Get the free 500CR

Show details

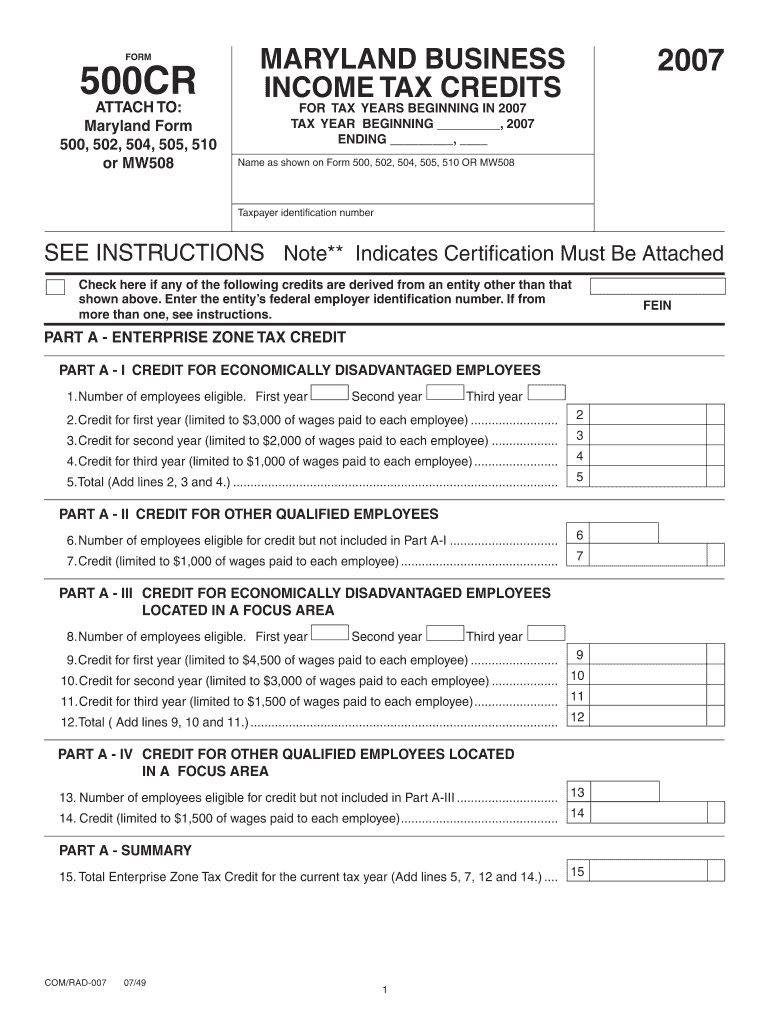

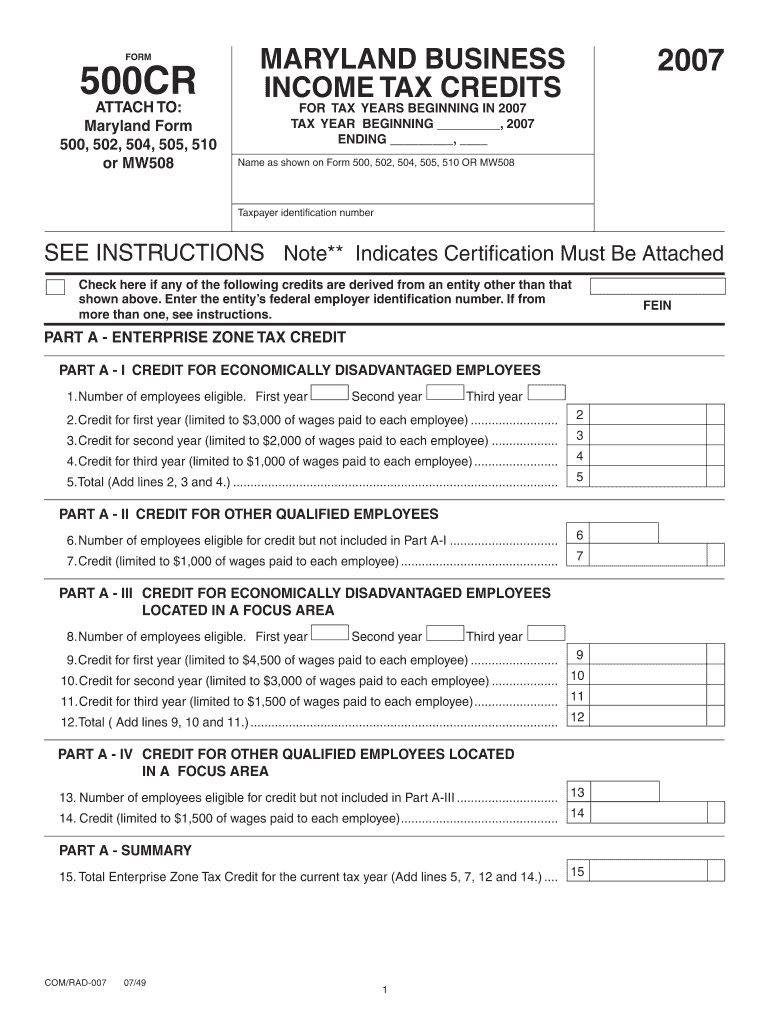

This document is used to claim various business tax credits against Maryland income taxes for tax years beginning in 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 500cr

Edit your 500cr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 500cr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 500cr online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 500cr. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 500cr

How to fill out 500CR

01

Gather the required personal and financial information.

02

Obtain the 500CR form from the relevant authority or website.

03

Begin filling out the form by entering your name and contact information.

04

Provide detailed financial information as requested, such as income and expenses.

05

Fill in any specific sections related to your eligibility or purpose for the 500CR.

06

Review your information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the designated office or online portal.

Who needs 500CR?

01

Individuals seeking financial assistance or benefits.

02

Businesses applying for funding or grants.

03

Anyone eligible for specific government programs requiring the 500CR form.

Fill

form

: Try Risk Free

People Also Ask about

What is a Maryland 502CR form?

Maryland Form 502CR is the Maryland Personal Income Tax Credits for Individuals form. Individuals in Maryland can use this form to claim personal income tax credits. The form must be submitted to the Maryland State Government.

What is a Maryland 502CR form?

Maryland Form 502CR is the Maryland Personal Income Tax Credits for Individuals form. Individuals in Maryland can use this form to claim personal income tax credits. The form must be submitted to the Maryland State Government.

How to avoid Maryland underpayment penalty?

The tax liability on gross income after deducting Maryland withholding is $500 or less, or, B. You have made four quarterly payments as required, each equal to or more than one-fourth of either of the following: (1) 110% of last year's taxes, or (2) 90% of the current year's taxes.

