Get the free Financial Disclosure Statement - washco-md

Show details

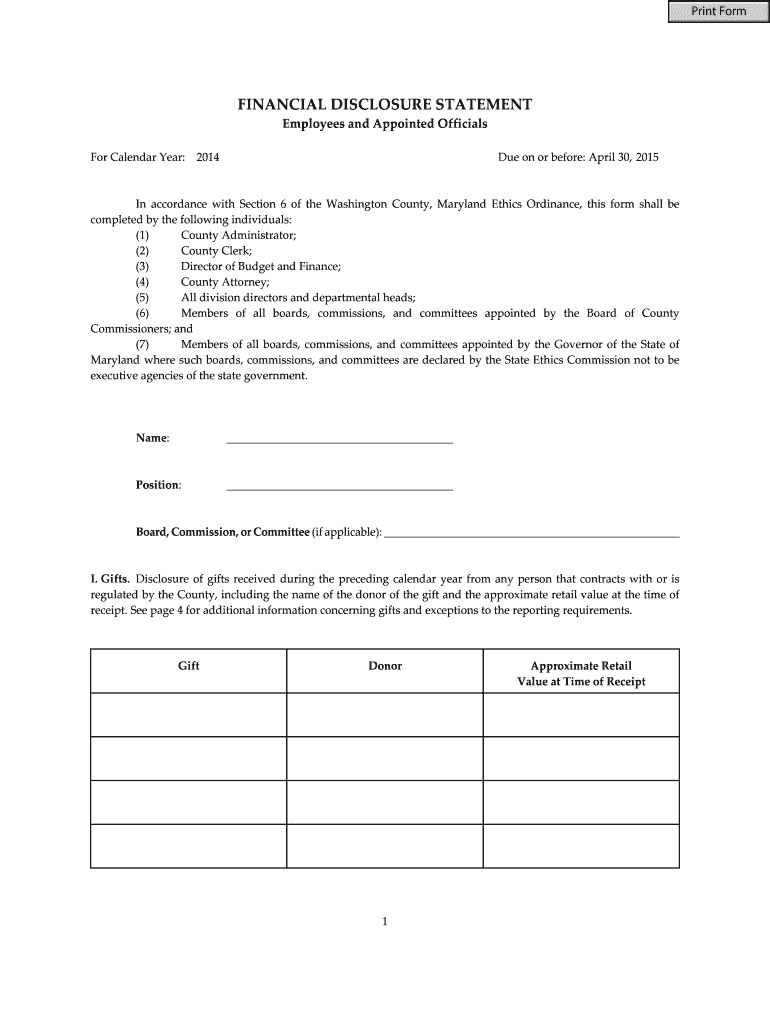

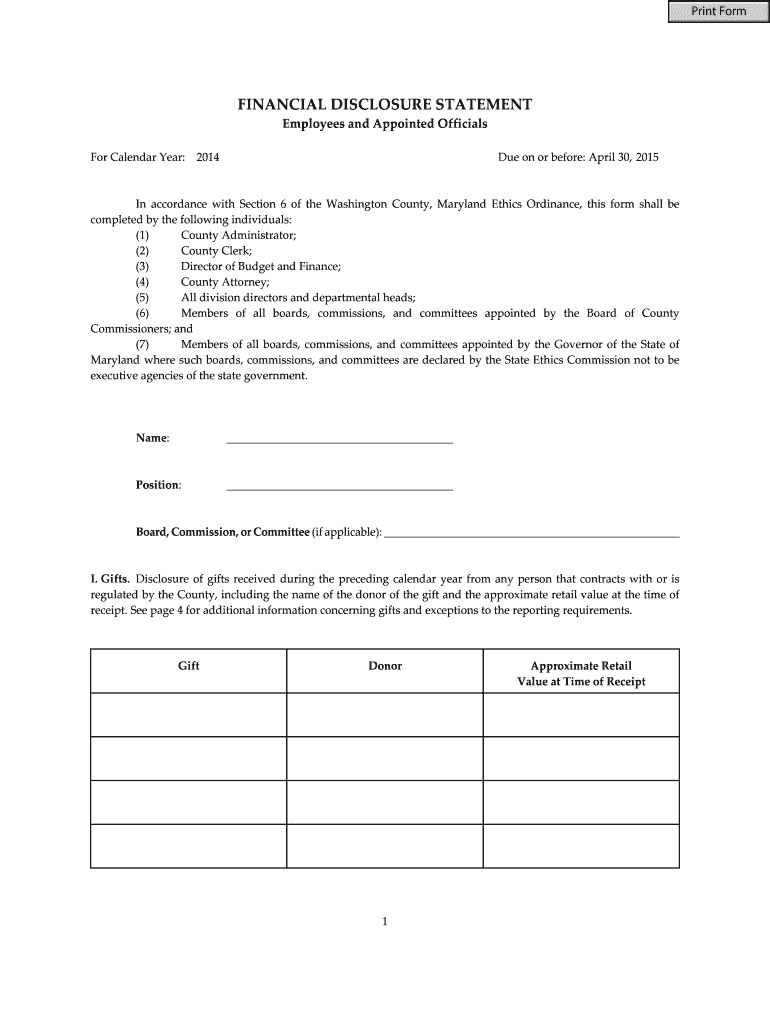

This document is a financial disclosure statement that must be completed by certain employees and appointed officials in Washington County, Maryland, detailing gifts received, conflicts of interest,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial disclosure statement

Edit your financial disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial disclosure statement online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial disclosure statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial disclosure statement

How to fill out Financial Disclosure Statement

01

Obtain the Financial Disclosure Statement form from the appropriate authority or website.

02

Begin by filling out your personal information, including your name, address, and contact details.

03

List all sources of income, such as salary, bonuses, investments, and rental properties.

04

Detail all assets, including bank accounts, real estate, vehicles, and other valuable property.

05

Disclose any liabilities, including loans, credit card debts, and mortgages.

06

Provide information about any financial interests or holdings in businesses or partnerships.

07

Review the form for accuracy and completeness before signing.

08

Submit the completed Financial Disclosure Statement to the designated agency or entity.

Who needs Financial Disclosure Statement?

01

Individuals applying for certain government positions or licenses.

02

Public officials and employees required by law to disclose financial interests.

03

Candidates for elected office as part of campaign regulations.

04

Employees in certain industries that require financial transparency.

Fill

form

: Try Risk Free

People Also Ask about

What is included in a financial disclosure statement?

California requires honest and complete financial disclosures in dissolution and legal separation cases. This includes the disclosure of your income, expenses, assets and debts, as well as your tax returns for the prior two years.

What is a financial disclosure checklist?

It is intended to help entities to prepare and present financial statements in ance with IFRS Accounting Standardsa by identifying the potential disclosures required. In addition, it includes the minimum disclosures required in the financial statements of a first-time adopter of IFRS Accounting Standards.

How do I write a disclosure statement?

How Should You Write a Disclosure Statement? Identify all relevant parties involved. Determine and state the purpose of the disclosure. Outline and provide the information that needs to be included in the disclosure. Be written using straightforward, non-technical, and easy-to-understand language.

What are examples of common disclosures in the financial statement notes?

