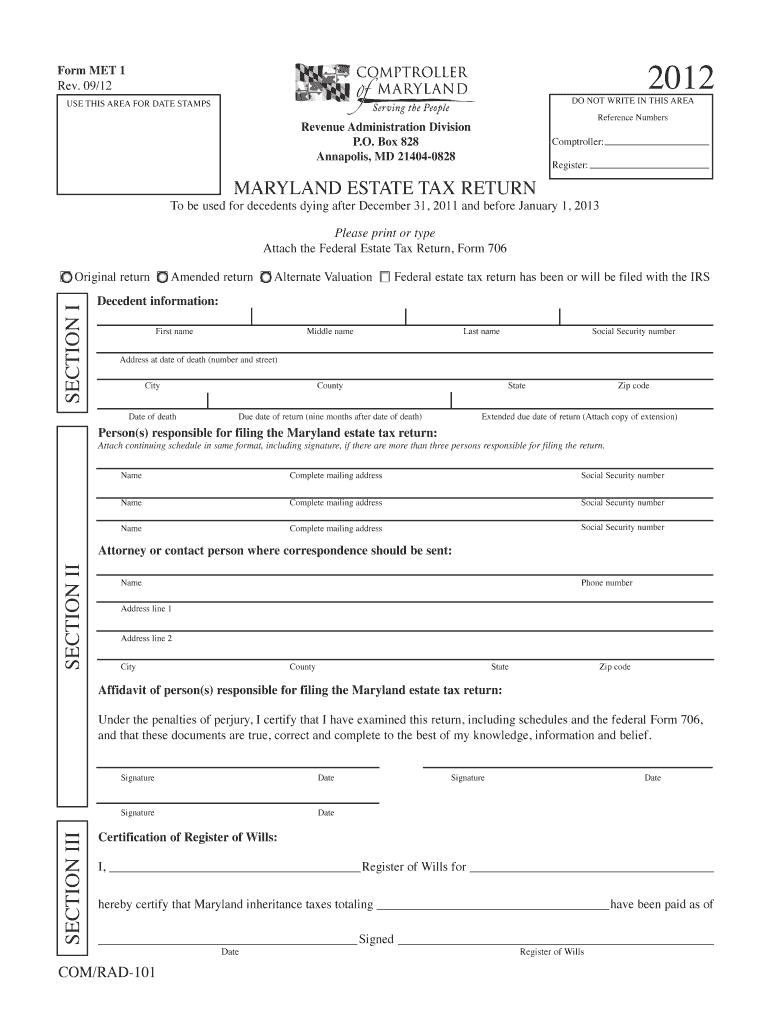

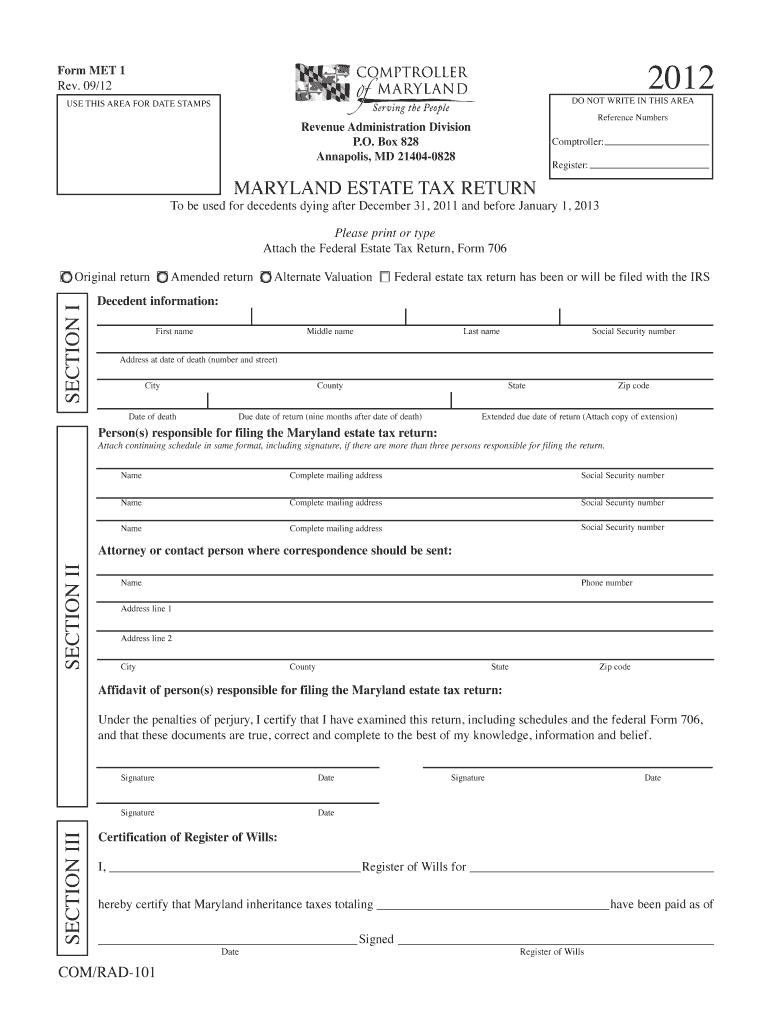

MD MET 1 2012 free printable template

Show details

Reporting of Adjustments After a Maryland estate tax return has been filed an amended Maryland estate tax return Form MET 1 shall be filed if the Maryland estate tax liability is increased because of 1. Report an election for alternate valuation of property by entering a check mark in the appropriate box on the front page of the Maryland estate tax return and by reporting the same on the pro forma Form 706 filed with the MET 1. Extension of time to file The Comptroller may extend the time to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD MET 1

Edit your MD MET 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD MET 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD MET 1 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD MET 1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD MET 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD MET 1

How to fill out MD MET 1

01

Obtain the MD MET 1 form from the relevant authority.

02

Carefully read all instructions provided on the form.

03

Fill out personal identification details such as name, address, and contact information.

04

Provide specific information regarding the medical conditions or disabilities.

05

Attach any required documentation or supporting evidence.

06

Review the completed form for accuracy.

07

Submit the form as per the instructions provided, either online or in person.

Who needs MD MET 1?

01

Individuals applying for medical assistance or benefits.

02

Patients with specific medical conditions requiring documentation.

03

Caregivers or healthcare professionals assisting patients.

Fill

form

: Try Risk Free

People Also Ask about

What is MD Form 502?

Choose the Right Income Tax Form If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

Who is exempt from Maryland estate tax?

Property passing to a child or other lineal descendant, spouse of a child or other lineal descendant, spouse, parent, grandparent, stepchild or stepparent, siblings or a corporation having only certain of these persons as stockholders is exempt from taxation. 10% on property passing to other individuals.

What is the Maryland tax form called?

2022 Individual Income Tax Forms NumberTitle502Maryland Resident Income Tax Return502BMaryland Dependents InformationPVPersonal Tax Payment Voucher for Form 502/505, Estimated Tax and Extensions502ACMaryland Subtraction for Contribution of Artwork14 more rows

