Get the free For Traditional, Roth,

Show details

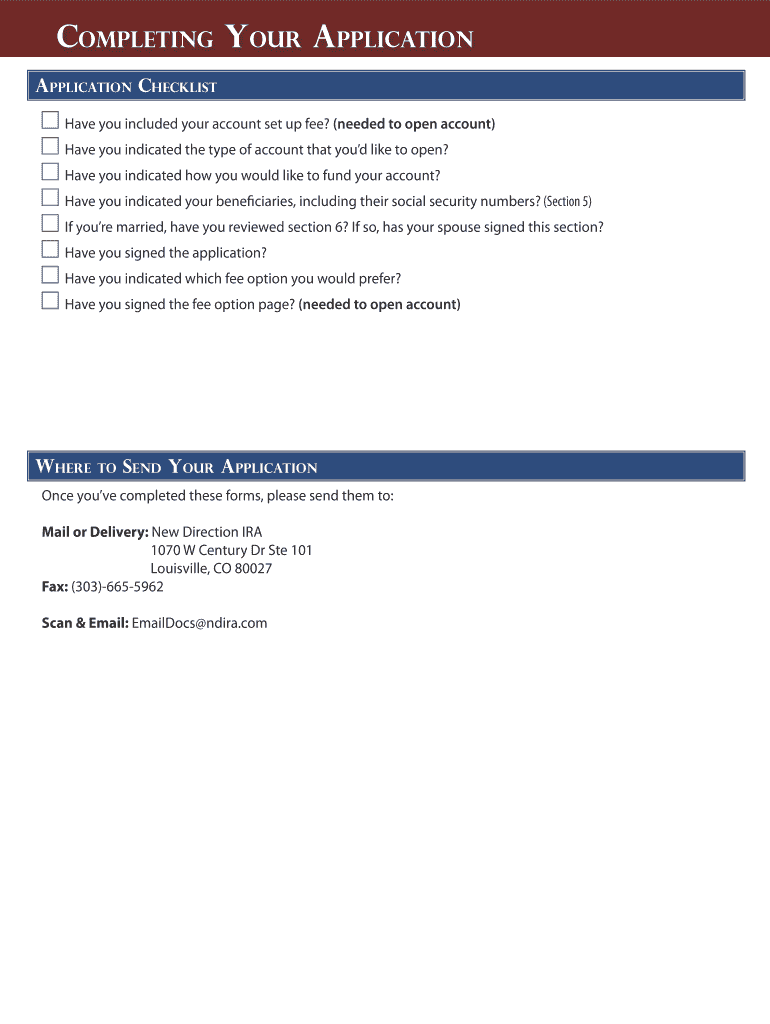

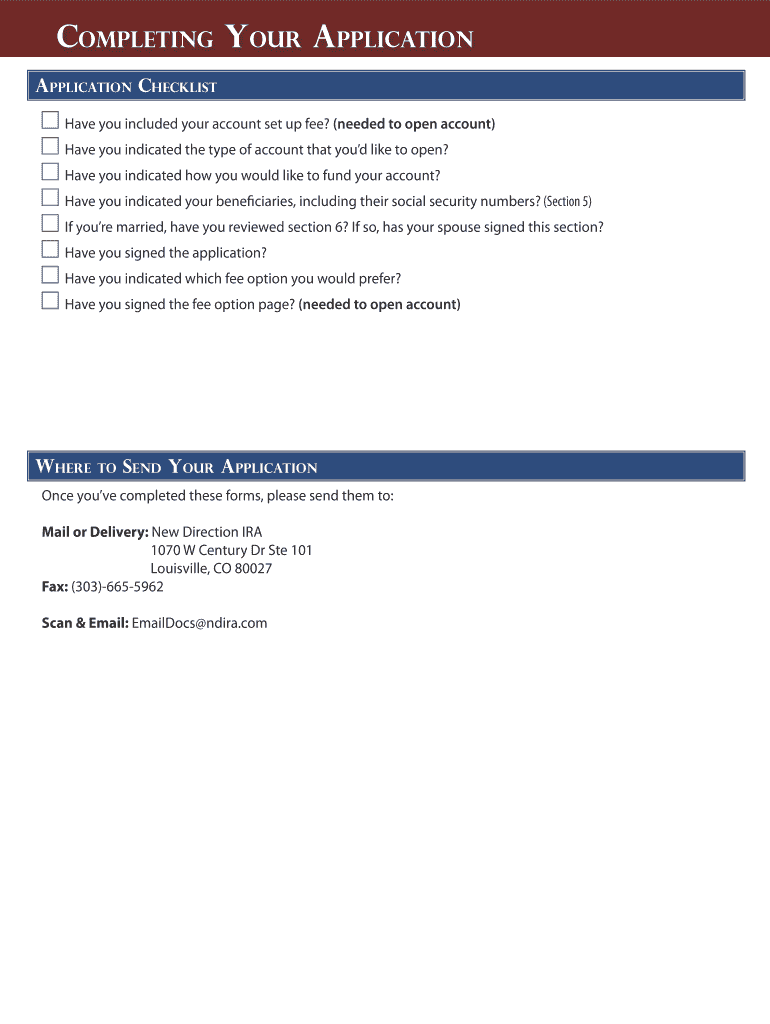

Self-directed IRA Application For Traditional, Roth, Beneficiary Accounts New Direction IRA, Inc. www.NewDirectionIRA.com 1070 W Century Dr Ste 101 Louisville, CO 80027 Email: Info ndira.com Toll

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for traditional roth

Edit your for traditional roth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for traditional roth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for traditional roth online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit for traditional roth. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for traditional roth

To fill out a traditional Roth, you can follow these steps:

01

Gather the necessary documents: Start by collecting all the relevant documents required to fill out the traditional Roth application, such as your personal identification information, social security number, proof of income, and any other supporting documents necessary.

02

Begin the application process: Visit the financial institution or brokerage firm of your choice that offers traditional Roth accounts. Request an application form from a representative or download it from the institution's website, if available.

03

Enter personal information: Fill in the application form with your personal details, including your full name, address, phone number, and social security number. Make sure to provide accurate information to avoid any delays or issues with your application.

04

Select account type: Indicate that you want to open a traditional Roth account. This account type offers tax advantages for retirement savings, allowing your contributions to grow tax-free until withdrawals are made during retirement.

05

Provide financial information: The application may require you to disclose your current income, employment status, and any other financial details. This information helps determine your eligibility and contribution limits for the traditional Roth account.

06

Nominate beneficiaries: Many traditional Roth applications will prompt you to designate beneficiaries who will receive the funds in the event of your passing. Ensure you provide necessary information about your chosen beneficiaries, such as their full names and contact details.

07

Review and sign: Before submitting your application, be sure to carefully review all the information you have provided. Check for any errors or missing details, as accuracy is crucial. Once satisfied, sign the application form following the provided instructions.

08

Submit the application: Once signed, submit the completed application form along with any required supporting documents to the financial institution or brokerage firm. You can typically mail it, drop it off at their office, or submit it electronically if online submission is available.

Who needs a traditional Roth?

A traditional Roth account can be beneficial for individuals who wish to save for retirement while enjoying certain tax advantages. Here are some reasons why someone might consider opening a traditional Roth account:

01