What is the new tax law for retirees in Maryland?

The Maryland Retirement Tax Credit works as a nonrefundable credit against your state income taxes. Here's what you can expect: $1,000 credit: Available for individual filers or couples with only one spouse 65+ $1,750 credit: Available for joint filers where both spouses are 65+

What is the Maryland form 500CR?

CLAIM TAX CREDIT Maryland Tax Form 500CR must be filed electronically with an attached copy of the certification from Commerce. Please note that the credit can be taken against the State income tax ONLY. It is not taken against the county income tax "add-on".

Who must file a Maryland nonresident tax return?

A nonresident individual is subject to tax on that portion of the federal adjusted gross income that is derived from tangible property, real or personal, permanently located in Maryland (whether received directly or from a fiduciary) and on income from a business, trade, profession or occupation carried on in Maryland

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 500CR?

500CR is a form used for reporting specific financial details related to foreign investments and expenditures in India, particularly under the Income Tax Act.

Who is required to file 500CR?

Individuals or entities engaged in foreign investments or those who have received foreign remittances are required to file Form 500CR.

How to fill out 500CR?

Form 500CR should be filled out by providing relevant financial information such as details of foreign assets, income earned, and taxes paid, following the guidelines set by the Income Tax Department.

What is the purpose of 500CR?

The purpose of Form 500CR is to ensure transparency and compliance with tax regulations for foreign transactions, helping the government track foreign investments and revenues.

What information must be reported on 500CR?

Information required on Form 500CR includes the nature of the foreign income, details of foreign bank accounts, assets held outside India, amounts received, and taxes paid on foreign income.

Fill out your 500cr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

500cr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.