Is there a Maryland state tax form?

Choose the Right Income Tax Form If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR. If you are a nonresident and need to amend your return, you must file Form 505X.

Who must file a Maryland estate tax return?

A Maryland estate tax return is required for every estate whose federal gross estate, plus adjusted taxable gifts, plus property for which a Maryland Qualified Terminal Interest Property (QTIP) election was previously made on a Maryland estate tax return filed for the estate of the decedent's predeceased spouse, equals

What is MD Form 504?

Form for fiduciaries to complete and attach to their Maryland Form 504 to report information on each beneficiary, including the following: Beneficiary's share of distributed net taxable income from an estate or trust. Beneficiary's share of nonresident tax paid by multiple pass-through entities.

What is MD 502CR?

Form 502CR is used to claim personal income tax credits for individuals (including resident fiduciaries).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MD MET 1 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including MD MET 1, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send MD MET 1 for eSignature?

MD MET 1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out MD MET 1 on an Android device?

Use the pdfFiller mobile app to complete your MD MET 1 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is MD MET 1?

MD MET 1 is a reporting form used for the Maryland Motor Vehicle Excise Tax under the state's taxation regulations.

Who is required to file MD MET 1?

Any individual or entity that purchases or transfers a motor vehicle in Maryland is required to file MD MET 1 to report the excise tax due.

How to fill out MD MET 1?

MD MET 1 can be filled out by providing the required details about the vehicle, such as the VIN, purchase price, date of purchase, and declaring any exemptions or deductions.

What is the purpose of MD MET 1?

The purpose of MD MET 1 is to report and collect the excise tax on motor vehicle purchases in Maryland, ensuring tax compliance and accurate revenue collection.

What information must be reported on MD MET 1?

MD MET 1 must report information such as the vehicle's VIN, purchase price, purchaser's details, purchase date, and any applicable deductions or exemptions.

Fill out your MD MET 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD MET 1 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.