Examples can include unexpected changes from the previous year, required disclosures, adjusted figures, accounting policy, etc. Footnotes may also contain notable future activities that are expected to have a significant impact on the company's future.

What is an example of a financial disclosure?

This can be information such as mortgage and bank statements, investments, pensions, business accounts, pay slips, details of your outgoings and so on. Essentially, this is putting all of the financial cards on the table and face up.

What are financial disclosures?

Sharing information about your finances with your spouse (or domestic partner) is a requirement for getting a divorce or legal separation. This is called disclosure or financial disclosure. The financial documents don't get filed with the court. You just share them with your spouse.

What is an example of a disclosure statement?

A disclosure statement in such a case might read: “The author declares that (s)he has no relevant or material financial interests that relate to the research described in this paper”.

What do you write in a disclosure statement?

A disclosure statement is a document that a landlord must give the tenant when entering into or renewing a lease. It outlines essential lease information so the tenant can understand, at a glance, the key elements of the lease. It can include: the term or duration of the lease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Disclosure Statement?

A Financial Disclosure Statement is a document that outlines an individual's financial interests, including assets, liabilities, income, and expenses, to provide transparency and accountability, usually in a governmental or legal context.

Who is required to file Financial Disclosure Statement?

Typically, government officials, public employees, candidates for public office, and individuals in positions of influence or trust are required to file a Financial Disclosure Statement, depending on the regulations of the jurisdiction.

How to fill out Financial Disclosure Statement?

To fill out a Financial Disclosure Statement, individuals should gather necessary financial documents, list all sources of income, report assets and liabilities, disclose any gifts or business interests, and ensure all information is complete and accurate before submitting it as per the guidelines provided.

What is the purpose of Financial Disclosure Statement?

The purpose of a Financial Disclosure Statement is to promote transparency, prevent conflicts of interest, ensure accountability in public service, and provide public access to information regarding the financial interests of public officials.

What information must be reported on Financial Disclosure Statement?

The Financial Disclosure Statement typically requires reporting of sources of income, details of assets and liabilities, information about business interests, gifts received, and any other financial interests that may pose a conflict of interest.

Fill out your financial disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.