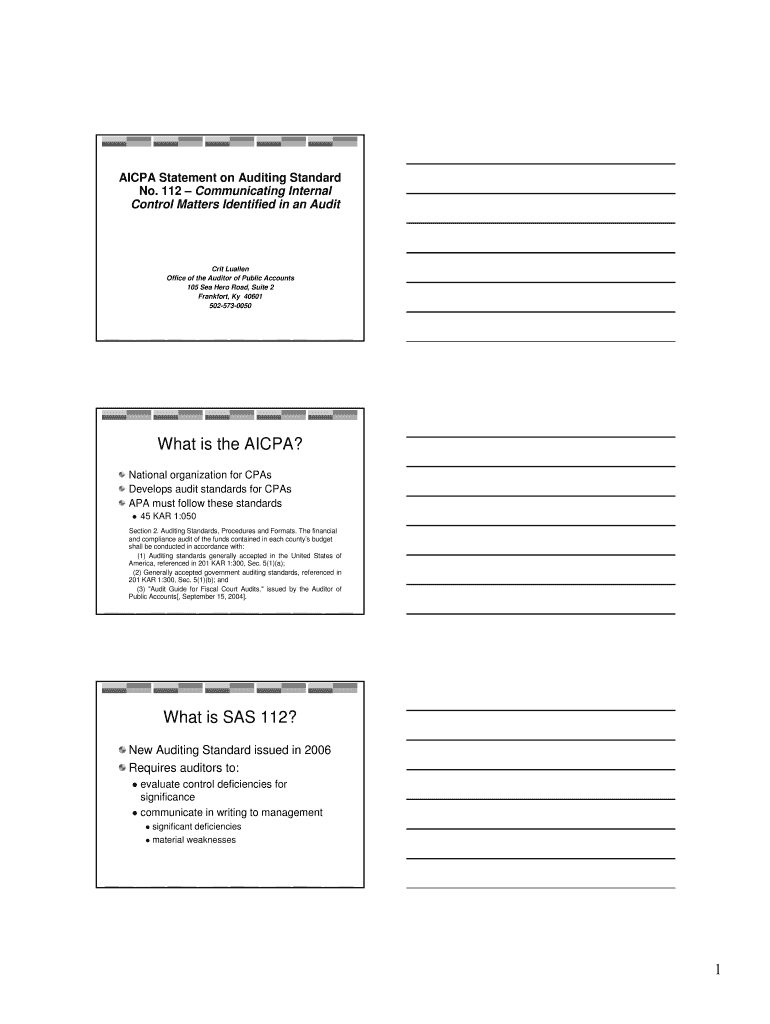

What is AICPA Statement on Auditing Standard No. 112?

AICPA Statement on Auditing Standards No. 112 provides guidance on the auditor's responsibilities regarding consideration of an entity's internal control over financial reporting while performing an audit. It emphasizes the need to understand internal controls to assess risks and design appropriate audit procedures.

Who is required to file AICPA Statement on Auditing Standard No. 112?

The AICPA Statement on Auditing Standards No. 112 does not require a specific entity to file it; rather, it applies to auditors performing audits of financial statements in accordance with Generally Accepted Auditing Standards (GAAS). This standard impacts auditors of publicly and privately held companies.

How to fill out AICPA Statement on Auditing Standard No. 112?

Filling out the AICPA Statement on Auditing Standards No. 112 involves following the guidelines outlined in the standard during the audit process. Auditors must assess the design and implementation of internal controls, document their findings, and communicate any deficiencies found in internal controls as part of their audit report.

What is the purpose of AICPA Statement on Auditing Standard No. 112?

The purpose of AICPA Statement on Auditing Standards No. 112 is to ensure that auditors have a thorough understanding of an entity's internal control over financial reporting, which helps them identify and assess risks of material misstatement in the financial statements.

What information must be reported on AICPA Statement on Auditing Standard No. 112?

The AICPA Statement on Auditing Standards No. 112 requires auditors to report on their evaluation of internal controls and disclose any significant deficiencies or material weaknesses identified during the audit. This includes a description of the internal control system and the findings related to its effectiveness.

Fill out your aicpa statement on auditing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aicpa Statement On Auditing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.