Tax benefits: Contributions made to a traditional Roth account are not tax-deductible. However, any earnings on those contributions grow tax-free, and qualified withdrawals made during retirement are also tax-free. This can result in significant savings over time.

02

Retirement savings: If you are looking for additional ways to save for retirement beyond your employer-sponsored retirement plan (such as a 401(k) or pension), a traditional Roth account provides another avenue to supplement your future income.

03

Flexibility: Unlike traditional IRAs, traditional Roth accounts do not have minimum distribution requirements during the account holder's lifetime. This flexibility allows individuals to potentially pass on their savings to beneficiaries and continue tax-advantaged growth for future generations.

04

Lower tax bracket during retirement: If you anticipate being in a lower tax bracket during retirement, contributing to a traditional Roth account now can be advantageous. You pay taxes on your contributions at your current tax rate, and then withdrawals during retirement are tax-free, potentially resulting in overall tax savings.

05

Investing options: Traditional Roth accounts offer a variety of investment options, allowing you to choose the mix of stocks, bonds, mutual funds, or other assets that align with your financial goals and risk tolerance.

Remember, while the information provided here gives a general understanding of filling out a traditional Roth application and who may benefit from it, it is always recommended to consult with a financial advisor or tax professional for personalized advice based on your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute for traditional roth online?

pdfFiller has made filling out and eSigning for traditional roth easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete for traditional roth on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your for traditional roth, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out for traditional roth on an Android device?

Complete your for traditional roth and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is for traditional roth?

The traditional Roth is a type of retirement account that allows individuals to contribute after-tax income, and withdrawals are tax-free.

Who is required to file for traditional roth?

Individuals who want to save for retirement and meet the income eligibility requirements are required to file for a traditional Roth.

How to fill out for traditional roth?

To fill out for a traditional Roth, individuals can open an account with a financial institution, complete the required paperwork, and make contributions according to the annual limits set by the IRS.

What is the purpose of for traditional roth?

The purpose of a traditional Roth is to provide individuals with a tax-advantaged way to save for retirement and access funds in retirement without incurring additional taxes.

What information must be reported on for traditional roth?

Individuals must report their contributions, withdrawals, and any earnings on their traditional Roth account on their annual tax return.

Fill out your for traditional roth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Traditional Roth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.